You make high stakes decisions every day. You manage large projects, lead teams, and handle complex legal or medical issues. But when it comes to your own finances, your biggest liability is your mortgage, and you could be stuck on an uncompetitive rate simply because you don’t have time to address it.

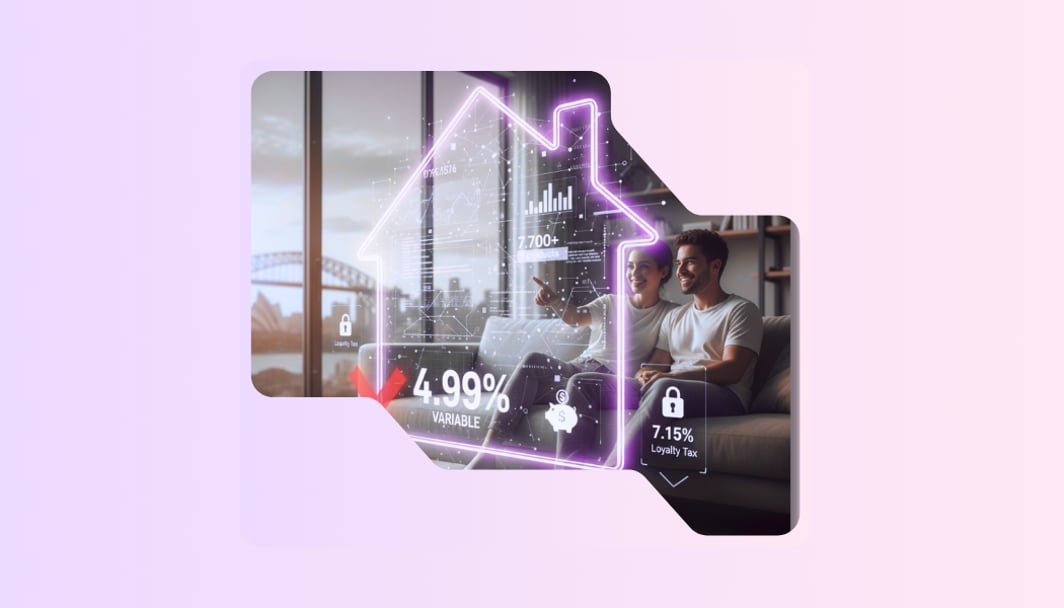

This isn’t just a simple mistake; it’s part of a bigger problem known as the "Professional’s Penalty." Australian banks know that high income earners, such as doctors, lawyers, and tech executives, often work more than 60 hours a week. They know your time is valuable, you dislike paperwork, and you’re unlikely to spend your weekend negotiating small rate changes. So, they rely on you staying put. They keep your rate high and collect a "loyalty tax" that quietly takes thousands from you each year. You’re being penalised for being busy and successful. It’s time to change that.

Why high-income professionals often have the worst rates

It doesn’t seem to make sense. You earn a good income, have a steady career, and always pay on time. By any standard, you’re an ideal customer. So why doesn’t your bank offer you its best interest rate?

The simple answer is that they don’t have to. Being a "good customer", loyal and easy to manage, can actually work against you in the Australian mortgage market. Lenders save their best rates for new customers to attract more business. Existing, reliable clients are often left with higher back book rates, and the gap can easily exceed 0.50%. Over the life of a typical Sydney or Melbourne mortgage, that difference adds up to a huge amount.

This problem gets worse when you consider the opportunity cost. The traditional refinancing process doesn’t work for busy professionals. Finding three hours to meet a mortgage broker during business hours is nearly impossible. That’s time you could spend with clients, in surgery, or working on important projects. At your hourly rate, that meeting could cost you over a thousand dollars in lost income, even before you save anything.

This tendency to delay is called "refinancing inertia," and it can seriously slow down wealth growth for high earners. With more people expected to refinance in 2026 as interest rates may drop, professionals who can’t act fast will miss a big chance to improve their finances. The old way, with lots of phone calls, paperwork, and hard to schedule meetings, just doesn’t work anymore. You need a faster, smarter solution.

What does a truly time-saving mortgage solution look like?

To fix a problem born of the digital age, you need a digital-first solution. The mortgage industry is starting to catch up, but many "digital" options are just old-fashioned brokers with nicer websites. A real-time, time-saving mortgage solution for professionals is based on three main principles.

