Ask. Check. Apply. Monitor.

All in one place. Compare home loans from 100+ lenders in seconds, powered by AI.

Stop paying the "Loyalty Tax."

Why we require a secure login?

Unlike generic calculators, Bheja.ai provides true personalisation based on your actual loan details. To protect your financial DNA, we use bank-level encryption.

- Zero Data Selling:Your data is for the AI only.

- Consent-First:Brokers only see your info if You ask them to

- Open Banking:Safe, fast, and government-regulated

The "Consent Switch"

Bheja works for you in private. When you are ready for human help, you grant your broker access with one click. They receive your full context immediately-no more repeating your story or re-uploading PDFs.

In the media

One Platform,Your Complete Home Loan Journey.

From your first question to your best rate and ongoing monitoring. No scattered tools, no jumping between sites, no repeating yourself. Just one conversation that remembers everything.

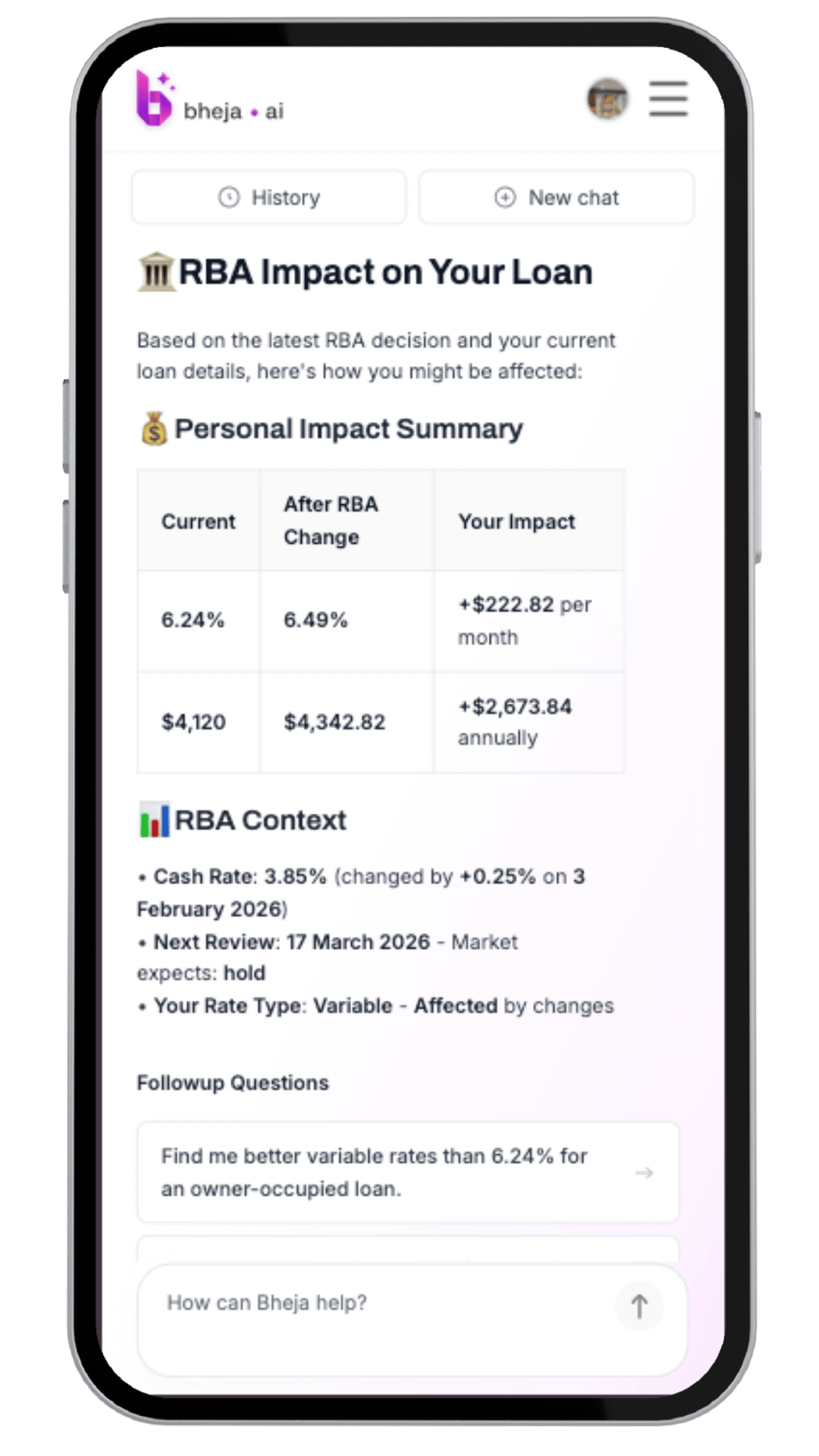

Ask.

