Mortgage Calculators

Bheja.ai connects to Australia’s Consumer Data Right (CDR) ecosystem, giving you live, lender-verified data — not outdated averages. Every calculation reflects real rates, fees, and product features from major banks and lenders.

✔️ Powered by live CDR Product Reference Data

✔️ Designed for home buyers, refinancers, and investors

✔️ Built for clarity, accuracy, and smarter loan decisions

💬 Try a calculator below or let Ask Bheja, your AI co-pilot, combine your results into a full Home Loan Health Check to find better options in minutes.

Top mortgage calculators for Australians

Below are the top calculators Australians search for each entry includes the primary intent, a short example, and related calculators to cross-check.

Home Loan Repayment Calculator

Estimate your monthly or fortnightly repayments and total interest payable based on your loan amount, interest rate, and term. Updated dynamically using lender data from the CDR network.

Example: $600,000 at 6.25% for 30 years ≈ $3,694/month.

Borrowing Capacity Calculator

Find out how much you can borrow based on your income, expenses, and existing liabilities. Uses serviceability models aligned with major lenders’ data via the CDR network.

Example: A couple earning a combined $180,000 with $2,000 in monthly expenses may borrow between $850k–$1.1M, depending on deposit size and interest rate.

Loan Health Check Calculator

Go beyond basic calculators and get a 360° view of your mortgage health.

The Home Loan Health Check Calculator combines everything you need to manage your loan smarter, all in one place.

It analyses your loan, compares rates from 100+ lenders using CDR-powered data, and identifies ways to:

✅ Check if your current rate is competitive

💸 See how much you could save with extra repayments or refinancing

📊 Monitor your Loan-to-Value Ratio (LVR) and borrowing position

🔔 Get alerts when your rate drifts above the market average

🤝 Book a free expert session to explore refinance or repayment options

Whether you’re a first-home buyer or looking to switch lenders, this calculator helps you make confident, data-driven decisions, your AI co-pilot for home loans.

Refinance Calculator

Compare your current loan with new offers to see potential savings from refinancing. Includes CDR-linked rate comparison across lenders.

Example: Refinancing a $700,000 loan from 6.75% to 5.99% could save ~$320/month or $115,000 over the loan term.

Home Loan Offset Account Calculator

Find out how an offset account reduces your interest by using your savings balance to offset your loan principal. Syncs with CDR interest rate feeds.

Example: Keeping an average $50,000 in your offset account on a $600,000 loan at 6% could save ~$180/month and cut years off your mortgage.

Loan to Value Ratio (LVR) Calculator

Determine your LVR to see if you’ll need LMI (Lenders Mortgage Insurance) and whether you meet typical lending thresholds.

Example: Buying a $900,000 property with a $100,000 deposit = LVR of 88.9%, which may trigger LMI costs.

Extra Loan Repayments Calculator

See how much time and interest you can save by making extra repayments on your home loan. Powered by CDR-based amortisation data.

Example: Paying an extra $200/month on a $500,000 loan at 6% could save over $52,000 in interest and cut your term by 3.5 years.

Lump Sum Repayment Calculator

Calculate how a one-off payment can reduce your interest and shorten your loan term. Based on real lender data through the CDR framework.

Example: A $20,000 lump sum on a $600,000 loan after five years could save ~$35,000 in interest and shave 1.8 years off the term.

💬 Ask Bheja - Your Smart Mortgage Copilot

Don’t just calculate, converse your way to clarity. With Ask Bheja, you can chat about your home loan goals, compare lenders, estimate repayments, or see how rate changes might impact you, all in one place.

🤖 Get personalised answers instantly using live calculator data

🏦 Compare loans from Big 4 banks and 100+ lenders

📊 Explore “what-if” scenarios like fixed vs variable or split loans

💡 Receive insights and tips tailored to your financial profile

Split Loan Calculator

Model different scenarios by splitting your loan between fixed and variable portions to balance rate security and flexibility.

Example: Splitting $600,000 into $300k fixed at 6.1% and $300k variable at 6.4% could help balance rate risk while allowing faster extra repayments.

Stamp Duty Calculator

Calculate stamp duty payable on property purchases across all Australian states and territories, with rates sourced from official government schedules.

Example: A $750,000 owner-occupied property in VIC attracts ~$40,070 in stamp duty (subject to concessions and exemptions).

Cost of Buying Property Calculator

Estimate the total upfront and hidden costs of buying a home, including stamp duty, legal fees, and lender charges.