1. It’s Asynchronous: Your Time, Your Terms. The 9 to 5 workday is outdated. You work when your job demands it, whether that’s closing a deal or caring for a patient. Your financial tools should fit your schedule, too. A modern mortgage solution lets you upload documents late at night, check options on your phone between meetings, and communicate securely with no more phone tag. The process should fit your life, not force you to adjust.

2. It’s Data First: Numbers, Not Sales Pitches. As a professional, you rely on data and evidence, not smooth talk. Your mortgage advice should work the same way. Instead of a broker showing you a few handpicked options, a data first platform reviews the whole market in real time. It uses AI to sort through hundreds of loans, filtering out the noise and showing you the best choices for your financial situation, including complex income from bonuses, investments, or partnerships. While some Australians remain cautious about AI in finance, the smart move is to use it as a powerful tool to ensure you see every option.

3. It’s Proactive: Your Financial Watchdog. The biggest time drain isn’t just applying for a loan, it’s managing it over time. A real time saving solution doesn’t wait for you to ask about better deals. It works in the background for you. With machine learning, it can monitor the market daily and analyse your financial habits. Now, machine learning can send you personalised alerts that go beyond just interest rate changes. It can spot chances to save based on your Loan to Value Ratio, changes in lender policies, or improvements in your spending. The savings come to you, not the other way around.

This isn’t about swapping human expertise for a robot. It’s about giving you a powerful tool that handles the hard work, so you can make smart decisions quickly. Think of it as an executive assistant for your mortgage, who is always available, highly analytical, and focused on your best financial interests.

This is where AI-powered mortgage help makes a real difference for professionals. It’s designed to save you time and help you get better results by using data.

For new home loans and purchases

Looking for home loan advice without all the sales talk and paperwork? Our AI Powered Broker platform is made for professionals like you.

Unlike traditional brokers who may only look at a limited panel, our system connects directly to Open Banking product reference data. It instantly scans over 7,000+ live product rates from across the market. The system uses automated tools to assess your complex income and borrowing power more accurately, filtering out the noise to give you a clear, data driven shortlist. No fluff, just the raw numbers you need to decide with confidence.

For existing home loans & refinancing

Your mortgage is one of your biggest assets, so it makes sense to manage it that way. Connect your current home loan to our AI Monitoring Tool and let it do the work for you. This "set and forget" solution runs in the background, continuously seeking better refinancing options. It acts as your personal financial watchdog, alerting you only when possible saving options are available. This is the best way to fight the loyalty tax without spending your valuable time, and it automatically keeps you on a competitive rate.

This approach isn’t just about making things easier; it’s also about compliance and security. All recommendations follow Australia’s Best Interests Duty, so the advice is legally required to put you first, not the lender. Developers also follow strict privacy rules to keep your financial data safe. All the next steps will be reviewed by our in-house experts to take over the application.

3 Quick wins for professionals (That take < 10 Mins)

While a fully automated solution is the end goal, you can take action right now to fight the Professional’s Penalty. Here are three quick steps you can do in under 10 minutes.

1. The "Rate check". Try Bheja’s health check to instantly see where your current rate really stands..

2. The LVR Check. Your Loan-to-Value Ratio (LVR) is your loan amount divided by your property’s value. If your property has gone up in value since you got the loan, which is likely in most Australian cities, your LVR has dropped. Many lenders put borrowers in different risk groups based on LVR. If you’ve passed a key point, usually 80%, you might qualify for a lower rate.

3. The Package Review (With a Caveat). Are you paying $395 a year for a "Professional Package" or "Wealth Package"? These bundles usually include the loan, a transaction account, and a fee-free credit card.

For many borrowers, these are a waste of money if you don't use the offset account or credit card. Switching to a basic loan could save you that annual fee plus get you a lower rate.

However, there is a crucial exception for professionals. If you are a Doctor, Lawyer, Accountant, or Engineer, your "Professional Package" might entitle you to an LMI Waiver. This allows you to borrow up to 90% of the property value without paying Lenders Mortgage Insurance (LMI), a benefit that can save you $10,000 to $30,000 upfront.

- The Rule: If you have an LMI waiver, keep the package.

- The Swap: If you don't need an LMI waiver and aren't using the offset, ask your bank to switch you to a basic loan to save the fees. Read more: Is a Package Loan worth the annual fee?

Your mortgage should be treated the same way. If you leave it unmanaged, you could be missing out on thousands of dollars each year just because the old process is too much of a hassle. It’s time to let smart technology handle your mortgage monitoring. Stop paying the price for being busy and start using time-saving mortgage solutions that work as hard as you do.