The Reserve Bank of Australia (RBA) has lifted the cash rate by 25 basis points to 3.85% at its February 2026 meeting, signalling the Board's determination to bring inflation back to target.

The historic decision marks the first rate hike in over 2 years, making the RBA the first major central bank globally to reverse its post-COVID cutting cycle

Why Did the RBA Hike?

1. Core inflation remains sticky

December 2025 CPI showed headline inflation at 3.8% and trimmed mean at 3.3%—both above the RBA's 2–3% target range. Services inflation (rents, education) and wage pressures continue to drive price growth.

2. Demand outpacing supply

Governor Michele Bullock highlighted that private demand is growing faster than expected. Australians are spending more than the economy can currently supply, pushing prices higher.

3. Tight labour market

Unemployment fell to 4.1% in December 2025. While positive for workers, this "tight" job market fuels wage growth and services inflation—the RBA's biggest concern.

Hawkish forward guidance

This wasn't a one‑off:

- Inflation target delayed: Now expected early 2027, not sooner.

- Narrow path warning: Leaving inflation unchecked risks "higher rates and larger unemployment rises later".

- More hikes possible: "Further increases cannot be ruled out" if services inflation/household spending doesn't cool by May.

How major banks are responding

- CBA expects there could be a pause in March, but sees a strong chance of a rate hike in May.

- NAB is maintaining its forecast of two rate hikes, in February and May, bringing the rate to 4.10%.

- Westpac and ANZ describe the hikes as “insurance” against inflation, but caution that fixed rates are rising because of higher funding costs.

The action plan: Your next 48 hours

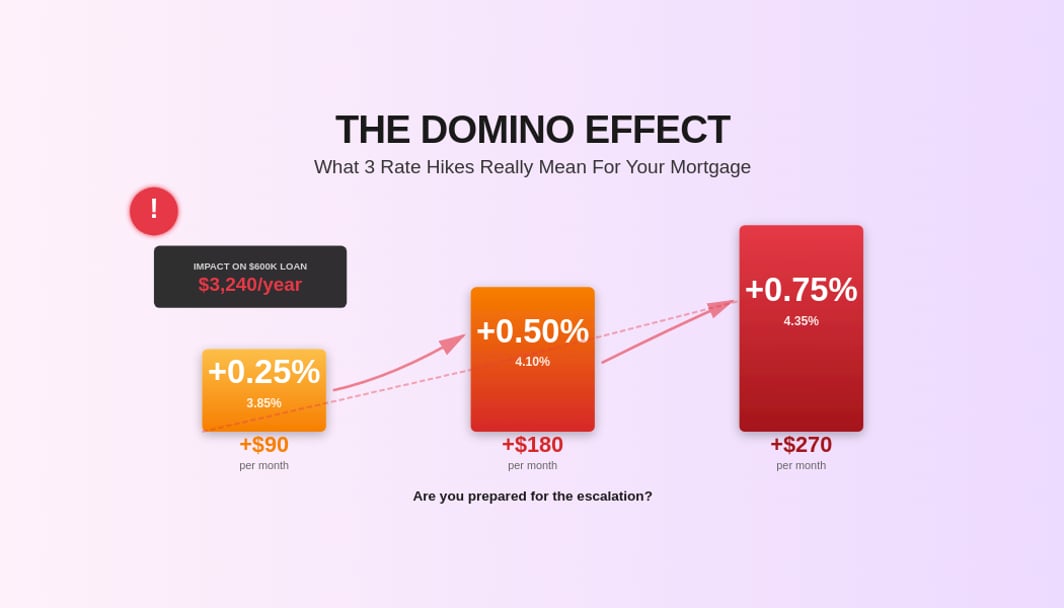

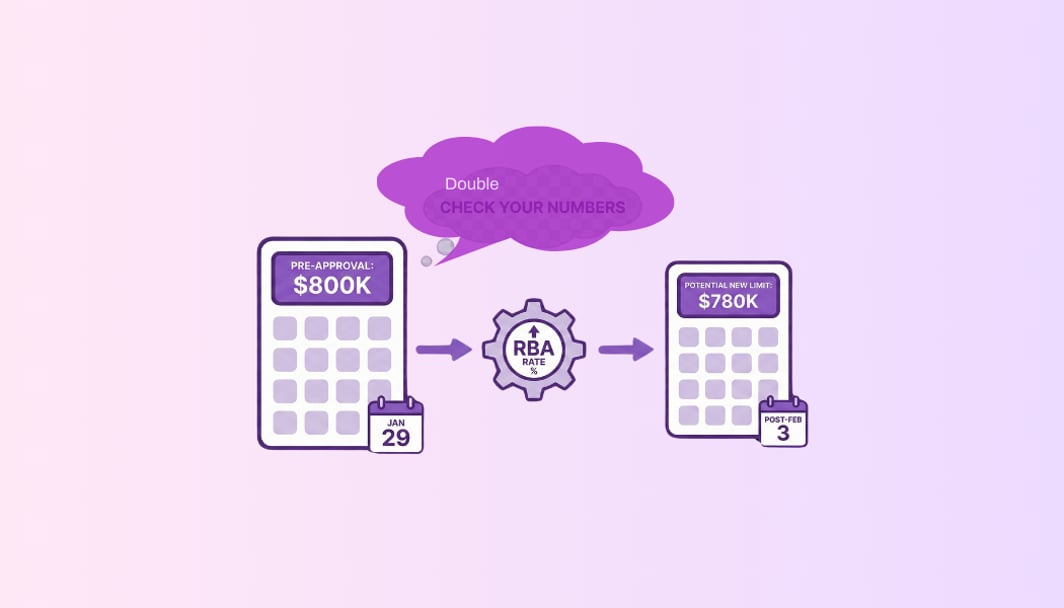

- Recalculate your borrowing power: A 0.25% hike typically reduces your maximum loan amount by 2-3%. If you are bidding on a house this weekend, your "max price" just dropped.

- Fix or float? With NAB forecasting another hike in May, the "wait and see" approach for variable rates is becoming risky. You can compare fixed rates for various terms to see if you can find a better deal before the rates rise further.

- The Bheja.ai solution: Refinance, fix, or continue as is? Run a health check on your home loan and your mortgage fitness score and the next steps to optimise your mortgage.