RBA Cash Rate Tracker

Get the latest updates on the Reserve Bank of Australia’s cash rate decisions and explore how these changes shape the economy, inflation, and lending rates.

Historical Rate Trend

RBA Cash Rate Target over time

Previous RBA Cash Rate Target3.85%

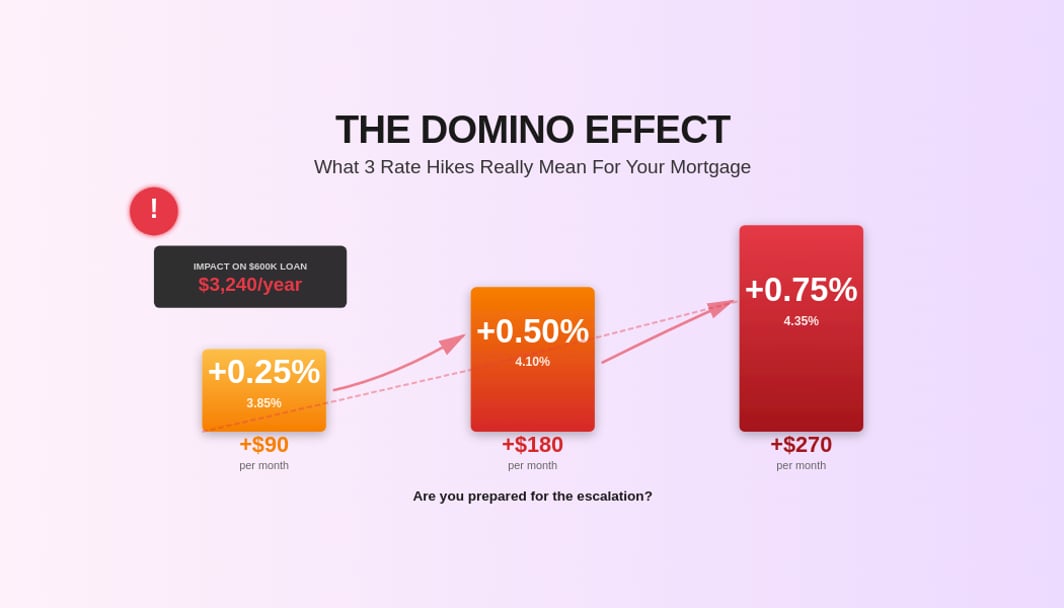

How much more will you pay after the RBA rate hike?

Ask Bheja, your AI mortgage copilot, how the latest RBA cash rate increase affects your home loan. Enter your loan details to instantly see the impact on your repayments.

