How to buy your first home in Australia (2025)?

Deposit, Grants, LMI & Parental Help Explained. We’re Here to Help You Every Step of the Way.

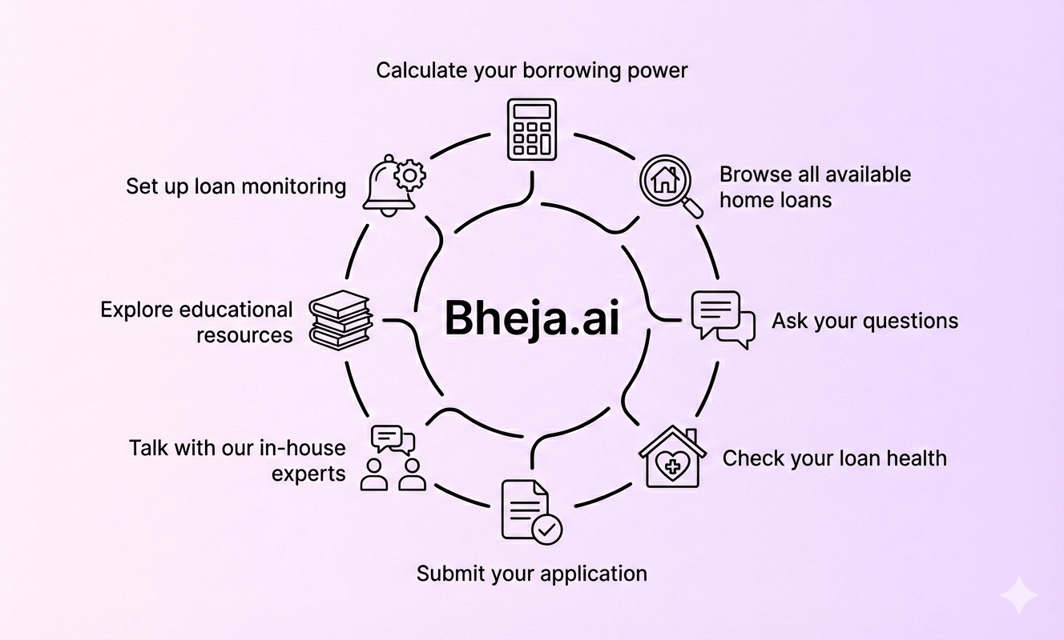

Buying your first home doesn’t need to be overwhelming. Whether you’re just starting to save for a deposit or comparing loan options, Bheja.ai helps you get clarity, eligibility, and expert support in minutes.

No matching loans found

Try adjusting your filters to see more options.

* Comparison rate is calculated on a loan amount of $150,000 over 25 years. Rates and fees are subject to change. Terms and conditions apply.

+ Only key fees (application, discharge, ongoing) are displayed - other fees such as redraw, administration, and processing fees may also apply.

First Home Buyer's key decisions

Focused on overcoming entry barriers, FHBs prioritise saving a deposit and leveraging government support. Their decisions are shaped by affordability and navigating extra costs like LMI.

45%

Saving the Deposit

A primary hurdle, involving strategies like automating savings, debt reduction, and leveraging schemes like the First Home Super Saver Scheme for tax benefits.

30%

Utilising Govt. Schemes

Exploring eligibility for grants (FHOG) and guarantees (FHBG, RFHBG) that can significantly reduce required deposits and waive LMI.

15%

Navigating LMI

Understanding Lenders Mortgage Insurance and exploring ways to avoid it, such as saving a 20% deposit or using a guarantor.

10%

Budgeting All Costs

Accounting for not just the loan principal but also stamp duty, legal fees, and other transaction costs to avoid financial surprises.

Watch out! If you are self-employed, you need different kinds of loans.

Lenders often perceive self-employed income as less stable, requiring specific documentation and potentially different loan products. It's crucial to understand these unique requirements.

The Path to Ownership

The home loan process is a structured journey with six critical stages. Understanding this path demystifies the process, reduces anxiety, and empowers you to be prepared for every milestone. Follow the steps from initial thought to final ownership.

