Refinance your home loan in Australia 2025

What is refinancing?

Refinancing simply means replacing your existing home loan with a new one. Think of it as shopping around for a better deal on your mortgage. You can refinance with your current lender or switch to a completely new financial institution. The goal is usually to secure loan terms that better suit your current financial situation and future goals.

No matching loans found

Try adjusting your filters to see more options.

* Comparison rate is calculated on a loan amount of $150,000 over 25 years. Rates and fees are subject to change. Terms and conditions apply.

+ Only key fees (application, discharge, ongoing) are displayed - other fees such as redraw, administration, and processing fees may also apply.

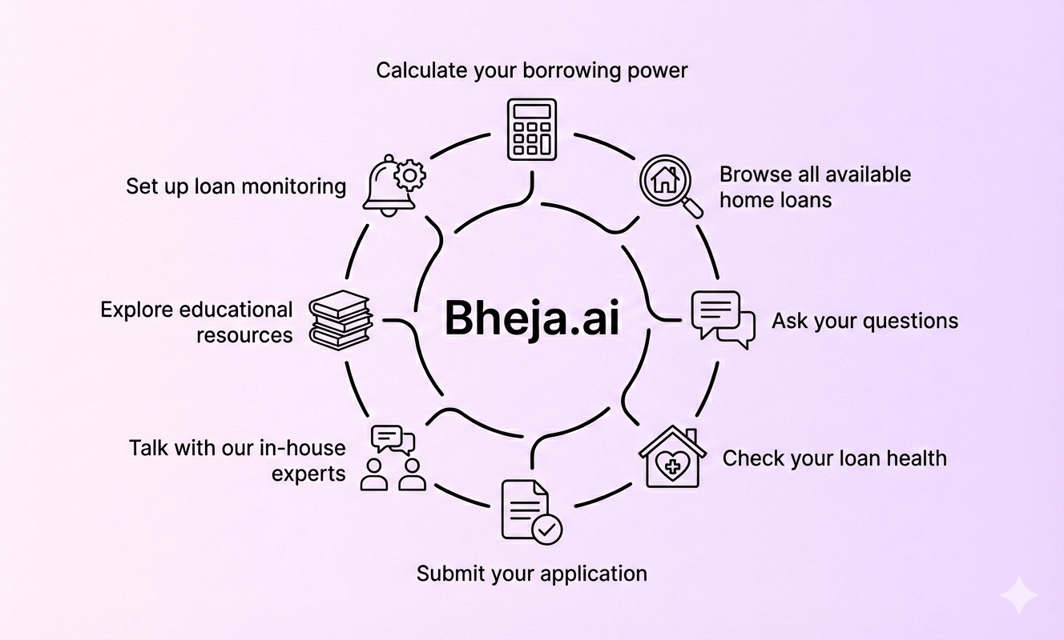

Got questions? We’ll guide you step by step.

Bheja looks at our product database and your needs to give you a personalised response.

Most users find a better mortgage rate with our platform.

Users who refinance can enjoy significant monthly savings.

Fast, personalised product matching in minutes.

Refinance to

Meet Sarah

Background

Sarah had been with the same bank for eight years, with a home loan of $600,000. She was on a variable rate of 6.20% p.a. but noticed the bank was offering new customers rates as low as 5.70% p.a.

Current Situation

She called her bank to request a lower rate, but they refused to match the offer. Despite her long-standing relationship with them, she wasn’t getting the best deal.

Action Taken

Sarah decided to refinance to another lender offering 5.65% p.a. (comparison rate 5.90% p.a.). This move saved her over $300 per month, proving that loyalty doesn’t always pay in banking.

Financial Impact

Notes on calculations:

- The monthly repayments are estimates based on standard mortgage calculations.

- The savings are calculated as the difference between the previous and new monthly repayments.

- Calculations assume a remaining loan term of 30 years unless otherwise specified.

Disclaimer:

These case studies are hypothetical examples only and are for illustrative purposes. Refinancing may come with costs such as break fees, discharge fees, application fees, and valuation fees, which could impact potential savings. Interest rates, fees, and loan terms vary between lenders, and individual financial situations differ. Before refinancing, carefully compare costs and benefits to ensure it aligns with your financial goals. Always seek professional advice where necessary

Lower interest rates

Refinancing to a lower rate can reduce your monthly repayments and save you thousands over time. You could also pay off your loan faster by keeping repayments the same.

Access to equity

Refinancing lets you tap into the equity built up in your home. You can use this for renovations, investments, or other large expenses.

Debt consolidation

Refinancing can help you roll multiple debts into your home loan to simplify repayments. You may also benefit from a lower overall interest rate.

Flexible loan Features

New loans may offer features like offset accounts, redraw, or extra repayments. These can help you save on interest and manage your loan better.

Better service and convenience

If your bank isn’t meeting your needs, you may want to switch to one that offers better service.

Access better benefits

Some lenders may offer cashback, fee waivers, or discounts to attract new customers.

When is the right time to refinance?

Refinancing your mortgage can be a powerful tool for achieving your financial goals, but it's not always the right move. To make an informed decision, you need to carefully consider your individual circumstances, current market conditions, and the potential costs and benefits involved.

Before you refinance: Know where you stand

Refinancing can offer real financial benefits—but it’s not one-size-fits-all. Taking the time to assess your current financial position and define your goals will help you make smart, strategic decisions that support your long-term financial wellbeing.

When NOT to Refinance Your Home Loan?

🚫 Timing Red Flags

💰 Financial Warning Signs

📊 Credit & Eligibility Issues

🏠 Property Considerations

📋 Loan Structure Factors

⚠️ Market Conditions

🔍 Research Gaps

💡 Pro Tip:

Before avoiding refinancing entirely, try these alternatives:

- Negotiate with your current lender for a better rate

- Switch to a different product with the same lender (internal refinance)

- Make additional repayments to achieve similar interest savings

- Use an offset account to reduce interest without changing loans

Quick Decision Framework:

✅ Proceed if: Savings >$200/month + staying >3 years + good credit score

🛑 Avoid if: Any 3+ checklist items apply to your situation

🤔 Get advice if: Unsure about costs, timing, or eligibility

This checklist helps Australian homeowners make informed refinancing decisions while avoiding costly mistakes that could set back their financial goals.

Pravin Mahajan

Founder

Pravin Mahajan is a seasoned technology leader with deep expertise in financial innovation and product strategy. He focuses on leveraging AI and automation to streamline financial processes, making them more accessible and efficient. Passionate about digital transformation, Pravin drives innovation in fintech, helping businesses and consumers adapt to an evolving financial landscape. His insights on technology, finance, and product strategy are widely recognised in industry forums.

In Case You have More Questions About

Refinancing can help you lower your interest rate, reduce monthly repayments, switch to a loan with better features, consolidate debts, or access equity in your home. It’s a way to ensure your home loan remains competitive and aligns with your financial goals.