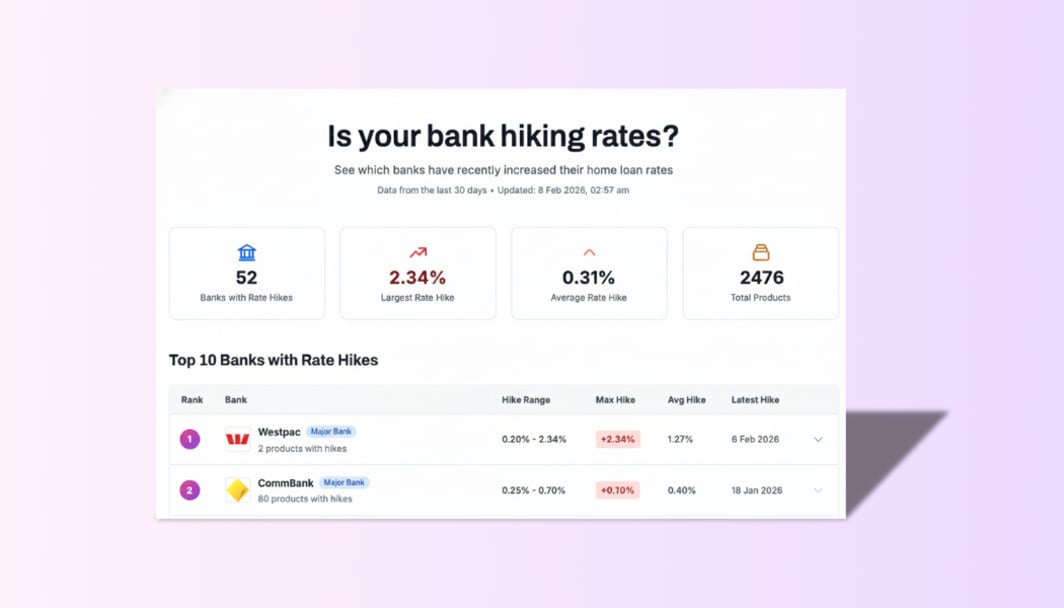

Is your bank hiking rates?

See which banks have recently increased their home loan rates

Data from the last 30 days • Updated: 7 Feb 2026, 09:48 pm

Banks with Rate Hikes

Largest Rate Hike

Average Rate Hike

Total Products

Top 10 Banks with Rate Hikes

| Rank | Bank | Hike Range | Max Hike | Avg Hike | Latest Hike | |

|---|---|---|---|---|---|---|

1 |  WestpacMajor Bank 2 products with hikes | 0.20% - 2.34% | +2.34% | 1.27% | 6 Feb 2026 | |

2 |  CommBankMajor Bank 80 products with hikes | 0.25% - 0.70% | +0.70% | 0.40% | 18 Jan 2026 | |

3 |  MyState BankMajor Bank 5 products with hikes | 0.15% - 0.60% | +0.60% | 0.34% | 6 Feb 2026 | |

4 |  NATIONAL AUSTRALIA BANKMajor Bank 65 products with hikes | 0.10% - 0.60% | +0.60% | 0.33% | 28 Jan 2026 | |

5 |  MOVE BankMajor Bank 15 products with hikes | 0.30% - 0.55% | +0.55% | 0.41% | 4 Feb 2026 | |

6 |  AMP - My AMPMajor Bank 128 products with hikes | 0.25% - 0.55% | +0.55% | 0.34% | 6 Feb 2026 | |

7 |  BankwestMajor Bank 35 products with hikes | 0.20% - 0.50% | +0.50% | 0.40% | 6 Feb 2026 | |

8 |  Bank of Queensland LimitedMajor Bank 63 products with hikes | 0.25% - 0.40% | +0.40% | 0.34% | 6 Feb 2026 | |

9 |  ME BankMajor Bank 188 products with hikes | 0.25% - 0.40% | +0.40% | 0.33% | 7 Feb 2026 | |

10 |  Bendigo BankMajor Bank 170 products with hikes | 0.20% - 0.36% | +0.36% | 0.24% | 5 Feb 2026 |

Data sourced from 6,489 home loan product variations

Showing 2,461 products with rate hikes in the last 30 days

The ultimate guide to RBA cash rate changes

A deep dive into how shifts in the Reserve Bank’s cash rate influence inflation, growth, and investment trends and what it means for households and businesses.

Pravin Mahajan

Founder @ Bheja.ai | Mortgage Broker | Ex-CTO RateCity & CIMET

Mahendra Duddempudi

CTO & Head of Research

Updated on 05 Feb 2026

- The RBA hiked the cash rate at its February 2026 meeting. The current cash rate is 3.85%.

- The RBA uses the cash rate to manage inflation within its 2–3% target, and reviews it eight times a year.

- A 25 basis point hike can increase monthly repayments by around $100 on a $600,000 variable loan.

- The next decision is due on 16-17 March 2026.

Understanding how the RBA's Decides the cash rate

The RBA’s board meets eight times a year, roughly every six weeks and over two days to decide whether to raise, cut, or hold the cash rate, with a decision announced on the second day (always a Tuesday) at 2:30 pm (AEST/AEDT).

These decisions directly affect home loan rates, borrowing costs, and Australia’s overall economy.

The RBA’s goal is simple:

✅ Keep inflation between 2–3%

✅ Support jobs and economic growth

To do that, it studies a wide range of economic data before making any move.

Key economic indicators driving RBA cash rate decisions

Explore the latest data shaping Australia’s cash rate, including inflation, employment, GDP growth, and consumer spending. Track historical trends and see how these indicators guide future rate moves.

