Before you sign a 30-year commitment, you need more than just a "good rate." You need a loan that fits your specific property type, your career stage, and the current 2026 economic landscape.

Use this guide to interview your broker and ensure your finances are as "intelligent" as your investments.

1. The "Essential" Questions (For Every Borrower)

These establish the broker’s transparency and the quality of their panel.

- "How many lenders are on your panel, and how many do you actually use?"

- Why: Some brokers have 40 lenders but send 90% of deals to one "Big Four" bank. You want a broker who utilises a diverse range of lenders to find the best policy for you.

- "How are you paid, and do you charge a separate 'Broker Fee'?"

- Why: Most brokers are paid by the bank, but some charge an upfront fee for complex structures. You need to know this cost on day one.

- "What is the 'Comparison Rate' vs. the 'Headline Rate'?"

- Why: The headline rate is marketing. The comparison rate includes the annual fees and charges. If there’s a big gap, the loan is "fee-heavy."

- "What is the 'clawback' period if I refinance early?"

- Why: If you move your loan within 12–24 months, the broker may lose their commission. It’s better to have this honest conversation early.

2. The Pre-Approval Checklist (Critical for 2026)

In today's market, a "weak" pre-approval can lead to a lost deposit. Ask these to find out where you stand.

- "Is this a 'System-Generated' or 'Fully Assessed' pre-approval?"

- Why: System-generated (Auto-approvals) are often unreliable. A fully assessed approval has been reviewed by a human credit officer and is much safer for bidding at auction.

- "What is my Debt-to-Income (DTI) ratio, and how does it limit my lender choice?"

- Why: With 2026 APRA regulations, some banks are strictly capping loans at 6x your income. Your broker should know which lenders are more flexible.

- "If I find a property on a Saturday, how quickly can you get a 'Desktop Valuation'?"

- Why: Speed wins deals. You need to know if your broker is available for urgent weekend checks.

3. Categorised by Buyer Type

For the First Home Buyer (FHB)

- "Which Government Grants am I eligible for (FHBG, Regional, or Family Home Guarantee)?"

- "Can we avoid Lenders Mortgage Insurance (LMI) with a 5% or 10% deposit through a specific scheme?"

- "How does my HECS/HELP debt impact my borrowing capacity?"

- "Do you have experience with 'Parental Guarantor' loans if I need a boost?"

For the Property Investor

- "Can we set up an Offset Account for my PPOR (Home) while keeping the Investment Loan 'Interest Only'?"

- "What is the 'Rental Shading' policy for this lender?" (e.g., Do they count 80% or 100% of my future rent as income?)

- "Can we structure this for 'Debt Recycling' in the future?"

- "Will this lender allow me to cross-collateralize, or are we keeping the titles separate?" (Hint: Keeping titles separate is usually safer).

4. Categorised by Property Type

Buying an Apartment / Unit

- "Are there postcode restrictions for this building?"

- Why: Many banks limit lending in high-density areas or specific postcodes (e.g., certain parts of Sydney or Melbourne).

- "What is the minimum internal square footage (sqm) this lender requires?"

- Why: Many lenders won't touch studios or apartments under 40sqm or 50sqm.

- "How do high Strata levies or cladding issues affect my serviceability?"

Buying Land + Construction

- "What is the 'Progress Draw' fee structure?"

- Why: You don't want to be charged $200 every time the bank pays your builder a new installment.

- "Does the lender offer 'Interest Only' payments during the build phase?"

- "What happens if the builder’s fixed-price contract increases mid-build?"

Buying a "Renovator's Delight"

- "Is the property considered 'Habitable' in its current state?"

- Why: If the house doesn't have a working kitchen or bathroom, many banks will refuse to settle the loan until it's fixed.

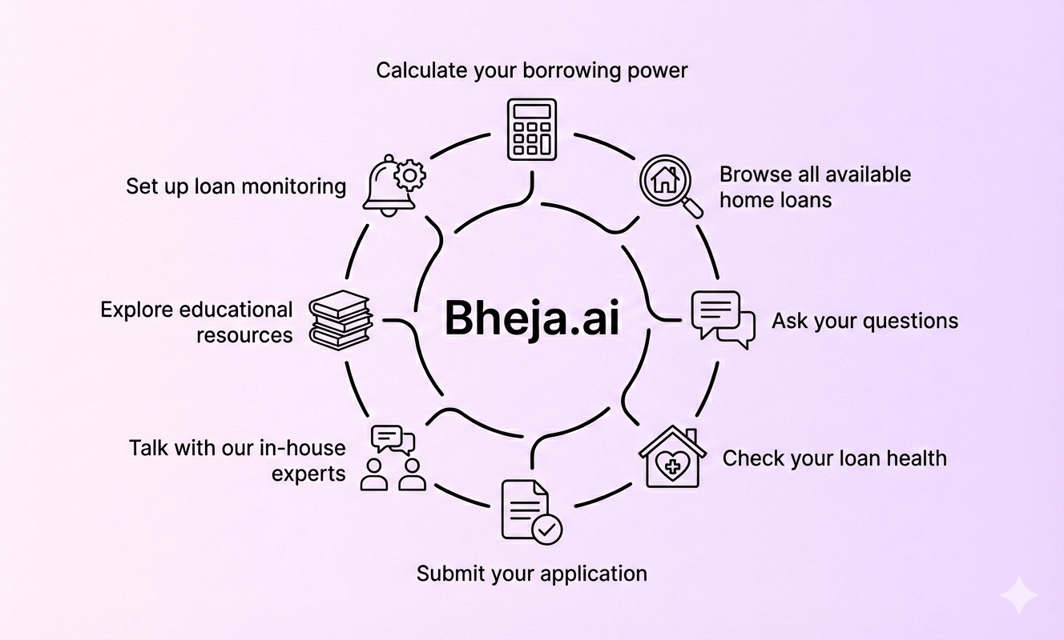

5. The "Bheja.ai" Smart Questions

Advanced questions that show you are an informed, tech-forward borrower.

- "Does this lender offer an 'Open Banking' (CDR) integration for faster approval?"

- "Are there 'Green Loan' discounts if the property has a high energy rating or solar panels?"

- "How often will you proactively review my rate against the market after I settle?"

Takes less than a minute to complete

What You'll Get

Free 30-minute consultation

Get expert advice from our licensed brokers with no cost or obligation

Personalized recommendations

Tailored loan options based on your unique financial situation

Market insights

Latest rates, trends, and opportunities in the current market

No pressure approach

Honest, transparent advice with no high-pressure sales tactics