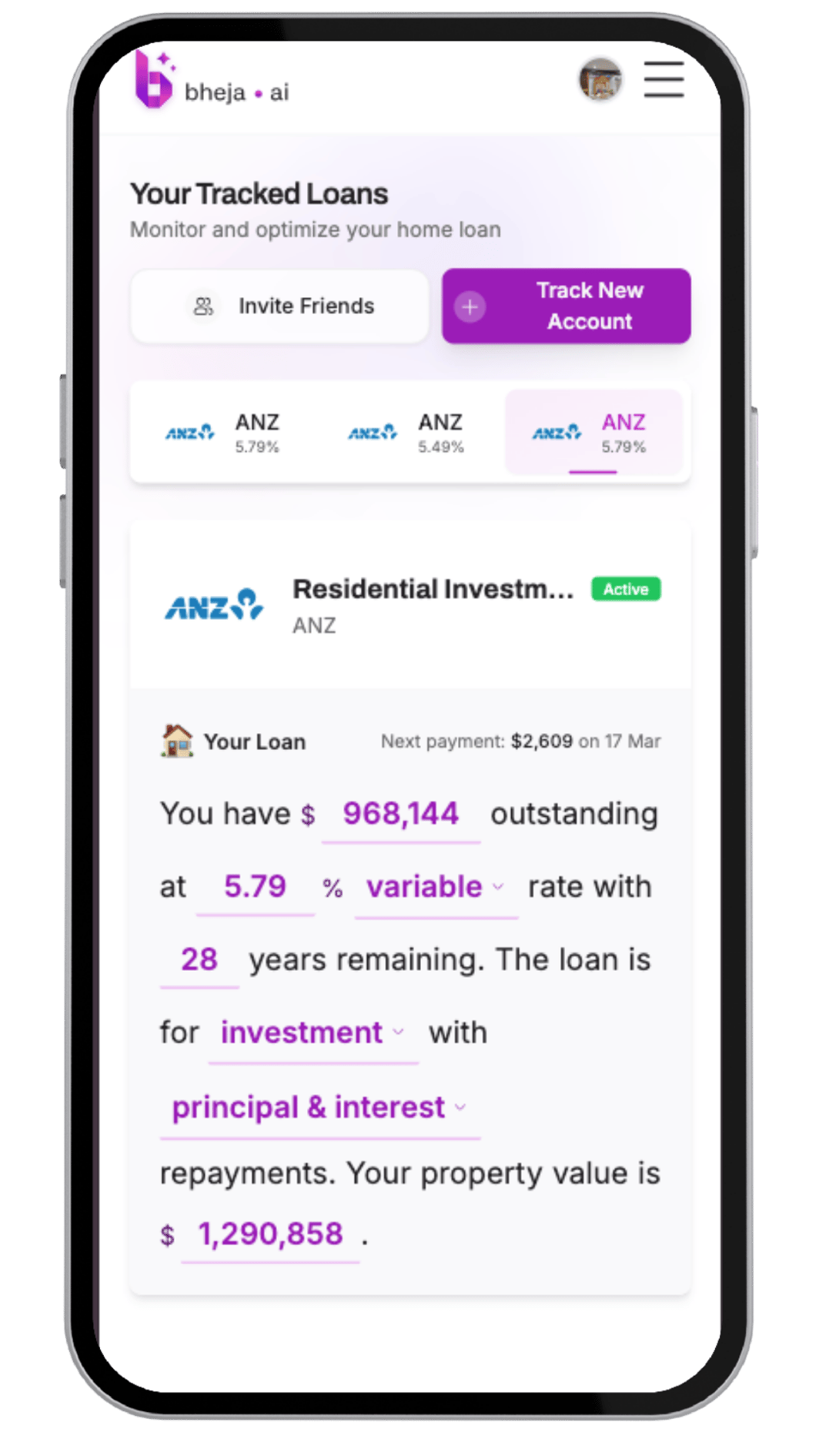

Type your question, whether it’s about your rate, lender, repayments, or refinance options. Bheja understands your loan and gives you clear, data-backed answers.