Economic Highlights

- Headline inflation surges to 3.8% across all groups, well above the RBA target.

- Economic growth decelerates sharply to 0.4%, indicating a significant slowdown.

- Unemployment rate rises to 4.3%, pointing to a softening labour market.

Inflation (CPI)

Consumer Price Index measuring changes in the cost of living. Both headline and core (trimmed mean) inflation are measured monthly, comparing to the same month last year.

Headline Inflation (YoY)

6 Months Ago

Core Inflation - Trimmed Mean (YoY)

6 Months Ago

Headline Inflation Trend (Monthly)

Core Inflation Trend (Monthly)

💡Expert Insights

Key Takeaway

While the year-over-year figure seems stable, that recent 1% monthly surge is a real red flag. It tells us underlying inflationary pressures might be re-emerging, which is a bit worrying.

What's Happening

Inflation is currently holding steady at 3.8% year-over-year, which is actually the same as six months ago and a notable jump from 2.4% last year. While the annual rate has been a bit sticky, that recent 1% month-over-month increase really stands out after a flat prior month.

Impact on Borrowing

This kind of sticky inflation, especially with that recent monthly bump, definitely puts pressure on central banks to keep interest rates higher. It means borrowing money will likely remain pricier for a while.

Unemployment Rate

It's basically the percentage of the workforce that's looking for a job but can't find one. A lower number means more people are working, which is usually a good sign for the economy.

Current Value

Quarterly Change

fell to a lower level

Same Time Last Year

June 2025

12-Month Trend

💡Expert Insights

Key Takeaway

This recent downward trend suggests the job market is holding up surprisingly well. It's a positive sign for economic resilience, indicating continued demand for workers even with other economic uncertainties.

What's Happening

The unemployment rate has actually been improving nicely, dropping from 4.44% in September to 4.10% this December. That's a decent decline in just a few months. It's also slightly lower than it was exactly a year ago and notably better than six months back.

Impact on Borrowing

When more people are working, it can signal a stronger economy, which often puts upward pressure on inflation. This might lead central banks to consider higher interest rates to cool things down a bit.

GDP Growth

This measures how much our country's total economic output, like goods and services, has grown compared to a year ago. It's basically the health check of our economy.

Current Value

12-Month Trend

💡Expert Insights

Key Takeaway

The economy is clearly sputtering, not just a blip. This prolonged period of weak growth suggests we're in for a tough ride unless something significantly changes soon.

What's Happening

The growth rate is currently quite low at 0.4%, holding steady from six months ago. It dipped from 0.7% in June and is significantly down from 0.9% a year ago, showing a sustained slowdown.

Impact on Borrowing

Such slow growth usually means central banks might consider lowering rates to stimulate the economy. This could lead to cheaper borrowing costs for loans and mortgages.

Home Prices

This tracks the average selling price of homes, giving us a sense of how much residential properties are going for across the market.

Current Value

Quarterly Change

rose by 2.2%

Same Time Last Year

March 2024

12-Month Trend

💡Expert Insights

Key Takeaway

While these climbing prices reflect market demand, they also highlight growing affordability challenges. Many prospective buyers might find themselves priced out, indicating a widening gap between aspirations and reality.

What's Happening

We're seeing a notable acceleration, with the latest year-over-year change hitting 1045.4. That's a decent climb from 1007.8 six months back, and it's a pretty big leap when you compare it to the 891 we saw at this time last year. Prices are definitely picking up steam.

Impact on Borrowing

Strong house price growth usually hints at a robust economy and some inflationary pressure. This might nudge central banks toward higher interest rates to keep things in check, ultimately making borrowing more costly for everyone.

Wage Growth

This index essentially tracks how much the cost of labor is changing over time, without getting bogged down by things like bonuses or overtime. It’s a clean look at core wage growth.

Current Value

Quarterly Change

remained stable to the same level

Same Time Last Year

March 2024

12-Month Trend

💡Expert Insights

Key Takeaway

It seems wage growth has leveled off a bit, which is a good sign for inflation not spiraling. The labor market is still pretty firm, but perhaps less frenzied than before.

