The “Rate Cut” party is over – and 2026 could even bring a hike.

The RBA has held the cash rate at 3.60% at its December 2025 meeting, after three cuts earlier in the year, and the next move is no longer guaranteed to be down.

What actually happened in 2025

The cash rate was cut three times in 2025:

- February: cut to 4.10%

- May: cut to 3.85%

- August: cut to 3.60% – where it sits today

What changed?

Inflation has picked up again, with the latest CPI reading around 3.8% – above the RBA’s 2–3% target band. In response, the RBA held the cash rate at 3.60% at its December meeting, and rate markets now price in a real chance that the next move in 2026 could be a hike rather than a cut.

In short, the conversation has quietly shifted from “how many cuts?” to “could the next move actually be up?”

What the big banks are forecasting about RBA’s next move:

According to the major bank economists, a rate cut in 2026 is unlikely. Here’s what the Big 4 predict at the time of writing:

- ANZ – hold

- CBA - predicts a 25 basis points hike in February

- NAB - predicts a rise of 25 basis points in February and another in May

- Westpac – hold

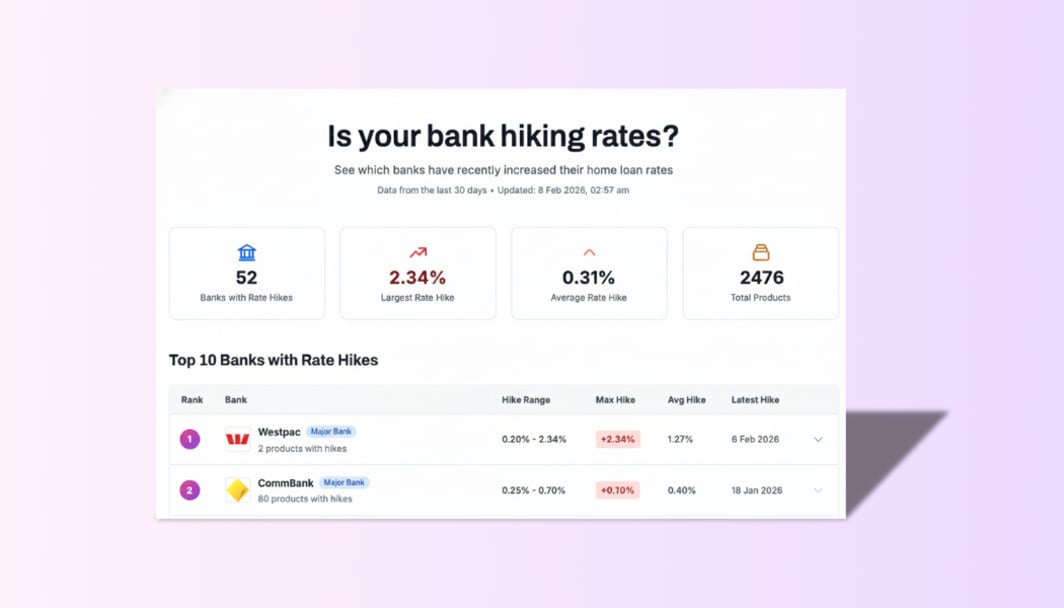

A quiet shift in the mortgage market

While the headlines focus on “no change” from the RBA, banks have already started tweaking their pricing. For borrowers, this means many older variable rates stay high, while some fixed‑rate deals are now priced slightly lower to attract new customers.

- Average variable interest rate: 5.95% pa

- Lowest variable interest rate: 5.14% pa

- Average fixed rate: 5.91% pa

- Lowest fixed rate: 5.09% pa

*data accurate as of 22 December 2025

However, this is only temporary, and fixed rates are already starting to rise. If you’re considering locking in a rate, now may be the right time to compare deals and choose a term that suits your budget and plans.

The next steps

In the current market, doing nothing is still a choice — but it can be a costly one.

If you’re on a variable rate, check how much higher it is than the sharpest deals available, including your own lender’s new-customer rates.

If you’re thinking about fixing, compare today’s 2–3-year fixed rates with your current variable rate and consider how long you plan to stay in the loan.

Either way, it’s a good time for a home-loan health check. Compare rates, test your repayments at a higher interest rate to understand the impact, and know your break costs and refinance options.

Looking for a lazy way to get ahead on your mortgage?

If you don’t plan to take instant action, you can still do something to save money on your mortgage.

By rounding up your repayments to the nearest dollar, you can end up saving thousands in home loan interest, and repay your loan faster. If you believe that the proof of the pudding lies in the number, here’s a small example to get you thinking:

What happens if you round up your repayments?

Example:

- Loan amount: $600,000

- Interest rate: 6.2% pa

- Loan term: 30 years

- Standard monthly repayment: $3,674.81

Round up to the nearest $5

- New repayment: $3,675

- Extra per month: ~$0.20

- Interest saved: ~$130

- Loan term reduced: ~1 month

Round up to the nearest $10

- New repayment: $3,680

- Extra per month: ~$5.20

- Interest saved: ~$3,500

- Loan term reduced: ~2 months

Round up to the nearest $100

- New repayment: $3,700

- Extra per month: ~$25

- Interest saved: ~$16,800

- Loan term reduced: ~7 months

As you can see, small, regular increases can make a meaningful difference over time, without changing lenders or refinancing. Ask Bheja for quick wins to get ahead on your mortgage.

Be money savvy in 2026!

Now that rate cuts are off the table, it’s less about timing the market and more about taking control. Understanding your loan and making small adjustments now can leave you better prepared for 2026.

As you plan for 2026, Team Bheja wishes you a joyful holiday season and a money-smart New Year!