Moving to a new country comes with countless challenges, and navigating the Australian home loan market ranks among the most complex. As a migrant, you face unique hurdles: understanding unfamiliar banking systems, comparing hundreds of products from over 100 lenders, proving your creditworthiness with limited Australian history, and making sense of industry jargon while managing the stress of settlement.

That's where Bheja.ai comes in.

We've built a comprehensive suite of AI-powered tools designed to simplify your home loan journey, giving you the same market insights and opportunities as Australian-born residents without the confusion, complexity, or time drain.

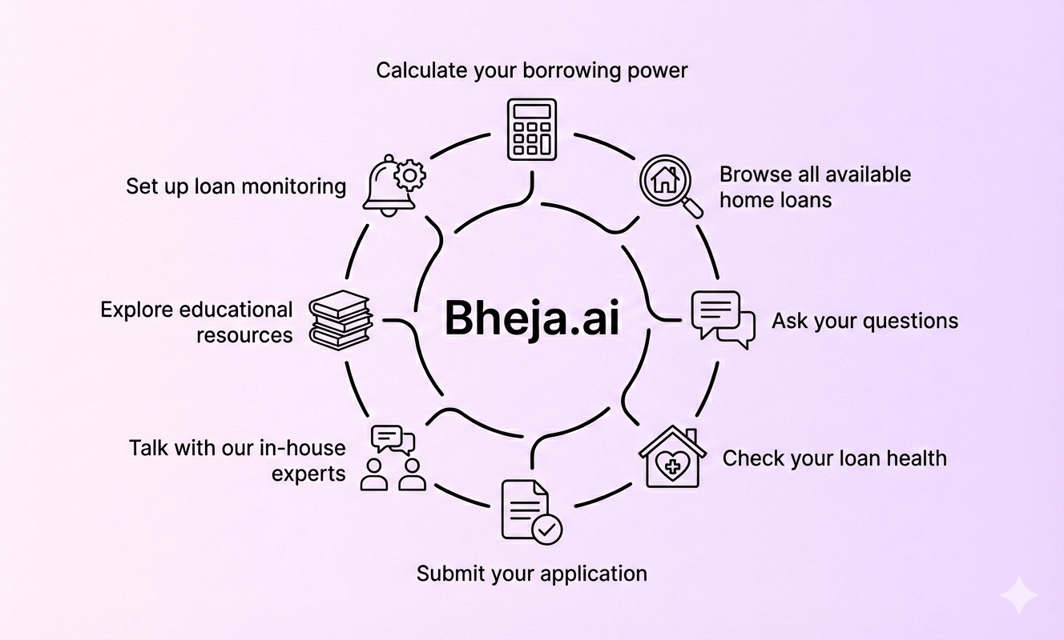

Your Complete Toolkit for Smart Home Loan Decisions

1. Comprehensive Comparison Tables (bheja.ai/home-loans)

Think of this as your window into the entire Australian mortgage market.

What you get:

- Access to 7,000+ live home loan products from 100+ lenders through Open Banking data

- Real-time interest rates updated as banks change their offerings

- Transparent comparison rates that show the true cost including fees

- Filter by your specific needs: first home buyer, investor, refinancing, or self-employed

- No hidden agendas; we show you everything the market offers, not just selected products

Why this matters for migrants: You don't have years of experience with Australian banks or personal recommendations from friends who've been here for decades. Our comparison tables level the playing field, showing you every option available so you can make informed decisions based on data, not guesswork.

Special features for your situation:

- See which lenders are more migrant-friendly

- Understand deposit requirements clearly

- Compare both major banks and smaller lenders who might offer better rates

- Identify cashback offers and special promotions

2. Ask Bheja - Your AI Mortgage Copilot (bheja.ai/ask)

This is where things get personal. Rather than drowning in spreadsheets and websites, you can simply ask questions in plain English, just like talking to a knowledgeable friend.

What you can do:

- Ask questions naturally: "What home loan options do I have as a migrant with a 15% deposit?"

- Compare products side-by-side: "Show me the difference between ANZ and Commonwealth Bank home loans for first-time buyers"

- Create different scenarios: "What happens to my repayments if interest rates rise by 1%?"

- Get instant answers about eligibility, documentation requirements, and approval chances

- Understand complex terms without wading through banking jargon

Why this transforms your experience: As a migrant, you might not know which questions to ask or what's normal in the Australian market. Ask Bheja guides you through the process conversationally, helping you understand not just rates, but the entire landscape from government grants to lender requirements specific to your visa status.