What's Happening

Wage growth is currently holding steady at 3.4% year-on-year. That's a tiny bit lower than the 3.5% we saw six months back, but it's still slightly up from this time last year. It looks pretty stable.

Impact on Borrowing

When wages stay elevated, it can signal ongoing inflation, so central banks might need to keep interest rates a bit higher for longer. This pushes up borrowing costs for everyone.

Ready to act on these insights?

Use our tools and talk to experts to understand how these economic conditions affect your home loan

Home Loan Market Snapshot

Real-time insights from thousands of Australian home loan products

Updated: 7 Feb 2026, 09:48 pm

Average Variable Rate

6.25%

Owner Occupied P&I

Average Fixed Rate

6.03%

3-year fixed

Best Available Rate

4.95%

Fixed • Owner Occupied

Total Products

6,198

Available in market

Most Competitive Lenders

Big 4 Banks Average

6.30%

Market Average

6.10%

Online Lenders Average

5.72%

Easy Street

13 products

From

5.19%

Avg

5.34%

gmcu

20 products

From

4.99%

Avg

5.34%

Unloan

4 products

From

5.19%

Avg

5.41%

BankVic

26 products

From

4.98%

Avg

5.47%

ORANGE CREDIT UNION LTD

15 products

From

5.29%

Avg

5.51%

Rate Comparison by Category

Variable vs Fixed

2,087 products

4,111 products

Owner Occupied vs Investment

3,119 products

3,054 products

Principal & Interest vs Interest Only

3,539 products

2,589 products

Market Features Overview

Products with Offset Account

Products with Cashback Offers

Average Cashback Amount

Products with No Fees

(No monthly, annual, or ongoing fees)

Data sourced from 6,198 home loan products

Analysis based on products supporting minimum $300K loan amounts over 25-year terms

What is the cash rate?

The cash rate is the interest rate the Reserve Bank of Australia (RBA) sets for overnight loans between commercial banks. This rate helps shape interest rates on mortgages, personal loans, savings accounts, and other financial products across the economy.

Banks borrow and lend money overnight in the interbank market. The RBA steps in to keep the cash rate near its official target, which then acts as the base for setting interest rates throughout the economy.

Adjusting the cash rate helps manage inflation, economic growth, and jobs. Lowering the cash rate encourages people and businesses to spend and invest more. Raising it helps slow things down if the economy is growing too fast.

What is the RBA and how does it control the cash rate?

The Reserve Bank of Australia is the nation’s central bank. Its main job is to keep the economy stable, support jobs, and keep inflation low. The official cash rate is one of its main tools for doing this.

The RBA Board meets often to check on Australia’s economy. If inflation is too high or growth is too fast, they might raise the cash rate. If the economy is slowing or inflation is low, they might lower the rate to encourage more spending and investment.

The RBA changes interest rates to help the economy grow steadily and to keep inflation within its 2–3% target range.

How often does the RBA change the cash rate?

The Reserve Bank of Australia (RBA) Board meets eight times per year to review economic conditions and determine the official cash rate. These meetings typically span two days, allowing the Board to thoroughly assess the latest economic indicators, including inflation trends, employment data, and global financial developments.

Based on this assessment, the Board may choose to adjust the cash rate or maintain it at the current level.

RBA cash rate meeting schedule and decisions 2026

What's the RBA cash rate history?

The RBA’s cash rate has fluctuated significantly over the years. It reached a peak of 17.50% in January 1990 as the Reserve Bank aimed to control high inflation. During the COVID-19 pandemic, the rate was lowered to a historic low of 0.10% in November 2020 to support the economy. From 1990 to 2025, the average cash rate was approximately 3.87%. Currently, at 4.10%, the rate is slightly above this long-term average, reflecting a moderately restrictive monetary policy stance aimed at curbing inflation. However, recent rate cuts suggest the RBA is beginning to ease policy as inflation shows signs of easing.

At its February 2026 meeting, the RBA hiked the cash rate by 0.25 percentage points. Inflation data from December was a major driver for the RBA to announce the hike.