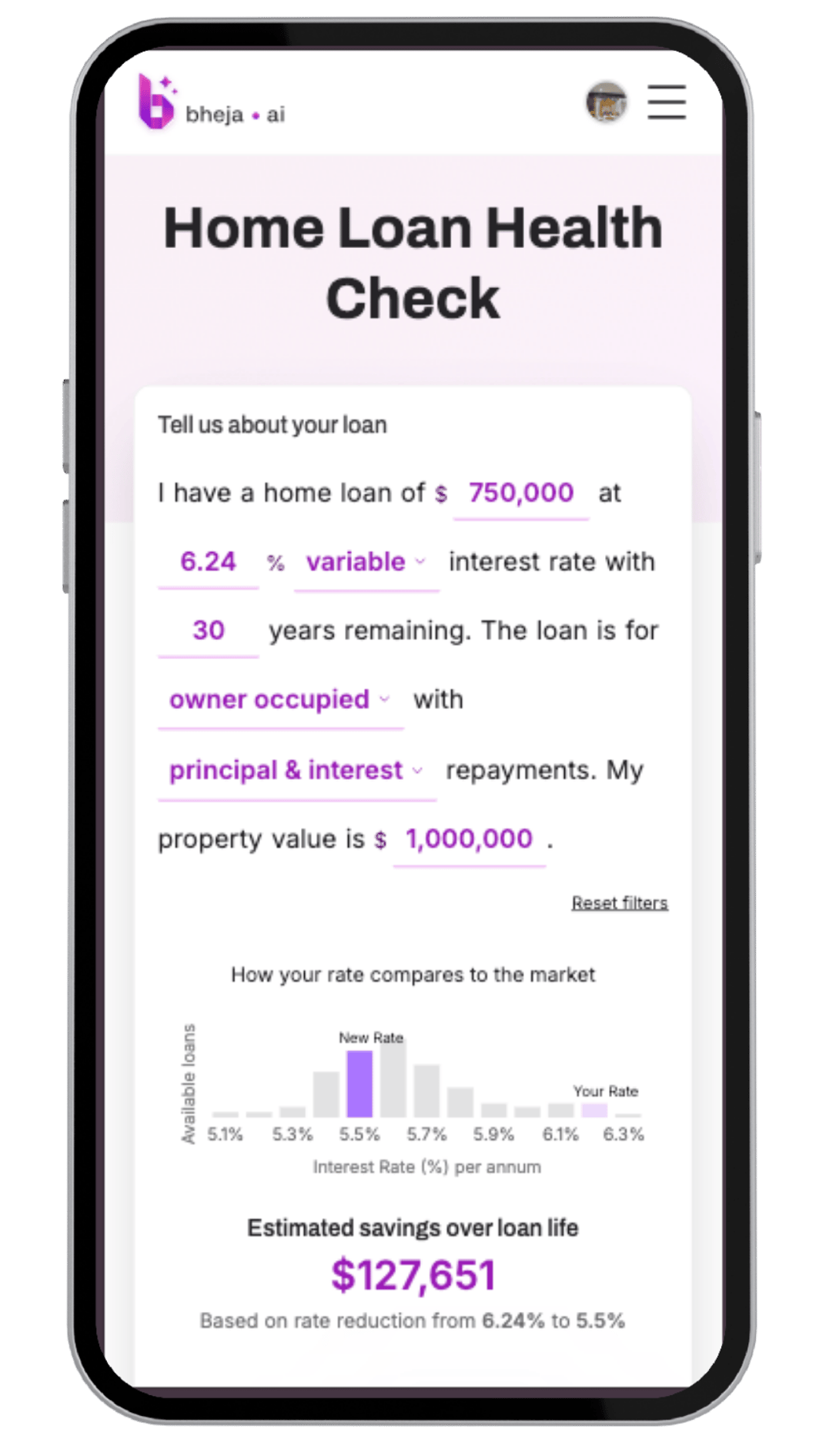

Check.

Enter your loan details, and Bheja compares it with the latest rates and products across lenders. Instantly see how your loan stacks up and where you could do better.

