Should I fix a portion of my loan? Your guide to navigating the 2025 Australian mortgage market

The great Australian BBQ debate has shifted. For the last couple of years, the chatter over the snags centered on how high interest rates would rise. Now, as we head into 2025, the question has flipped: when will they finally start to drop?

After a relentless cycle of rate hikes from the Reserve Bank of Australia (RBA) that stretched household budgets, there's a collective sigh of relief. But with that relief comes new uncertainty. If rates are expected to fall, does it make sense to lock in a fixed rate? Or do you ride the variable wave down and hope for the best?

For thousands of Australian homeowners, from first-home buyers in Perth to seasoned investors in Sydney, this isn't just a financial puzzle. It's a decision that will impact their monthly cash flow for years. The good news? You don't have to bet the house on one option. The answer might lie in a strategy gaining traction: the split home loan. In the sections that follow, we'll outline practical steps to help you determine if this approach is right for you. We'll discuss key factors to consider and how to assess your individual situation to make an informed choice.

What the Crystal Ball says for 2025 rates?

Before we dive into loan structures, let's examine the economic forecast. The consensus among Australia’s major banks and economists is that the RBA's cash rate has likely hit its peak. The battle against inflation seems to be turning a corner, and the focus is shifting towards easing the pressure on the economy.

What does that mean for your mortgage? The predictions point to a series of rate cuts. Commonwealth Bank (CBA), for example, is forecasting a gradual reduction in the cash rate to 3.35% by December 2025. NAB is also expected to make multiple cuts throughout the year. The OECD, taking a broader international view, suggests Australian rates could fall to around 3.1% by the end of 2025.

This expectation of falling rates is already reflected in the market. Lenders are more competitive with their fixed-rate offers. The gap between fixed and variable rates has narrowed, a classic signal that the market expects the RBA to start cutting soon. For borrowers, this creates a tricky situation. Today's fixed rates might look appealing, but will they still look good in six or twelve months if variable rates have dropped?

The classic showdown: Fixed vs. Variable

For years, the choice has been presented as a simple binary: security or flexibility.

A fixed-rate loan gives you certainty. Your repayment amount is locked in for a set period, typically ranging from one to five years. This is helpful for anyone on a tight budget who needs to know exactly what their biggest expense will be each month. It eliminates the guesswork from your finances. The downside? You get less flexibility. Most fixed loans limit how much extra you can repay and rarely come with features like an offset account. The biggest sting is the break fee. If you need to sell your home or refinance during the fixed period, you could face a hefty penalty.

A variable-rate loan is the flexible option. The interest rate moves with the market, tracking the RBA's cash rate decisions. When rates fall, you benefit from lower monthly repayments. Variable loans almost always come with features such as offset accounts and the ability to make unlimited extra repayments, which can help you pay off your loan faster. The risk is clear: when rates rise, so do your repayments, as many Australians have experienced since 2022. Fully variable seems like the logical choice to catch the falling rates. But what if the experts are wrong? What if global events cause inflation to spike again, forcing the RBA to hold rates higher for longer? That’s the gamble.

Enter the split loan: Having your cake and eating it too?

This is where the idea to fix a portion of my loan comes into play. A split home loan is exactly what it sounds like: you divide your total mortgage into two or more parts. One part is on a fixed interest rate, and the other is on a variable rate.

Think of it as an each-way bet. You get certainty from the fixed portion, protecting you from unexpected rate hikes. At the same time, the variable portion lets you benefit from anticipated rate cuts.

How effective is this strategy in the real world? Let’s look back at the brutal 2022-2024 rate hiking cycle. Homeowners on fully variable loans saw their repayments skyrocket with each RBA announcement. Those on fully fixed loans were shielded, but only until their fixed term ended, at which point many faced a terrifying ‘mortgage cliff’.

A borrower with a split loan would have experienced a middle path. Their repayments would have increased, but not as much as someone on a fully variable rate. The fixed portion acted as a shock absorber. While not a perfect shield, this strategy proved effective in reducing mortgage stress for many Australians by providing a buffer against the full force of the rate hikes. It offered a balance between protection and exposure that neither of the other options could.