Looking ahead, some economists predict further rate hikes this year, with another potentially as soon as May 2026.

When does the RBA change the cash rate?

When the RBA raises the cash rate?

The RBA raises the cash rate when it needs to cool the economy and control inflation. If prices rise too fast, such as in housing, groceries, or fuel so the RBA may act to slow demand.

A higher cash rate makes loans and mortgages more expensive but encourages saving. This reduces demand in the economy, helping bring inflation back within the RBA’s target range of 2–3%.

When the RBA cuts the cash rate?

The RBA cuts the cash rate when it wants to stimulate the economy. This usually happens during periods of high unemployment or slow economic growth.

Lowering the cash rate makes loans cheaper, encourages business investment, and boosts consumer spending. For example, in November 2020, the RBA dropped the cash rate to 0.10% to support Australia’s recovery from the economic impact of COVID-19.

When the RBA keeps the cash rate on hold?

The RBA may hold the cash rate steady when the economy is balanced, meaning inflation is under control, unemployment is low, and growth is sustainable.

In these conditions, maintaining the current cash rate helps preserve price stability and long-term confidence in Australia’s financial system.

RBA cash rate vs mortgage rate explained

The RBA cash rate and home loan interest rates are connected but not the same. The cash rate is the RBA’s target for the overnight interbank lending market. It sets the benchmark for the cost of money in the financial system.

Your mortgage rate, on the other hand, is what a bank or lender charges you to borrow money for your home loan.

When the RBA cuts the cash rate, banks often reduce their variable mortgage rates, making home loans cheaper. However, this depends on each lender’s funding costs, market competition, and profit strategy, meaning not every rate cut is passed on in full.

Fixed home loan rates are influenced more by long-term market expectations and global bond yields than by the immediate cash rate. That’s why fixed rates don’t always move in sync with the RBA’s decisions.

Does the cash rate affect bank interest rates?

Yes. The RBA cash rate has a direct impact on how banks and lenders set their interest rates, though the link isn’t always one-to-one.

When the Reserve Bank of Australia (RBA) changes the cash rate, it changes the cost of borrowing money for banks.

- A higher cash rate makes it more expensive for banks to borrow funds, which often leads to higher home loan rates for borrowers.

- A lower cash rate reduces funding costs, allowing banks to lower their variable loan rates and stimulate borrowing.

However, not all rate changes move in perfect sync with the RBA.

Banks also rely on customer deposits, offshore funding, and wholesale markets, which can move independently of the cash rate.

That’s why lenders sometimes adjust rates out of cycle with the RBA’s decisions.

How banks and lenders set their interest rates?

Banks consider multiple factors when deciding on interest rates:

- The RBA cash rate and other wholesale funding costs

- The interest they pay on customer deposits

- Their assessment of risk for different loan types

- Competitive pressure from other banks and lenders

- Their target profit margins and business goals

These combined factors determine how much a bank charges for home loans and why rates can vary so much between lenders.

Why banks don’t always pass on rate cuts?

When the RBA lowers the cash rate, most people expect banks to cut home loan rates too but that doesn’t always happen.

Banks set their rates based on more than just the RBA decision. They also consider their own funding costs, including customer deposits, offshore borrowing, and the Bank Bill Swap Rate (BBSW) which can move independently of the RBA’s cash rate.

If these costs rise, banks may hold back some or all of a rate cut to protect their profit margins. Often, they pass on discounts only to new customers, while existing borrowers stay on higher “back-book” rates.

This approach helps banks balance customer competition, profitability, and financial stability, especially when markets are volatile.

In short:

- RBA cuts don’t always mean lower home loan rates.

- Banks weigh multiple funding and market factors.

- New customers often get better rates than existing ones.

RBA cash rate: What it means for you?

Changes to the RBA’s cash rate ripple through the entire economy — shaping home loan rates, savings returns, business investment, and property prices.

It’s important to remember that a change in the official cash rate doesn’t automatically mean banks will move their rates the same way. Each lender decides whether to pass on rate changes based on their funding costs, profit margins, and market competition.

