Key Points Summary:

- The Reserve Bank of Australia (RBA) has held the cash rate at its July meeting.

- The official cash rate continues to stand at 3.85%.

- You can still potentially save money on your home loan by refinancing to a lower rate.

The Reserve Bank of Australia (RBA) has left the official cash rate unchanged at 3.85% at its July meeting, defying market expectations for a third rate cut in 2025.

This pause follows two earlier cuts in February and May, which brought the cash rate down from 4.35% at the start of the year to its current level.

So what does this hold mean for you—and your home loan?

What the RBA decision means?

Despite falling inflation and weak household spending, the RBA chose to hold steady. Here’s why:

- Inflation is easing—but slowly

The May monthly CPI came in at 2.1%, with the trimmed mean at 2.4%. While this is within the RBA’s target band (2–3%), the RBA highlighted ongoing uncertainty in the outlook for services inflation. - Global risks remain high

Geopolitical tensions and volatility in global energy markets have added pressure on import prices. The RBA cited external headwinds as a reason to proceed cautiously. - Wages and productivity data still unclear

The bank is watching closely to ensure wage growth doesn’t reignite inflation, particularly in services.

So what does this mean for mortgage holders?

While the widely anticipated additional relief for mortgage holders didn't come through, if your lender passed on the earlier rate cuts in full, you could already be saving significantly on your home loan. For example, a borrower with a $600,000 mortgage who was paying 6.25% in January would now be on a rate closer to 5.75%. That equates to a saving of around $155 per month, or nearly $1,860 per year.

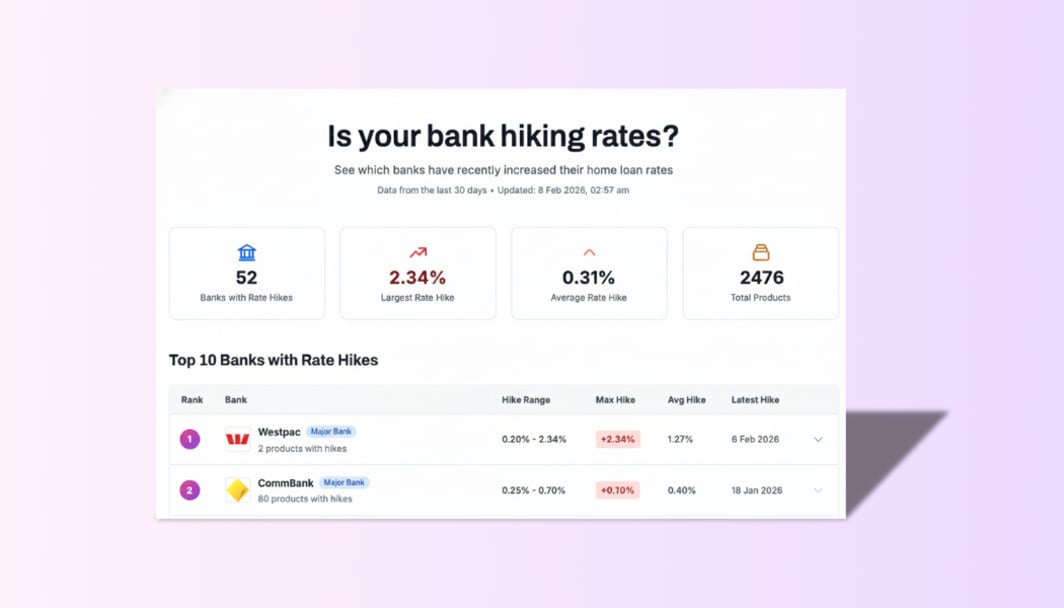

However, not all lenders pass on rate cuts in full—or at all. If you’ve seen little or no change in your repayments since the start of the year, it’s a strong signal that you may be paying more than you need to. In today’s environment, complacency can cost thousands of dollars over the life of a loan. So while you wait for the RBA to make its next move, it could be good to take matters in your own hands and give yourself a rate cut! Here's how:

1. Ask your lender for a better deal

Most lenders won’t tell you when better rates are available. But many will match lower offers if you ask. Start by checking what others are offering.

2. Compare and refinance

Rates as low as 5.25%–5.50% are now on the market. Refinancing could save you $2,500+ a year on an average loan. You can use our health check calculator to see how your mortgage interest rate stacks up against what's available on the market.

3. Fix part of your loan

With more cuts expected, full-term fixed rates may not appeal—but splitting your loan (part fixed, part variable) could be an option worth exploring.

Will there be another rate cut in 2025?

Although the RBA held rates steady this month, many economists still expect further cuts later in the year—possibly as early as August—if inflation continues to ease and economic conditions remain soft.

But borrowers don’t need to wait for the next move to start saving. Whether or not another cut comes this year, the current environment still presents strong opportunities to lower your repayments. The key is to take action now—check your current interest rate, compare it to what’s available in the market, and don’t hesitate to ask your lender for a better deal. If they won’t budge, refinancing could deliver meaningful savings and put you ahead no matter what the RBA does next.