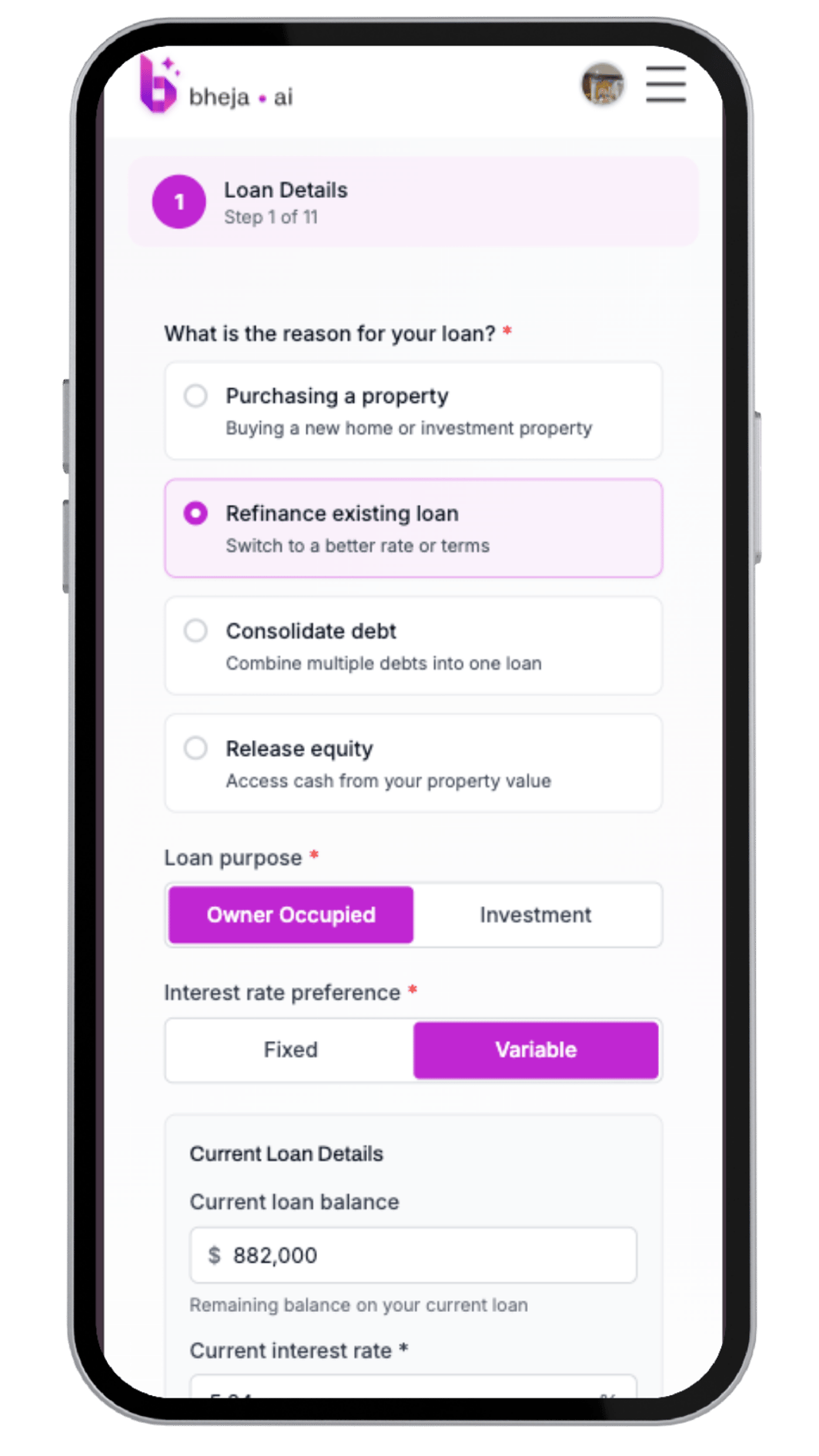

Apply.

Move from "better rate" to "done" on a single secure platform. No zip files, no messy email chains, and no sensitive data floating in the cloud. We handle the complexity; you just provide the consent.

Monitor.

Set it and forget it. Bheja acts as your 24/7 financial watchdog. If your lender raises rates or a competitor drops theirs, you’ll get an instant alert. We automatically kill the "Loyalty Tax".