Here’s how different groups are affected:

Borrowers

When the cash rate falls, lenders often lower variable home loan rates, reducing monthly repayments. When it rises, repayments usually increase. Either way, it’s a good time to check your home loan rate and see if refinancing could save you money.

Savers

Rate cuts usually mean lower returns on savings accounts and term deposits. Rate hikes can improve deposit rates, though outcomes vary by bank.

Property buyers

Lower rates boost borrowing power and can lift property prices as demand grows. Higher rates reduce affordability, helping cool the housing market.

Investors

Falling rates tend to support share markets and property investments, as investors seek higher returns. Rising rates can make bonds and fixed income more attractive, shifting money away from riskier assets.

Households and businesses

Changes in the cash rate affect spending confidence. Lower rates can support household budgets and business borrowing, while higher rates typically slow spending to curb inflation.

The RBA cash rate is one of Australia’s most powerful economic tools — but it doesn’t guarantee banks will follow suit. Staying informed, comparing rates, and reviewing your financial position regularly can help you make the most of every rate change.

How’s your rate is holding up?

Interest rates move. Your home loan should too.

Instead of guessing what to do after every RBA rate change, perform a quick Home Loan Health Check and see if your current deal still makes sense.

Ask Bheja to:

- Check if you’re overpaying on your current rate

- Compare your loan with the latest RBA cash rate impact

- Estimate potential savings from refinancing

- Discover if fixing or splitting could improve flexibility

It only takes a minute to find out if your home loan is still working for you.

What our customers say

Trusted by thousands of Australians for their home loan journey

Ian Fletcher

a month ago

I tried the home loan health check and was amazed how quickly it outputted the results with a graph of how my loan compares. With an estimated savings of over 100 thousand at a click of other home loa...

Always Seeking

2 weeks ago

I found the calculator super easy and informative. Great to help me plan my next steps. I feel this will make our search and finance for a investment property super easy.

Deb M

2025-10-28

I found Bheja.ai to be such a great DIY tool to explore mortgage options, no wall of big jargons, no judgement for my messy thoughts, most importantly no agenda trying to push sell anything, just a wa...

Frequently Asked Questions

The RBA Cash Rate is the official interest rate target set by the Reserve Bank of Australia for overnight loans between banks. It serves as the primary tool for the RBA to implement monetary policy and influence economic activity, inflation, and employment levels across Australia.

Pravin Mahajan

Founder @ Bheja.ai | Mortgage Broker | Ex-CTO RateCity & CIMET

Pravin Mahajan is the Founder of Bheja.ai and an accredited Mortgage Broker (Credit Rep. 570637). Based in Sydney, he sits at the unique intersection of financial regulation and enterprise technology.

With over 30 years of experience, Pravin has architected the consumer platforms that millions of Australians rely on for daily financial and purchasing decisions. His career is defined by building high-scale systems that simplify complex choices:

- RateCity (Acquired by Canstar): As Chief Product & Technology Officer, Pravin led the tech transformation that culminated in the company's acquisition. He orchestrated "Australia’s First Home Loan Sale," a digital initiative that reached over 12 million people.

- CIMET: As CPTO, he built enterprise-grade infrastructure for energy and broadband comparison, scaling operations to support major B2B partners.

- Salmat (Lasoo): He architected digital catalogue systems used by 5.7 million monthly users, digitising the retail experience for brands like Target and Myer.

- Woolworths: Designed the real-time, secure "Pay at Pump" transaction infrastructure deployed Australia-wide.

Today, at Bheja.ai, Pravin combines this deep technical background with his Certificate IV in Finance and Mortgage Broking to build AI agents that don't just compare loans, but help Australians actively secure their financial future.

Mahendra Duddempudi

CTO & Head of Research

Mahendra Duddempudi is the CTO, Founder, and Head of Research at Bheja.ai. With 15+ years in software architecture, data engineering, and analytics, he combines technology and research to simplify complex topics in property, home loans, and finance. His work focuses on using AI, natural language search, and data-driven insights to make financial decisions clearer and more accessible for Australians.