1. Pre-Application

The research phase. You assess financial goals, calculate borrowing power, and gather documents. Key Decision: "Am I financially ready to begin this journey?"

2. Pre-Approval

A game-changing step where you get conditional approval from a lender. Key Decision: "Which lender should I approach to get a realistic budget and strengthen my position as a buyer?"

3. Choosing Lender & Product

Now you compare the market. Key Decisions: "Fixed or variable rate? Which features like offset accounts are essential for my lifestyle? What are the true costs?"

4. Application & Approval

With a property chosen, you submit your formal application for unconditional approval. Key Decision: "Have I provided all documentation accurately to ensure a smooth and fast approval?"

5. Contract & Settlement

The legal finalisation of the purchase. Key Decisions: "Do I fully understand the loan contract? Have I engaged the right legal support for settlement?"

6. Post-Settlement

Your journey continues as a homeowner. Key Decision: "How can I manage my loan effectively, and when should I review it to ensure I still have the best deal?"

Daniel

Profile

Age: 32

Profession: Engineer

Salary: $95,000

Deposit: $35,000

Location: Brisbane

Challenge

Was keen to buy but didn’t want to wait another 1–2 years to save a 20% deposit.

Solution

Went ahead with a 10% deposit and paid Lenders Mortgage Insurance (~$8,500) to get into the market faster.

Plan : Plans to refinance and drop LMI once LVR drops below 80%.

Disclaimer:

The case studies provided above are examples only and based on common lending scenarios. They are intended for general information purposes and do not constitute financial advice. Individual circumstances, lender policies, and scheme eligibility may vary. Please consult a licensed mortgage broker or financial adviser before making any home loan decisions.

Complete step-by-step first home buying process

Phase 1: Research & Preparation (Months 1-3)

Month 1: Financial Assessment

Week 1-2: Income & Expense Analysis

Week 3-4: Government Scheme Research

Month 2: Savings Optimisation

Month 3: Market Research

Phase 2: Pre-Approval & Property Search (Months 4-6)

Month 4: Lender Comparison

Required Documents Checklist:

Month 5: Pre-Approval Process

Month 6: Serious Property Search

Phase 3: Purchase & Settlement (Months 7-8)

Property Purchase Process:

Final Loan Approval:

Settlement Preparation:

Common First Home Buyer Mistakes ( How to avoid them?)

Mistake #1: Not Using Government Schemes

The Problem: 40% of eligible first home buyers don't apply for government assistance

The Cost: Missing out on $10,000-$50,000 in benefits

The Solution: Research every scheme you're eligible for before starting your search

Mistake #2: Focusing Only on Interest Rates

The Problem: Choosing loans based solely on advertised rates

The Cost: Missing features that could save thousands long-term

The Solution: Compare total cost over loan lifetime, including fees and features

Mistake #3: Not Getting Pre-Approval

The Problem: House hunting without knowing your true budget

The Cost: Wasted time, missed opportunities, weak negotiating position

The Solution: Get pre-approval before serious property searching

Mistake #4: Ignoring Additional Costs

The Problem: Only budgeting for deposit and missing other upfront costs

The Cost: $15,000-$40,000 in unexpected expenses

The Solution: Budget for stamp duty, legal fees, inspections, and moving costs

Mistake #5: Emotional Decision Making

The Problem: Falling in love with properties beyond realistic budget

The Cost: Overextending financially, stress, potential default

The Solution: Set clear criteria and stick to budget limits

Mistake #6: Poor Timing

The Problem: Not considering market cycles and personal readiness

The Cost: Buying at market peaks or before financially ready

The Solution: Understand market trends and ensure 6+ months financial stability

Learn. Compare. Decide.

DTI Rules 2026: Why ADI vs Non-ADI lenders could save (or cost) you $100,000

The Ultimate Mortgage Checklist: Every Question to Ask Your Broker (2026 Edition)

Is a 0% Deposit Home Loan Possible in Australia?

How AI Tools helps Migrants Compare Mortgage Rates in Australia

How you could become a homeowner in 2026