Split Loan Pros and Cons at a glance

Pros:

- Balanced Risk: You get the repayment certainty of a fixed rate on one part of your loan and the potential savings of a variable rate on the other.

- Budgeting Stability: Knowing a chunk of your repayment is fixed makes managing your household budget easier.

- Flexibility: You can still make extra repayments on the variable portion and often link it to an offset account, helping you save on interest.

- Psychological Comfort: For many, this hybrid approach simply feels safer, reducing the anxiety of trying to perfectly time the market.

Cons:

- Not the Cheapest (Potentially): If rates fall sharply, you might wish you’d gone fully variable. If they rise unexpectedly, you might wish you’d fixed the whole loan. You’re unlikely to get the lowest possible cost in either scenario.

- More Complicated: You’re managing two loan accounts, which can feel more complex.

- Break Fees Still Apply: The fixed portion of your loan is still subject to potential break costs if you need to exit the term early.

Finding your perfect split: How much should I fix?

Okay, so the split loan sounds like a sensible strategy. But what’s the right ratio? 50/50? 70% fixed and 30% variable?

There’s no magic number. The right split depends entirely on your personal financial situation, your goals, and your tolerance for risk. Here are the key questions to ask yourself: It's also highly advisable to consult a mortgage broker. Brokers can provide tailored advice based on your unique circumstances, helping to reassure you and inform your decision-making process.

- What’s my risk tolerance? Are you the type of person who loses sleep over financial uncertainty? If so, you might lean towards fixing a larger portion (e.g., 70-80%). If you’re comfortable with some fluctuation and want to maximise your chances of benefiting from rate cuts, a smaller fixed portion (e.g., 30-40%) might be better.

- How tight is my budget? Be honest about your cash flow. You need to be able to handle repayments on your variable portion if rates don't fall as quickly as predicted. As a rule of thumb, Australian regulators require banks to test if you can handle your loan at an interest rate 3% higher than the current rate. It’s a good idea to apply that same test to your own budget. Can you comfortably afford the repayments on your variable portion if interest rates were to increase instead of decrease?

- What are my future plans? Do you plan on selling your home in the next few years? Are you expecting a financial windfall that you’d like to use to pay down your debt? If so, keeping a larger portion of your loan variable gives you the freedom to do so without incurring break fees.

- Do I need an offset account? If you have a decent amount of savings, an offset account linked to your variable portion can save you a significant amount of interest. The more you want to leverage an offset, the larger your variable portion should be.

One way to decide is to use tools and templates available on financial planning websites. Input scenarios with different proportions, like 30%, 50%, and 70% fixed portions, to see how your repayments compare under various market conditions. Creating a simple table to compare outcomes can be very revealing:

