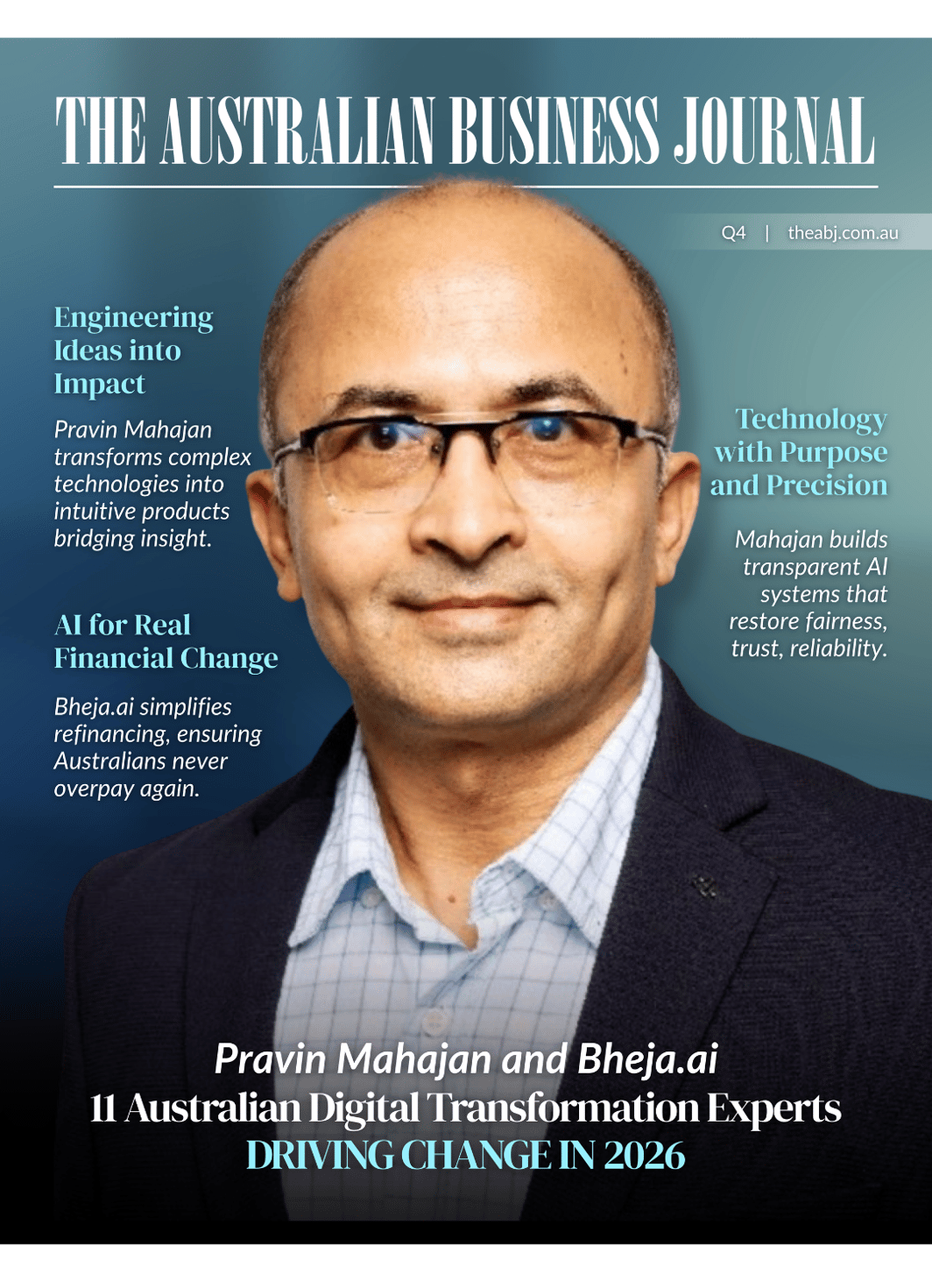

Pravin Mahajan is the Founder of Bheja.ai and an accredited Mortgage Broker (Credit Rep. 570637). Based in Sydney, he sits at the unique intersection of financial regulation and enterprise technology.

With over 30 years of experience, Pravin has architected the consumer platforms that millions of Australians rely on for daily financial and purchasing decisions. His career is defined by building high-scale systems that simplify complex choices:

RateCity (Acquired by Canstar): As Chief Product & Technology Officer, Pravin led the tech transformation that culminated in the company's acquisition. He orchestrated "Australia’s First Home Loan Sale," a digital initiative that reached over 12 million people.

CIMET: As Chief Product & Technology Officer, he built enterprise-grade infrastructure for energy and broadband comparison, scaling operations to support major B2B partners.

Salmat (Lasoo): He architected digital catalogue systems used by 5.7 million monthly users, digitising the retail experience for brands like Target and Myer.

Woolworths: Designed the real-time, secure "Pay at Pump" transaction infrastructure deployed Australia-wide.

Today, at Bheja.ai, Pravin combines this deep technical background with his Certificate IV in Finance and Mortgage Broking to build AI agents that don't just compare loans, but help Australians actively secure their financial future.