Real questions you can ask:

- "I'm on a skilled migrant visa—which lenders will consider my overseas income?"

- "What documents do I need to prove my income as a recent migrant?"

- "How does my credit history from overseas affect my application?"

- "Which loan type is better for me: fixed or variable?"

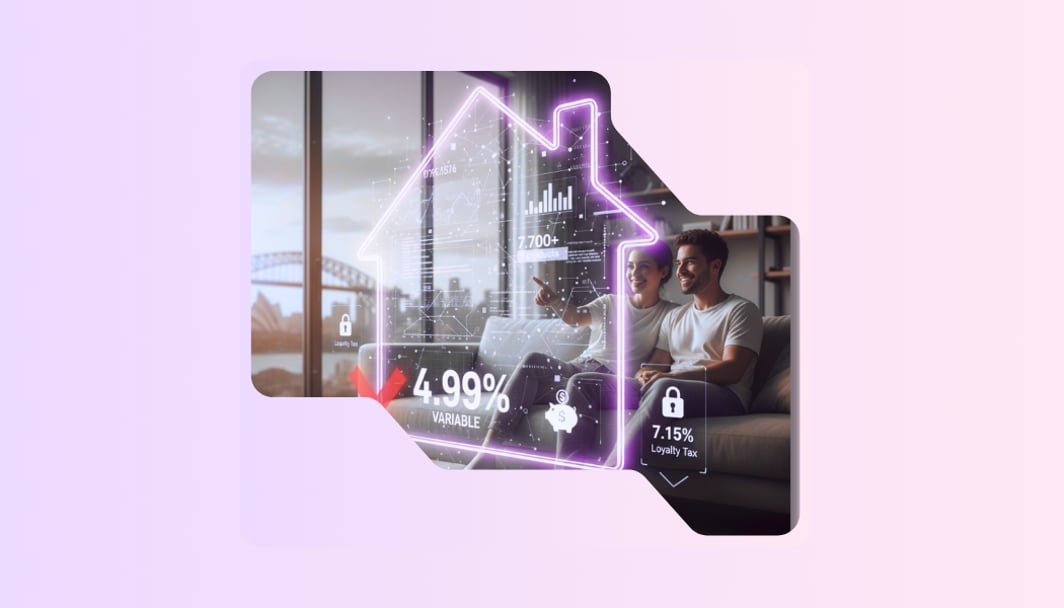

3. Home Loan Health Check (bheja.ai/home-loans/health-check)

Already have a home loan? This tool reveals whether you're paying too much, a common problem for migrants who accepted their first offer without realizing better options existed.

What it does:

- Analyses your current loan against all available market options

- Shows potential savings in dollars and years off your mortgage

- Identifies if you're paying the "loyalty tax" (higher rates for existing customers)

- Displays a visual graph comparing your loan to the market

- Calculates whether refinancing makes financial sense after fees

The reality for many migrants: Many newcomers to Australia accept their first home loan without fully understanding the market, then stay with that lender out of loyalty or unfamiliarity with alternatives. Australian users report being "amazed how quickly it outputted the results with a graph of how my loan compares" with "estimated savings of over 100 thousand" in some cases.

How it helps you:

- Quick assessment: Get results in minutes, not days

- Clear visualisation: See exactly where your loan stands

- Actionable insights: Understand if switching lenders could save you thousands

- No commitment: Check your loan health without any obligation

4. Borrowing Capacity Calculator (bheja.ai/home-loans/how-much-can-i-borrow)

One of the biggest questions migrants have: "How much can I actually borrow?" This tool gives you clarity before you even apply.

What makes it special:

- Multiple lender assessment: See your borrowing capacity across different lenders simultaneously

- Accurate calculations: Based on your income, expenses, and existing debts

- Scenario planning: Adjust variables to see how changes affect your borrowing power

- Realistic expectations: Know what price range to search in before house hunting

Critical for migrants because: Your borrowing capacity might differ significantly from back home. Australian lenders assess income, expenses, and debt differently. Some lenders are more accommodating to migrants with overseas income or limited Australian credit history. This tool helps you understand where you stand with different lenders before making applications that could affect your credit score.

