Home Loan Health Check

Wondering if your home loan is still the right one for you?

With interest rates constantly changing, your mortgage might be costing you more than it should.

Tell us about your loan

Home loan health check Australia: A complete guide to reviewing your mortgage

For most Australians, a home loan is their biggest financial commitment. After the excitement of moving in, it often becomes something people stop thinking about, just another direct debit each month. But ignoring your mortgage can be costly. Many homeowners end up paying a "loyalty tax," where existing customers are charged higher interest rates than new ones, sometimes up to 0.5% more.

A proactive home loan review could save you thousands. Research shows that homeowners, on average, save approximately $1,524 annually just by refinancing. For many, that's a family holiday, a significant boost to the kids' school fees, or a much-needed top-up to the savings account.

Your mortgage needs regular attention, just like your car. If you skip servicing your car, it won’t run well. Checking your home loan helps make sure it still suits your needs, stays competitive, and matches your goals. This is a smart move for any homeowner, not just those struggling with repayments.

Why your mortgage needs a regular check-up

Many people think you only need a home loan review if you're struggling financially, but that's not true. Regular checks help you maximize your financial resources. The mortgage market changes rapidly, and a loan that was ideal a few years ago may no longer be the best option.

Several key triggers should prompt an immediate review:

- Significant Life Events: Your financial situation changes over time. If your income changes, you have a new baby, move to a larger home, or approach retirement, it’s a good time to check if your home loan still meets your needs.

- A Shifting Economic Climate: Australia has experienced significant changes in its economy, most notably the recent shift from low fixed rates to higher variable rates. Since mid-2022, more competition among lenders has helped keep mortgage rates lower than expected. With possible rate cuts coming by late 2025, now is a good time to review your loan.

- Your Fixed-Rate Period is Ending: This is one of the most important times to review your loan. When your fixed rate ends, you usually move to the bank’s standard variable rate, which is often not the best deal. This is a great chance to renegotiate or refinance.

If you ignore these signs, you could miss out on thousands of dollars in savings. Regular reviews can save you $5,000 to $10,000 or more over the life of your loan. This could help you pay off your mortgage years sooner.

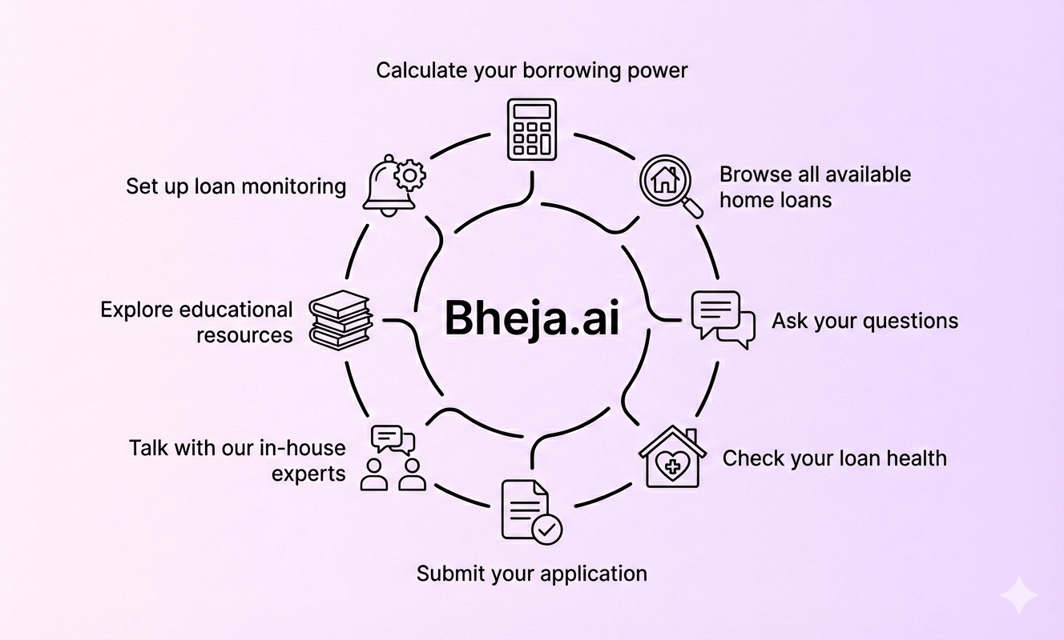

Why Use Bheja.ai?

