Investor Home Loans Australia

Expert guidance for every stage of your investment journey

From your first rental property to building a multi-property portfolio, the right loan structure can make all the difference. Our tailored strategies help Australian property investors maximise returns, reduce tax, and build long-term wealth through smart finance decisions, including advanced options like SMSFs and trusts.

No matching loans found

Try adjusting your filters to see more options.

* Comparison rate is calculated on a loan amount of $150,000 over 25 years. Rates and fees are subject to change. Terms and conditions apply.

+ Only key fees (application, discharge, ongoing) are displayed - other fees such as redraw, administration, and processing fees may also apply.

The new investor

For those taking their first step into property investment, understanding the fundamentals of loan types and setting clear goals is crucial for a strong foundation.

Why Invest in Property?

Defining Your Goal

Decide if your primary objective is rental income (cash flow) or capital growth (property value appreciation). This fundamental decision will shape your property selection and influence your loan choices.

Your Budget: Borrowing Power & Deposit

Calculate Borrowing Power & Deposit

Understand how much lenders are willing to offer based on your income, existing debts, and expenses. Be aware that investors typically need larger deposits, often 20% or more, compared to owner-occupiers.

Choosing Your Loan Type: P&I vs. Interest-Only

Select loan features

Over a 30-year loan term, an Interest-Only loan (even with a reversion to P&I) will generally result in significantly more total interest paid compared to a straight Principal & Interest loan. For example, on a $500,000 loan, a P&I loan might incur around $800,000 in total interest, while an IO loan could reach $950,000 or more.

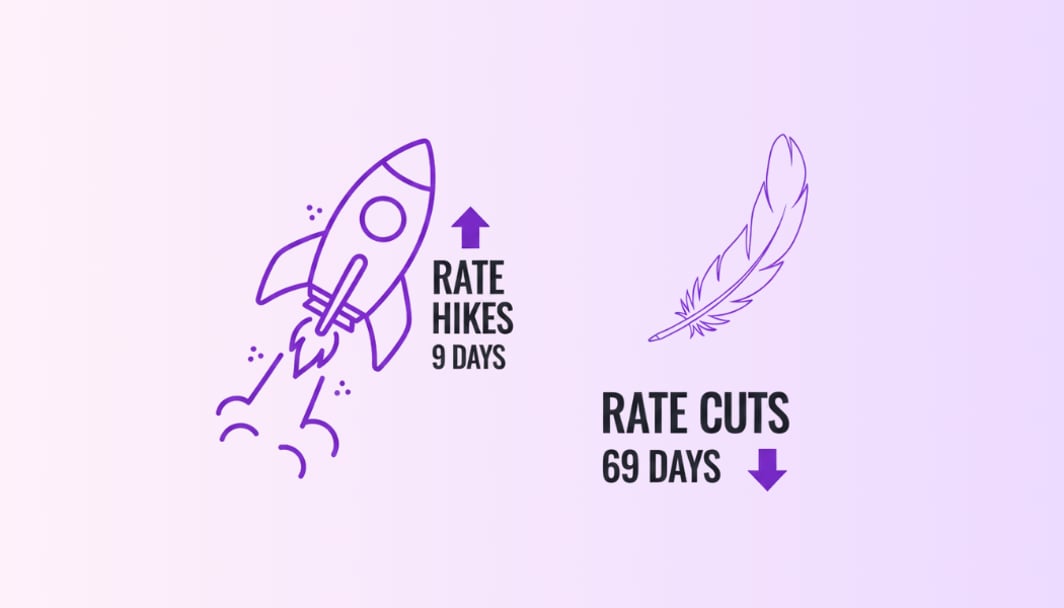

Understanding Risks: Be Prepared

Property investment carries risks. Be aware of potential vacancy periods, fluctuations in interest rates, and unexpected maintenance costs. Always ensure you have a financial buffer to cover these eventualities.

Buying your first investment property is a big step. It’s important to set strong financial foundations early so your portfolio can grow sustainably over time.

Property Investor's key decisions

Investors are driven by financial returns and tax efficiency. Their loan choices are strategic, aimed at maximising income and capital growth while managing risk.

35%

Loan Type Selection (P&I vs IO)

Choosing between Principal & Interest (P&I) for equity building or Interest-Only (IO) for cash flow and tax benefits.

25%

Gearing Strategy

Understanding negative (expenses > income) vs. positive (income > expenses) gearing and their tax implications.

25%

Tax Deductions & Compliance

Identifying eligible tax deductions (interest, fees, depreciation) and ensuring compliance with ATO rules for maximum returns.

15%

SMSF Property Investment

Exploring strict rules and higher costs of purchasing property through a Self-Managed Super Fund for retirement benefits.