Key insights you'll gain:

- How much different lenders might offer you

- The impact of your deposit size on borrowing capacity

- How your existing debts affect your loan amount

- Whether you can afford properties in your target areas

5. Streamlined Application Engine with Open Banking

When you're ready to apply, we make it fast and simple using Open Banking technology.

How it works:

- Secure data sharing: Connect your bank accounts safely to share financial information

- Pre-filled applications: Your verified income and expense data populates automatically

- Faster processing: Lenders can verify your information instantly

- Less paperwork: Reduce the documentation burden that often overwhelms migrants

- Quick submission: Submit applications to multiple lenders efficiently

The migrant advantage: Traditional applications can be overwhelming when you're unfamiliar with Australian banking systems. Open Banking removes friction, letting your actual financial behaviour speak for itself rather than requiring complex paper trails. The system connects directly to Open Banking product reference data and instantly scans over 7,000+ live product rates from across the market.

6. Track - Your AI Financial Watchdog

Your mortgage is one of your biggest financial commitments, yet most people simply set it and forget it. The Track tool changes that by continuously monitoring your loan for opportunities to save.

How it works:

- Connect via Open Banking: Securely link your current home loan account

- Continuous monitoring: AI automatically tracks your loan against market conditions 24/7

- Smart alerts: Get notified when opportunities arise, not constant noise

- Multi-factor analysis: Monitors interest rates, your property value, RBA cash rate changes, and loan structure

What it tracks for you:

Interest Rate Competitiveness: The system compares your current rate against 7,000+ live products in the market. As new rates emerge or lenders adjust their offerings, Track identifies if you're paying more than necessary. This is especially important as Australian banks frequently offer better rates to new customers while quietly increasing rates for existing borrowers, the notorious "loyalty tax."

Property Value Changes: As your property value increases, your Loan-to-Value Ratio (LVR) decreases. This can open up new opportunities like removing Lenders Mortgage Insurance, accessing better rate tiers, or switching to loan products with superior features. Track monitors these changes automatically.

RBA Cash Rate Movements: When the Reserve Bank changes the cash rate, lenders don't always pass on the full benefit to existing customers. Track watches how your lender responds to RBA decisions and alerts you if competitors are offering better pass-through rates.

Loan Structure Optimisation: Beyond just rates, Track analyses whether your current loan structure still suits your situation. Perhaps you're paying for package features you no longer use, or you could benefit from an offset account you don't currently have.

Why this matters for migrants:

As a newcomer to Australia, you might have accepted your first home loan without fully understanding the market landscape. You might also be unfamiliar with the concept of regularly reviewing and optimising your mortgage, something many born-and-raised Australians also neglect. Track ensures you're never left behind by market changes, even if you don't have the time or local knowledge to monitor rates yourself.

The reality is that life gets busy. You're settling into a new country, building your career, perhaps raising a family. Monitoring mortgage markets shouldn't require your constant attention. Track acts as your personal financial watchdog, working in the background and only alerting you when action could genuinely benefit you.

Real-world impact:

Consider this: Interest rates can change multiple times per year. Property values shift with market conditions. New loan products launch regularly. Without continuous monitoring, you could be paying thousands more than necessary simply because you don't have time to check the market every month.

According to analysis from Bheja.ai's monitoring system, borrowers often discover potential savings of over $100,000 over the life of their loan simply by switching to more competitive products. For migrants establishing financial security in Australia, these savings can be transformational.

Set and forget peace of mind:

The beauty of Track is that it's truly passive. Connect your loan once, and the AI does everything else. You're not bombarded with constant notifications, only genuine opportunities that warrant your attention. It's like having a mortgage broker watching your loan full-time, but without the ongoing fees or sales pressure.

7. Educational Resources - Knowledge When You Need It

Beyond tools, Bheja.ai provides comprehensive educational content to help you understand every aspect of home loans and property buying in Australia.

What's available:

Step-by-Step Decision Guides: Whether you're choosing between fixed and variable rates, deciding on loan features, or planning your property purchase journey, our guides walk you through each decision point with clear explanations and actionable advice.

Deep RBA Cash Rate Research: Understanding how the Reserve Bank's decisions affect your mortgage is crucial. Our dedicated RBA Cash Rate Hub provides historical data, current analysis, expert forecasts, and practical implications for borrowers. You'll understand not just what the RBA decided, but what it means for your specific situation.