- AI-powered insights: Our system automatically monitors your loan and alerts you when a better rate becomes available.

- Broker-backed support: Connect with an accredited mortgage expert only if you choose to.

- No cost, no credit impact: 100% free tool designed to put you in control.

- Built for Australian borrowers: Whether you’re in Sydney, Melbourne, or Brisbane, we help you stay mortgage-smart.

The health check process: A step-by-step guide

So, what does a home loan review involve? It’s a simple process that gives you the information you need to make a good decision.

To get started, you'll need to gather a few key documents. Being prepared makes the process much smoother. You should have your latest home loan statement, the original loan agreement, evidence of income (such as payslips/tax returns), and a recent credit report. Alternatively, you can join our waiting list above in the health check calculator, and we will send you an invitation to the automated process for collecting this information.

This information gives a clear picture of your current position and what you’re eligible for.

Once you have your information, the review focuses on a few key areas.

Scrutinising your loan: What to look for

A thorough home loan health check looks at more than just the interest rate. It ensures your entire loan setup works for you, whether it's variable, fixed, or a combination of both.

1.Types of Rates: The choice between a fixed and variable rate is a constant tug-of-war between stability and flexibility.

Fixed rates offer predictable repayments, which is great for budgeting, especially in a rising rate environment. It’s a safe bet for the risk-averse.

Variable rates move with the market. They often come with additional features, such as offset accounts and the ability to make extra repayments without penalty. With rate cuts in 2025, a variable loan could be very attractive.

Split loans offer a middle ground. You can fix part of your loan for certainty and keep the rest variable to take advantage of possible rate drops.

2. Loan Features: Are You Paying for Things You Don't Use? Features like offset accounts and redraw facilities can help you save on interest and pay off your loan faster. An offset account, which reduces your loan principal by your savings balance, can save you a lot over time. But some loans charge higher fees for these features. A health check helps you determine if you’re using these tools effectively or if a simpler, lower-fee loan might be a better option.

3. The Lenders: Big Four Banks vs. Non-Majors. While the big banks remain popular, non-major and non-bank lenders are becoming increasingly competitive. Recent reports show that non-bank lenders are winning more new home loans by offering better rates and features. You might find lower refinance rates with these lenders. A health check can help you discover options you may not have thought about.

4. The Bottom Line: Refinancing Costs vs. Savings Switching lenders isn't always free. You should be aware of potential costs, including application fees, valuation fees, and settlement fees. If you're on a fixed rate, there could also be substantial break fees. A thorough mortgage review will calculate these costs and weigh them against the potential long-term savings to provide a clear break-even point. A general rule of thumb is that refinancing is worth considering if you can secure a rate at least 0.5% below your current one.

Title: Case Study: Renegotiate or Refinance?

Scenario: An Adelaide family with a $600,000 loan balance and 25 years remaining. Their current variable rate is 6.25%.

Note: This is an illustrative example. Actual savings, rates, and costs will vary based on individual circumstances, you can try our calculator above or just Ask Bheja.

The feedback so far has been strong, even from experienced finance experts:

"I can’t believe it's going to drop 4 to 5 years off the loan term." - Asset finance Cofounder.

"The simplicity and hack for switching repayments is awesome." - Big Four loan officer with 15+ years.

"Shocked to see the amount of savings." - business analyst at a major bank.

Read more details about why we built health check calculator.