Example: For a $900,000 home in NSW, expect upfront costs of $40k–$50k, including stamp duty and settlement fees.

Cost of Selling Property Calculator

Work out what it will cost to sell your home, including agent commissions, marketing, and conveyancing.

Example: Selling a $1M property may cost $20k–$30k in agent and marketing fees, depending on location and campaign type.

🏡 Talk to a Home Loan Expert

Done exploring our calculators? Get personalised guidance from one of our mortgage experts. We’ll help you find the best loan for your needs, review your current rate, and check if you could save thousands through refinancing or better features.

✅ Tailored advice based on your goals and financial profile

💡 Compare over 40 lenders — including the Big 4 banks

📈 Check your borrowing power or home loan health instantly

🗓️ Get actionable insights — not just numbers

Pravin Mahajan

Founder @ Bheja.ai | Mortgage Broker | Ex-CTO RateCity & CIMET

Pravin Mahajan is the Founder of Bheja.ai and an accredited Mortgage Broker (Credit Rep. 570637). Based in Sydney, he sits at the unique intersection of financial regulation and enterprise technology.

With over 30 years of experience, Pravin has architected the consumer platforms that millions of Australians rely on for daily financial and purchasing decisions. His career is defined by building high-scale systems that simplify complex choices:

- RateCity (Acquired by Canstar): As Chief Product & Technology Officer, Pravin led the tech transformation that culminated in the company's acquisition. He orchestrated "Australia’s First Home Loan Sale," a digital initiative that reached over 12 million people.

- CIMET: As CPTO, he built enterprise-grade infrastructure for energy and broadband comparison, scaling operations to support major B2B partners.

- Salmat (Lasoo): He architected digital catalogue systems used by 5.7 million monthly users, digitising the retail experience for brands like Target and Myer.

- Woolworths: Designed the real-time, secure "Pay at Pump" transaction infrastructure deployed Australia-wide.

Today, at Bheja.ai, Pravin combines this deep technical background with his Certificate IV in Finance and Mortgage Broking to build AI agents that don't just compare loans, but help Australians actively secure their financial future.

Frequently Asked Questions

We integrate with CDR Product Reference Data meaning our insights are backed by live data from Australian banks and lenders, not static averages.

Learn. Compare. Decide.