Migration Content Hub: Recognising that migrants face unique challenges, we've created a dedicated resource center covering topics like eligibility requirements for different visa types, how to prove overseas income, documentation requirements specific to migrants, lender policies on temporary residents, pathways to approval with limited Australian credit history, and government schemes available to eligible migrants.

Property Buying Guides: Detailed resources covering the entire property purchase process in Australia, from understanding property markets and auction strategies to conveyancing and settlement. These guides explain uniquely Australian concepts like negative gearing, capital gains tax implications, and state-specific stamp duty rules.

News and Insights: Stay updated with the latest developments in Australian property markets, lending policy changes, new government schemes, rate movements, and economic trends. Our content breaks down complex financial news into clear, actionable insights.

100+ Articles and Resources: Covering every imaginable aspect of home loans, from basic concepts to advanced strategies. Topics include refinancing strategies, investment property finance, construction loans, equity release, debt consolidation through home loans, first home buyer schemes, and much more.

Why educational content matters:

Knowledge is power, especially in financial decisions. As a migrant, you're not just learning about home loans, you're learning about an entire financial system that operates differently from what you might know. Our educational resources bridge that gap, providing context and understanding that pure tools alone cannot deliver.

The Australian home loan market has its own terminology, practices, and regulatory environment. Understanding concepts like comparison rates, offset accounts, redraw facilities, LMI, and split loans requires clear explanation. Our guides provide that clarity without overwhelming you with jargon or assuming prior knowledge.

Accessible and practical:

All educational content is written in plain English, avoiding unnecessary complexity while still providing comprehensive information. Each guide includes practical examples, clear explanations of pros and cons, and actionable next steps. You're not left with abstract knowledge, you understand how to apply what you've learned to your specific situation.

Always current:

The home loan market evolves constantly with new products, changing regulations, and shifting economic conditions. Our content is regularly updated to reflect current market realities, ensuring you're working with accurate, relevant information rather than outdated advice.

8. Human Expert Support - Always Available

Technology is powerful, but sometimes you need a real person who understands your unique situation.

When you need us:

- Direct human support: Connect with licensed mortgage brokers when facing complex issues

- Flexible engagement: Choose the level of support that suits your comfort level

- No pressure: Expert guidance without aggressive sales tactics

Why this matters: As a migrant, you might encounter situations where technology alone isn't enough—questions about visa implications, overseas income verification, or navigating cultural differences in the lending process. Our experts understand these nuances and can guide you through them with empathy and expertise.

Available support includes:

- MFAA-accredited mortgage brokers on staff

- Specialists familiar with migrant lending scenarios

- Assistance with documentation and compliance requirements

- Help understanding and negotiating with lenders

Your Step-by-Step Journey with Bheja.ai

Step 1: Discover Your Options

Start at our comparison tables to see the entire market. Filter by your specific situation (migrant, first home buyer, deposit amount) to narrow down suitable products.

Step 2: Educate Yourself

Browse our educational resources to understand Australian home loan concepts, migrant-specific requirements, and current market conditions. Our guides provide the foundation you need to make informed decisions.

Step 3: Ask Questions

Use Ask Bheja to clarify anything confusing. No question is too simple or too complex. Understand the difference between products, what documentation you'll need, and what to expect.

Step 4: Check Your Numbers

Run the borrowing capacity calculator to understand your realistic budget. Create different scenarios to see how variables like deposit size or interest rates affect your situation.

Step 5: Compare Your Scenarios

Use Ask Bheja to compare different loan structures side-by-side. Should you go fixed or variable? How much difference does 0.5% in interest rate make over 30 years? What about offset accounts?

Step 6: Health Check (If Applicable)

Already have a loan? Run it through the health check to see if you could save by refinancing. Many migrants find they were paying significantly more than necessary.

Step 7: Apply with Confidence

When ready, use our streamlined application engine to submit your application efficiently. Open Banking technology makes the process faster and less document-intensive.

Step 8: Set Up Continuous Monitoring

Once you have your loan, connect it to Track. Let AI monitor your mortgage 24/7, alerting you to opportunities as they arise—whether from rate changes, property value increases, or new market offerings.

Step 9: Get Expert Help When Needed

At any point in your journey, connect with human experts who can address your specific concerns, whether it's visa-related questions or complex income situations.

Why Bheja.ai is different?

Transparency Over Sales

We're not pushing specific products or earning commissions that influence our recommendations. Our AI provides objective recommendations based on data, not commissions or incentives. You see the whole market, not just what's profitable for us to sell.