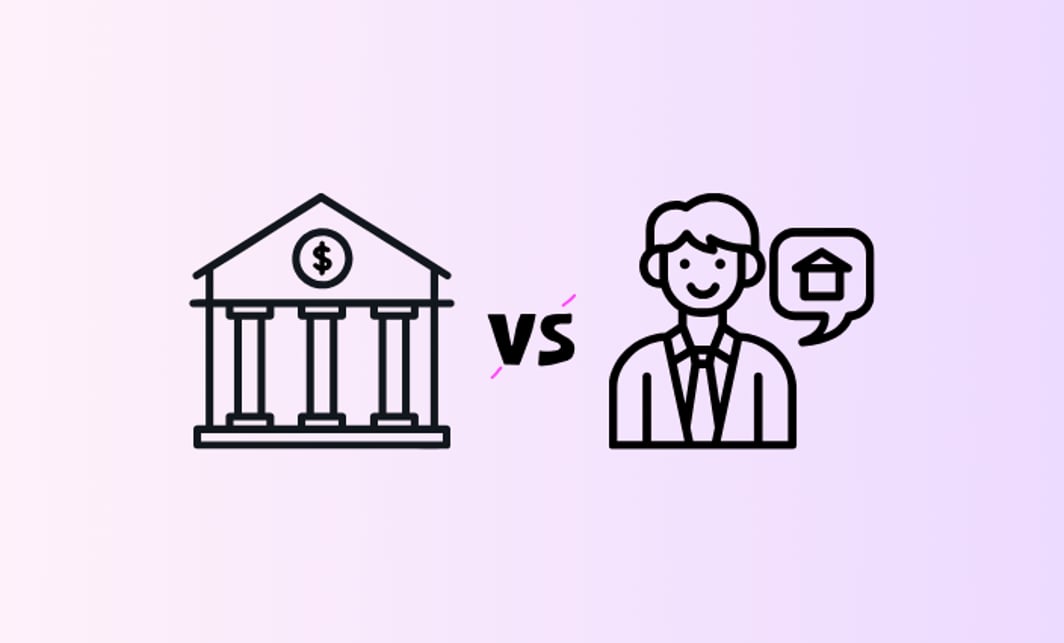

Getting professional help: Brokers vs. lenders.

You can conduct a basic health check on your own, but seeking professional help can make a significant difference in your overall well-being. You can either go straight to a lender or use a mortgage broker.

Using a Mortgage Broker: Mortgage brokers are now the top choice for many Australians, helping with almost 75% of new home loans in 2024. Here’s why they’re a good option:

- Choice: A broker has access to a panel of dozens of lenders, including majors and non-majors, whereas your bank can only offer its own products.

- Expertise: They are experts at navigating the complexities of different loan products and policies.

- Best Interests Duty: Since 2021, brokers have been legally obligated to act in their clients' best interests. This Best Interests Duty provides a crucial layer of consumer protection, ensuring the advice you receive is tailored to your benefit, not the broker's commission.

On average, homeowners who use a broker for refinancing can achieve an interest rate reduction of 0.3% to 0.5%, resulting in substantial savings.

Going Direct to Your Lender: Your current bank wants to keep your business. If you consider refinancing, they may have special teams who can offer you a better rate. Banks are also utilising new technology to streamline the review process and maintain customer satisfaction.

However, going direct means you're only seeing one set of products. You won't know if a better deal exists elsewhere unless you've done the research yourself or engaged a broker.

Take Control of Your Home Loan: Start Your Health Check Today

Your home loan is more than a debt. If you manage it effectively, it can help you build wealth and achieve your goals more quickly. If you ignore it, you may end up paying more than you need to. By regularly checking your home loan, you stay in control of your finances.

Your mortgage is likely your biggest financial commitment. Give it a proper check-up. Use our home loan comparison calculator to see how much you could save by switching, refinancing, or making extra repayments. Book a free, no-obligation home loan health check with the calculator above and take control of your financial future.

Frequently Asked Questions

It’s a quick review of your current mortgage to see if you’re still on a competitive rate based on today’s market.

Take the next step

so you can save money and find the best home loan that fits your needs.

Learn. Compare. Decide.

DTI Rules 2026: Why ADI vs Non-ADI lenders could save (or cost) you $100,000

The Ultimate Mortgage Checklist: Every Question to Ask Your Broker (2026 Edition)

How AI Tools helps Migrants Compare Mortgage Rates in Australia

Home loan advice for busy professionals

Mortgage Broker vs Bank