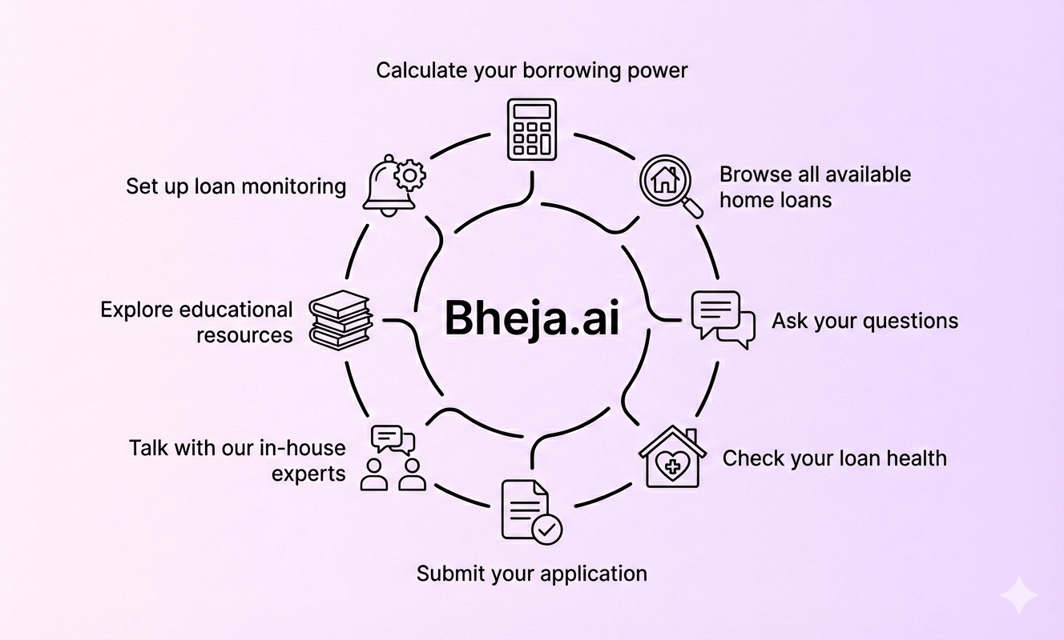

This table isn’t exhaustive but serves as an illustrative guide to help you visualize the trade-offs. Financial advice and online calculators available through services like Bheja.ai can further assist in running these scenarios effectively.

The Big Red Flag: Understanding break costs

We've mentioned break fees a few times, and it's vital to understand them, especially now. Break costs are a penalty charged by a lender if you pay off all or part of a fixed-rate loan before the end of the term.

The fee is designed to compensate the bank for its "economic loss." In simple terms, if you locked in at 5.5% and market rates have since dropped to 4.5%, the bank is losing out on the higher interest they expected to earn from you for the rest of your fixed term. The calculation is complex, but it’s based on the loan amount, the remaining time on your term, and the difference between your fixed rate and the bank’s current wholesale funding costs.

Why is this important right now? If you fix a portion of your loan and the RBA cuts rates aggressively, potential break costs could be huge. If you need to sell your house due to a job change or family reasons, you could face a bill for thousands or even tens of thousands of dollars. This risk makes fixing 100% of your loan in a falling-rate environment a bold move. A split loan reduces this risk, as you can always pay out the variable portion penalty-free.

A word for property investors

If you’re a property investor, the fixed vs. variable vs. split decision has another layer of complexity. Your strategy might differ depending on your portfolio and the market you’re in.

For investors in regional markets that have experienced strong growth, such as parts of regional Queensland, fixing a portion of the loan can be a smart way to lock in your costs and protect your cash flow against a known rental income stream.

For those investing in capital cities where growth might be slower and rental yields tighter, the flexibility of a larger variable portion might be more appealing. It allows you to take advantage of rate cuts to improve your cash flow position. The decision also ties into your overall strategy—are you chasing capital growth or rental yield? Certainty of costs (fixed) often appeals to yield-focused investors, while flexibility (variable) is better suited for those with a growth-oriented, buy-and-hold strategy.

The Final Verdict: Is it time to split?

Navigating the 2025 mortgage market feels like trying to predict the weather in Melbourne. While forecasts point to rate cuts, nothing is guaranteed.

For the average Australian homeowner, opting for a fully variable or fully fixed loan carries significant risk. A fully variable loan leaves you exposed if rate cuts don't materialise as expected. A fully fixed loan could result in you paying an uncompetitive rate for years and facing substantial break fees if your circumstances change.

This is why the split loan has become such a compelling strategy. It’s not about trying to beat the market. It’s about managing risk. It’s a financial hedge that provides a sensible, balanced path forward in uncertain times.

The ultimate decision rests with you. Take a close look at your finances, your future plans, and your comfort level with risk. Chat with a mortgage broker, use a split loan calculator, and model the different outcomes. Additionally, improve your chances of getting loan approval by checking your credit score, paying off existing debts, and preparing the necessary documentation, such as proof of income and expense records. In the end, the best strategy for 2025 isn't about finding the perfect answer, but about building a loan structure that lets you sleep soundly at night, no matter what the RBA decides at its next meeting.

Frequently Asked Questions (FAQs)

Yes, fixing part of your loan now can lock in all the benefits of the current low rates while still leaving you flexible enough to ride any future changes. However, it’s best to speak with a financial advisor to see if it fits your plan