For years, Australia’s top finance brands and media outlets like Canstar, Finder, RateCity, Compare the Market, Yahoo Finance, 9 News, Channel 7, Channel 10, ABC News, and many personal finance experts have focused on helping borrowers. The goal is simple: help people save on their home loans by checking rates, making extra payments, or rounding up repayments.

We all agree on the fundamentals, but there’s still a gap. Many Australians unknowingly overpay their home loans by tens of thousands of dollars, simply because most advice is too generic to act on. It’s easy to wonder, “How much could I actually save on my own loan?” or “I don’t know what this means for me.”

That’s where we wanted to contribute something extra. So without tailored advice, most borrowers fail to take action and end up paying more than they should.

How does Bheja.ai personalise your home loan savings?

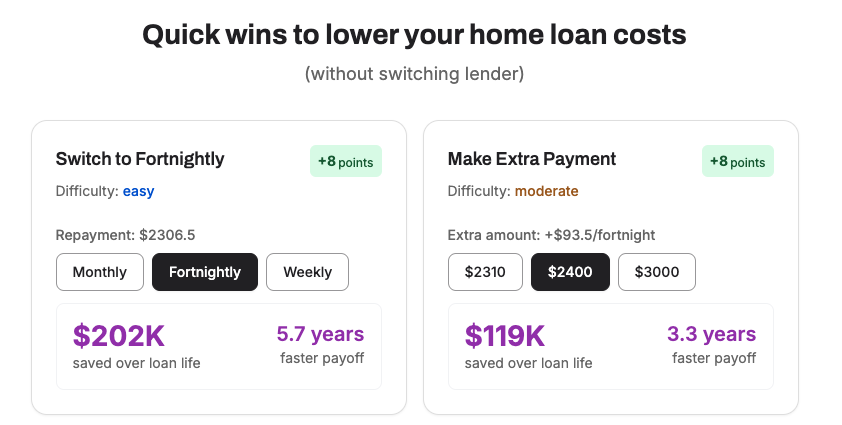

We built the Home Loan Health Check tool, which gives you instant, personalised insights based on your own loan details. It’s like having a savings roadmap made just for you.

1. Discover how much you could save by changing repayment frequency, such as switching from monthly to fortnightly payments.

2. See where your current rate sits in the market. You can identify if you are paying more than you should.

3. Explore the impact of rounding up your repayments by $10, $100, or even $1,000.

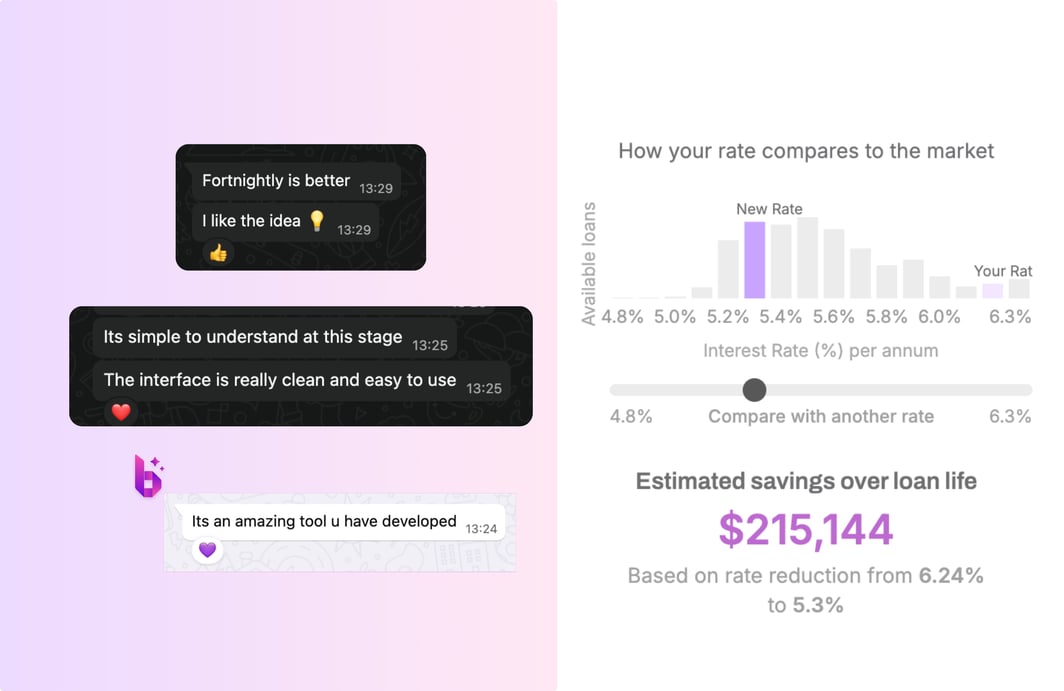

Real reactions from industry professionals

After using the tool, many people, including finance professionals, friends, and our team, have been surprised by how much they could save. Seeing the numbers often motivates people to take action that really makes a difference.

The feedback so far has been strong, even from experienced finance experts:

"I can’t believe it's going to drop 4 to 5 years off the loan term." - Asset finance Cofounder.

"The simplicity and hack for switching repayments is awesome." - Big Four loan officer with 15+ years.

"Shocked to see the amount of savings." - business analyst at a major bank.

Why this matters

The truth is, most people don’t need more financial content. They need clear answers and confidence to make better choices about their own loan.

By using real loan data and smart AI, we’re helping Australians find a personalised way to pay off their loans faster, save money, and feel more secure about their finances.

And this is just the start. At Bheja, we believe that personalised AI tools will change how people manage debt, making it easier to make informed financial decisions for years to come.

Ready to see your own savings roadmap?

Generic tips are everywhere, but personalised insights make a real difference. With the Home Loan Health Check tool, you get a clear, practical way to understand and improve your finances. See your numbers, explore your options, and start saving today.