The developing investor

As you acquire more properties, optimising your financial strategy through smart gearing and maximising tax efficiencies becomes paramount for sustainable growth.

1. Tax Smart: Gearing Strategy

- Negative Gearing: This occurs when the costs of owning an investment property (e.g., loan interest, expenses) exceed the rental income. The net loss can be offset against your other taxable income, reducing your overall tax bill.

- Positive Gearing: This is when the rental income exceeds the property's expenses. The net gain is added to your taxable income.

- Impact on Taxable Income: For instance, a $10,000 property loss from negative gearing could reduce your taxable income by $10,000, while a $10,000 property gain from positive gearing would increase it by $10,000.

2. Maximising Tax Deductions

Ensure you claim all eligible expenses to reduce your taxable income. These can include:

- Loan interest

- Property management fees

- Council rates and strata fees

- Building and landlord insurance

- Repairs and maintenance

- Depreciation on capital works and plant/equipment (e.g., carpets, appliances)

3. Equity Power: Refinancing for Growth

As your properties appreciate in value and you pay down your loans, you build equity. This equity can be a powerful tool. You can utilise it to:

- Fund deposits for new investment properties.

- Refinance existing loans for better interest rates or features, improving your cash flow.

4. Protect Your Assets: Structuring Your Holdings

Consider how you hold your properties (e.g., in an individual name, joint names, or a company/trust structure). Different ownership structures have varying implications for risk management, tax, and future estate planning. Seek professional advice to determine the best structure for your long-term goals.

The Matured Investor

For seasoned investors, exploring complex structures like Self-Managed Super Funds (SMSFs) and trusts, along with commercial property, can offer significant long-term benefits but come with strict regulations and higher complexities.

- SMSF Property Investment: Buying property through a Self-Managed Super Fund (SMSF) can offer tax benefits in retirement. However, it involves strict rules, higher costs, and requires specialist financial, legal, and accounting advice.

- Investing via Trusts: Trusts can offer advantages like asset protection and tax flexibility, but they involve complex setup and administration.

- Commercial Property Loans: This type of investment differs significantly from residential property. Commercial loans involve higher risks and typically require larger deposits, but can offer higher rental yields.

For advanced strategies involving SMSFs, trusts, or commercial property, engaging a team of financial advisors, tax accountants, and legal professionals specialising in property and superannuation is not just recommended, it's essential. Their expertise will ensure compliance and optimise your investment structure.

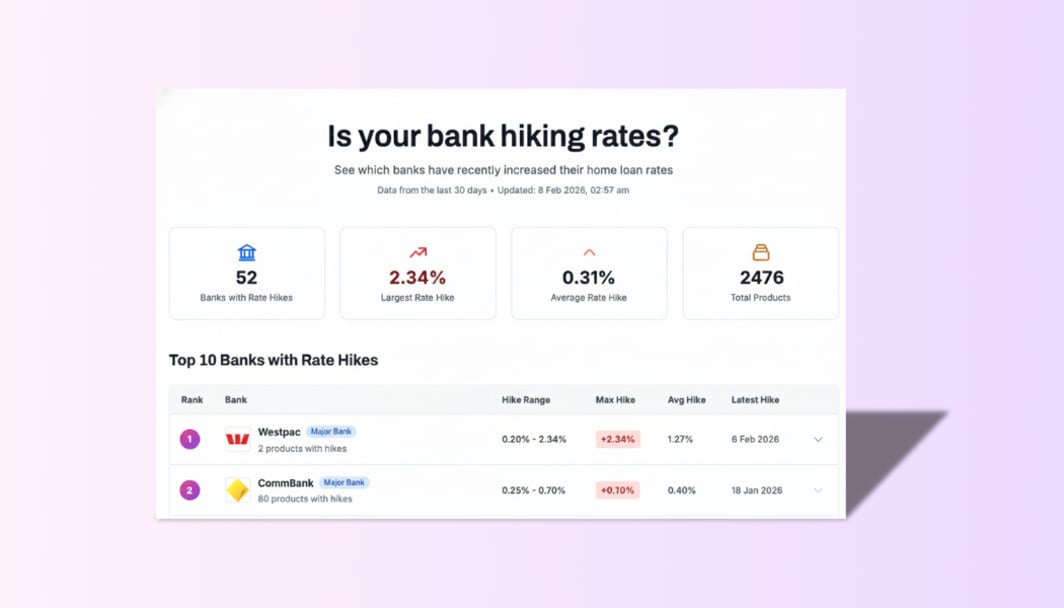

Compare Investor Loans & take the next step

Your loan choices are strategic and should align with your investment goals. Finding the best loan for your situation is the first step toward building a successful portfolio. Compare investor home loans with our advanced tool to find the right loan for you.