Many people search for "0% deposit home loan" in Australia. With property prices going up and living costs rising, saving a 20% deposit can feel out of reach and take years.

The simple answer is that true "zero-deposit" loans are no longer available from most lenders.

However, there are still ways to buy a home with little or no upfront cash. You can use other assets, get help from family, or take advantage of government programs.

Here are six ways you can buy a home without spending years saving a large deposit.

1. Guarantor Home Loans (The Family Guarantee)

This is the closest option available for buying with no deposit.

- How it works: A family member (usually parents) uses the equity in their own property to secure your loan.

- The benefit: You can borrow up to 100% of the property value, so you don’t need a cash deposit. You also avoid paying Lenders Mortgage Insurance (LMI), which can save you thousands of dollars.

- The requirement: Guarantors must meet strict lender rules, such as being an Australian citizen or resident, having enough equity in their home, and being financially stable. It is a serious responsibility because they are backing part of your loan.

2. Gifted Deposits

If your family has cash savings instead of home equity, they can help you cover the deposit.

- How it works: Close family members give you money to use as your deposit.

- The catch: Lenders need a letter confirming the money is a gift, not a loan. You don’t have to pay it back.

- Note: Some lenders still want to see "genuine savings"—usually 5% of the purchase price saved by you over three months—to show you can manage a mortgage, even if the rest is a gift.

3. The Australian Government 5% Deposit Scheme

The Home Guarantee Scheme (HGS) is a powerful tool for eligible buyers.

- First Home Guarantee: Eligible first home buyers can purchase a home with as little as a 5% deposit, with the government guaranteeing the remaining 15%. This removes the need for LMI.

- Family Home Guarantee: Single parents and legal guardians with dependants may be able to buy with a deposit as low as 2%.

- Eligibility: Caps apply regarding income levels and property price thresholds depending on your location.

4. Professional Loan Packages

Your profession could help you qualify for a lower deposit.

- How it works: Some lenders see certain jobs, like doctors, lawyers, accountants, and sometimes engineers, as "low risk" borrowers.

- The Benefit: Eligible professionals can often borrow up to 90% (sometimes 95%) of the property value without paying LMI. While you still need a deposit, it significantly reduces the upfront cost of entering the market.

5. First Home Owner Grant (FHOG)

While not a loan product, this grant helps boost your deposit funds.

- How it works: You get a one-time cash grant, which is available in some states and territories.

- The catch: In most states, you can only use this grant to buy or build a new home, not an existing one.

- Strategy: Many buyers combine the FHOG with the 5% Deposit Scheme to boost their buying power.

6. Deposit Bonds

A deposit bond is not a loan, but it can help with cash flow when you are buying a home.

- How it works: A deposit bond is an insurance policy that replaces the cash deposit (usually 5-10%) you would pay when you sign the contract. You pay the full price at settlement.

- Best for: Buyers who are purchasing off-the-plan or at auction, have their finance approved, but do not have the cash deposit ready when signing.

Important: The "No Free Lunch" Reality Check

Buying with a low deposit lets you get a home sooner, but it affects your loan details.

- Higher loan amount: If you borrow 95% or 100% of the property price, your mortgage will be bigger and your interest payments will be higher.

- LMI costs: If you borrow more than 80% and do not use a guarantor or government scheme, you will usually have to pay Lenders Mortgage Insurance (LMI). This insurance protects the bank, not you.

- Interest rates: Loans with a higher Loan-to-Value Ratio (LVR) can sometimes have higher interest rates.

Action Plan: Before you commit, run the numbers. Use our online calculators to see what your repayments would look like at a higher LVR. We recommend stress-testing your budget by adding 1-2% to the current interest rate to ensure you are prepared for future market shifts.

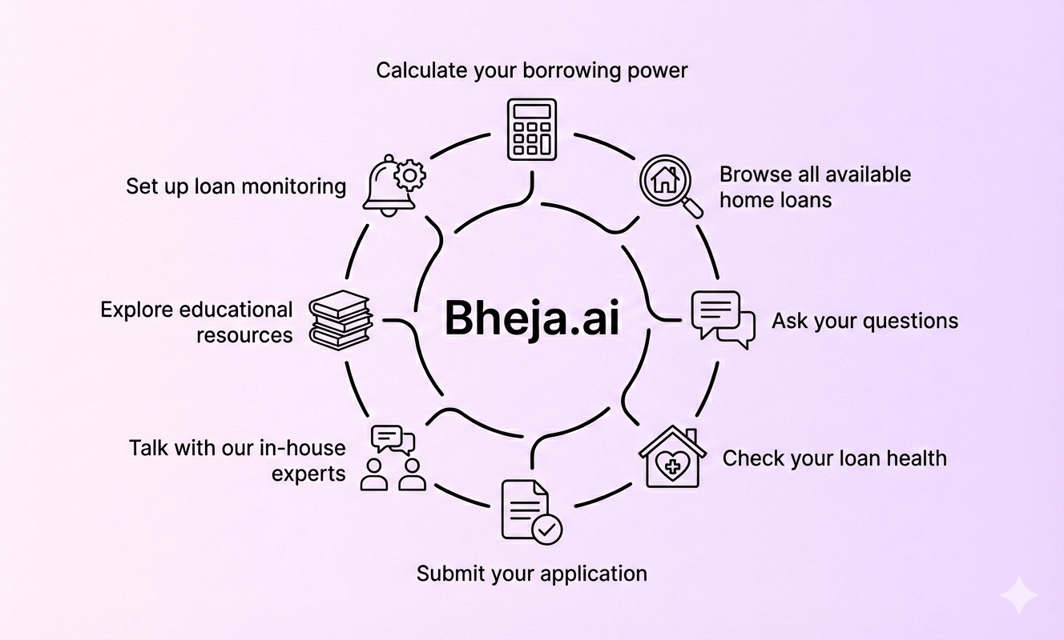

Disclaimer: General information only. Every financial situation is different. You can speak to our licensed mortgage broker at Bheja.ai for advice specific to you.