Built on Open Banking

We use Australia's Consumer Data Right (Open Banking) to access real, verified product data directly from lenders. This means you're seeing accurate, up-to-date information, not marketing spin. When you use Track, Open Banking allows secure, read-only access to monitor your loan without sharing sensitive credentials.

AI That Learns and Adapts

Our AI engine continuously learns from market conditions, user behaviour, and lender policies to provide better recommendations. As the market changes, our insights evolve to keep you informed.

Free to Use

All our core tools (comparison tables, Ask Bheja, calculators, health checks, and Track monitoring) are available at no cost. No hidden fees, no subscriptions required.

Designed for Everyone

Whether you're tech-savvy or prefer simple interfaces, whether English is your first language or fifth, our platform is built to be accessible and understandable. Users appreciate it as "such a great DIY tool to explore mortgage options, no wall of big jargons, no judgement for my messy thoughts, most importantly no agenda trying to push sell anything".

Real Results for Real People

The platform has already helped thousands of Australians make smarter financial decisions:

- Users discover savings they didn't know existed

- Complex calculations happen in seconds instead of hours

- Side-by-side comparisons reveal the true differences between products

- AI guidance removes the intimidation factor from financial decisions

For migrants specifically, Bheja.ai removes the knowledge gap that often leads to accepting suboptimal deals. You get the same market visibility and decision-making power as someone who's been in Australia their entire life.

Understanding the Australian Home Loan Market as a Migrant

What makes Australia different?

The Australian mortgage market has unique characteristics that might surprise you:

- Variable rates are common: Unlike some countries where fixed rates dominate, many Australian borrowers choose variable rates that change with market conditions

- Offset accounts are popular: These let you use savings to reduce interest without losing access to your money

- Lenders Mortgage Insurance (LMI): If you borrow more than 80% of the property value, you typically pay this insurance to protect the lender

- Comparison rates matter: The advertised rate isn't the whole story; comparison rates include fees and give a truer picture of costs

Challenges Migrants Face

- Limited credit history: Australian credit scores don't transfer from overseas

- Income verification: Proving your income when you're new to the country can be complex

- Deposit requirements: Some lenders require higher deposits from recent migrants

- Understanding local terminology: Australian banking has its own vocabulary

- Knowing which lenders are migrant-friendly: Not all banks have the same policies toward recent arrivals

How Bheja.ai addresses these challenges?

Our platform specifically helps with these migrant-specific issues:

- Transparent eligibility information: See which lenders work with recent migrants

- Documentation guidance: Understand exactly what you need to provide

- Plain English explanations: No confusing jargon or unexplained acronyms

- Scenario modeling: Test different deposit amounts and income levels to see your options

- Expert support: Connect with brokers experienced in migrant lending

The Power of informed decisions

The difference between a great home loan and an average one can mean:

- Tens of thousands of dollars in interest saved over the life of the loan

- Years shaved off your mortgage term

- Hundreds of dollars monthly in reduced repayments

- Better features like offset accounts, redraw facilities, and flexible repayments

- Peace of mind knowing you're getting a competitive deal

For migrants establishing themselves in Australia, these savings can be transformational, accelerating your path to financial security and home ownership.

Your journey to home ownership starts here

The Australian dream of home ownership is within reach, even as a recent migrant. With the right tools, information, and support, you can navigate the mortgage market with confidence.

Bheja.ai exists to give you that confidence. We believe everyone deserves access to clear, comprehensive financial information regardless of how long they've been in Australia or how familiar they are with the banking system.

Start exploring today:

- 🏠 Browse all available home loans: bheja.ai/home-loans

- 💬 Ask your questions: bheja.ai/ask

- 🩺 Check your loan health: bheja.ai/home-loans/health-check

- 💰 Calculate your borrowing power: bheja.ai/home-loans/how-much-can-i-borrow

- 🔔 Set up loan monitoring: bheja.ai/track

- 📝 Submit your application: bheja.ai/apply

- 📚 Explore educational resources: bheja.ai/home-loans/resources

- 🤝 Talk with our in-house experts: bheja.ai/book-appointment

Welcome to Australia. Welcome to smarter home loan decisions. Welcome to Bheja.ai.

Bheja.ai connects you with MFAA-accredited mortgage brokers and uses AI to simplify complex financial decisions. All tools are free to use with no obligation. We comply with Australian privacy regulations and use bank-grade encryption to protect your data.