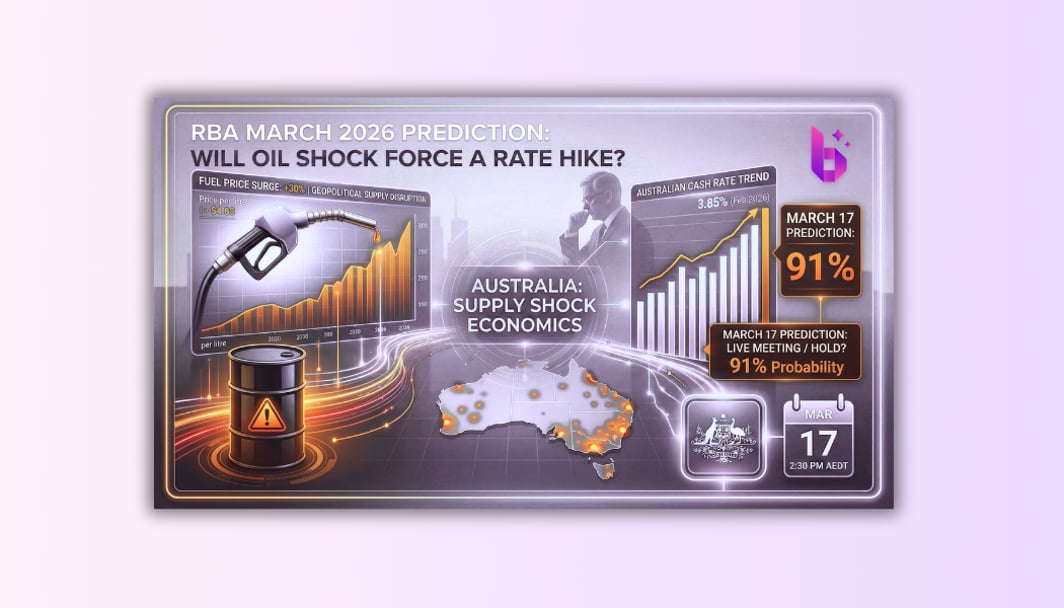

Market Intelligence

Stay ahead of the market with the latest news, RBA updates, and expert financial insights.

RBA Cash Rate 2026: Could the Oil Shock Lead to a March Rate Hike?

Interest Only Home Loans in Australia - A Friendly Guide for 2026

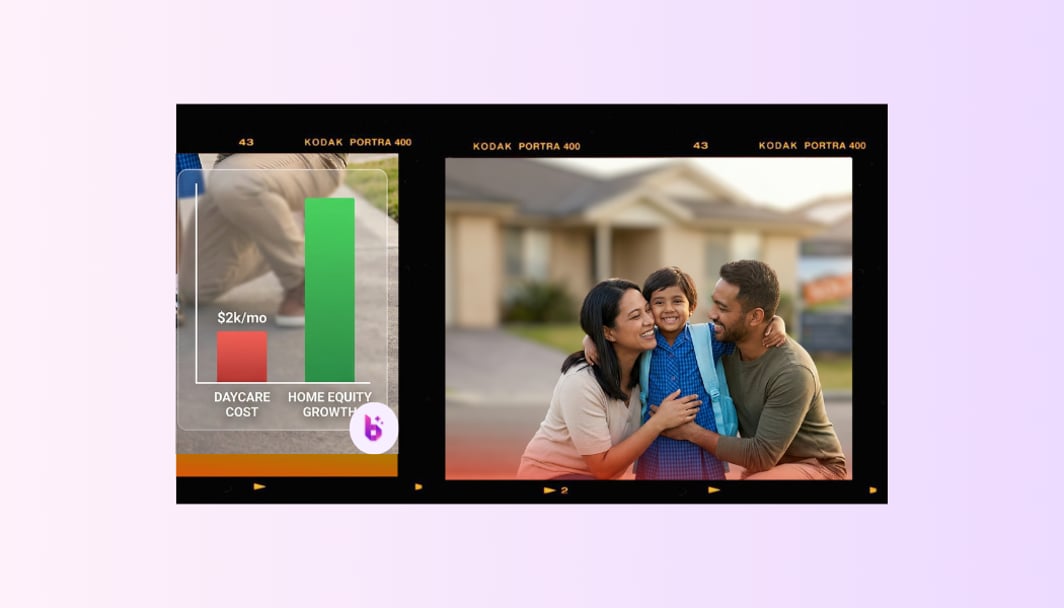

Your Child's First Day of School, could also be your Best Financial Day

Mortgage over Meals: The ‘62% respondent’ and How to Safeguard Your Relationship in 2026

Is Your Mortgage Ready for the "May Spike"?

The "Red Zone": Is Your Mortgage Buffer Evaporating?

The $44 Default: How a Tiny Shortfall Can Lock You Out of the Property Market

The 7-Star Discount: How Your Home's Energy Rating Can Unlock Lower Interest Rates in 2026

RBA Cash Rate

Meet the Team Behind Bheja.ai

Tech veterans and licensed brokers combining AI with human expertise

Watch how Bheja.ai works

6500+

Loans compared

100+

Lenders connected

24/7

Always available

Ready to Find Your Best Home Loans Rate?

Get AI-powered answers instantly or connect with a human expert. your choice.