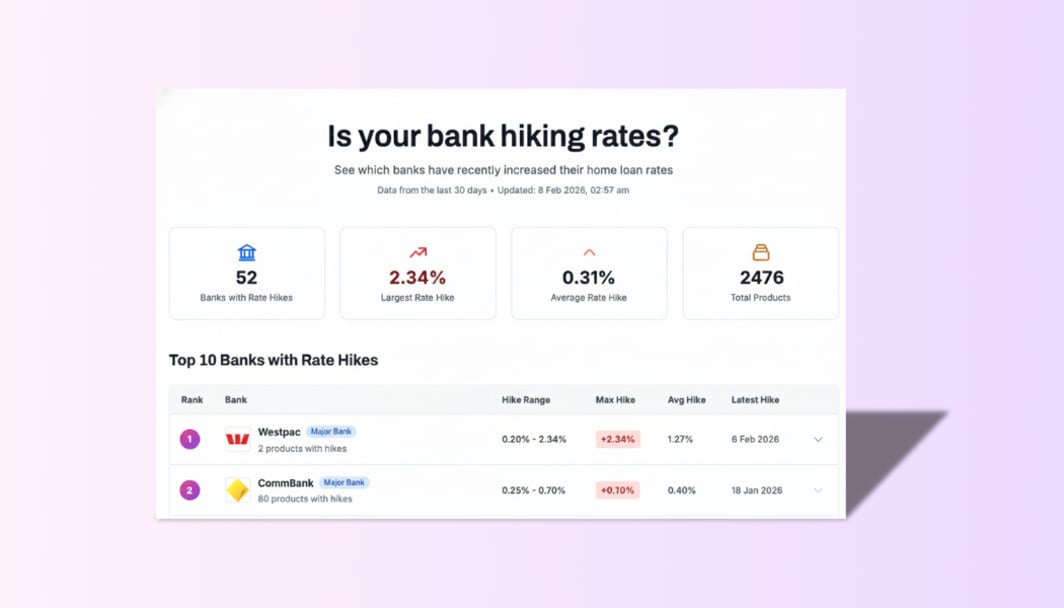

Fixed Rates Surge 70bps: How banks front-ran the RBA rate hike

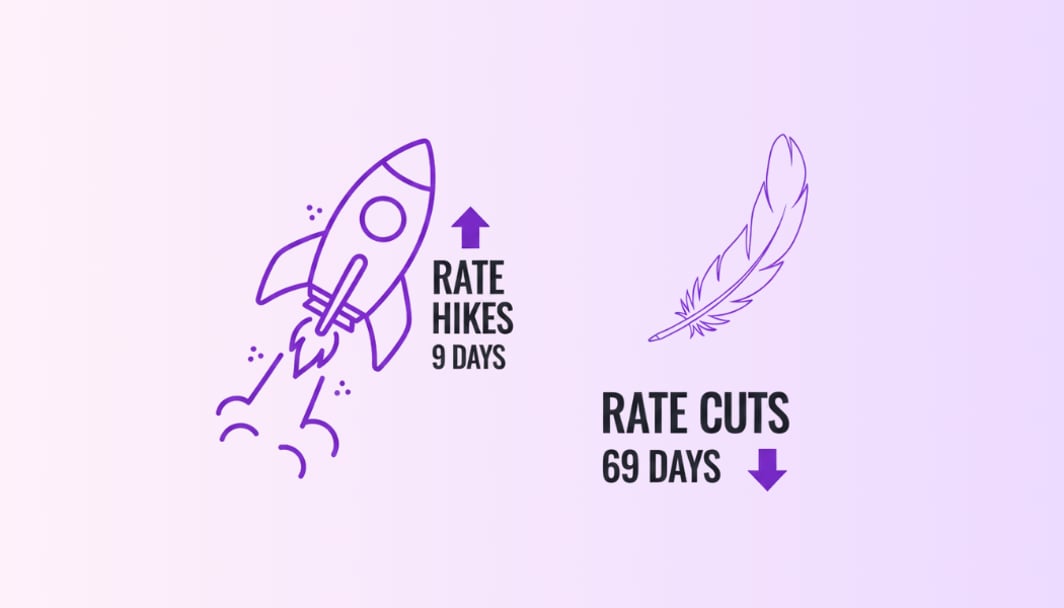

The 9-day hike vs. The 69-day cut: Australian bank lags 2026

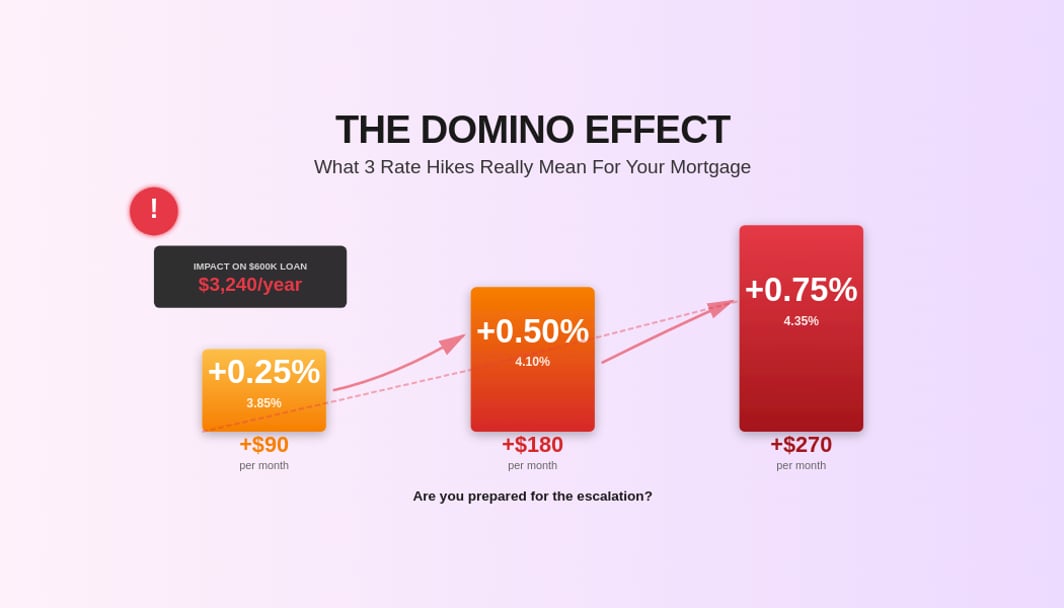

RBA lifts cash rate to 3.85%. What does it mean for Australian home borrowers?

How high will the home loan interest rates go?

DTI Rules 2026: Why ADI vs Non-ADI lenders could save (or cost) you $100,000