Most Australians are overpaying on their mortgage because of a number they've never checked

It's not your income. It's not your credit score. Right now, one number on a certificate most homeowners have never read is quietly costing them thousands in extra interest every year. That number is your NatHERS star rating. And if your home scores 7 stars or above, you may already qualify for a rate discount your bank has never told you about.

What is a NatHERS 7-Star Energy Rating?

A NatHERS (Nationwide House Energy Rating Scheme) star rating measures how much energy your home needs for heating and cooling, scored from 0 to 10 stars. Energy assessors use NatHERS computer modelling tools to predict how much heating and cooling a home will need to stay comfortable year-round, with the results converted into a star rating specific to each property. Nathers

The National Construction Code 2022 officially mandated that all new homes must meet a 7-star minimum standard, lifting the bar from the old 6-star baseline. In practice, this means better insulation, smarter glazing, and lower energy bills, all of which lenders are now using to price your mortgage.

Does a 7-Star Rating Actually Affect Your Mortgage Rate?

Yes. In 2026, several major Australian lenders have created what they call "Green Tier" pricing for high-efficiency homes. The Clean Energy Finance Corporation has provided $60 million in finance for Bank Australia's Clean Energy Home Loan, enabling eligible borrowers to secure a 0.40 per cent discount on their home loan.

That is not a rounding error. On a $750,000 loan, a 0.40% rate reduction saves approximately $3,000 in interest per year. Over a five-year fixed term, that is $15,000 sitting on the table.

Why Do Lenders Care About Your Star Rating?

There are two hard financial reasons.

Lower default risk. Lenders consider energy-efficient home loans lower risk because energy bills are among the largest household expenses and a contributing factor in households forced to default. Homeowners in energy-efficient homes typically save significant amounts on energy costs, so lenders may prefer these loans because there is less chance that the household's expenses become overwhelming.

Higher borrowing power. When a bank assesses your serviceability, it takes into account your living costs. A documented 7-star home means lower projected energy spend, which means a lower cost of living on paper. Bank Australia's Clean Energy Home Loan applies a 0.40 per cent discount for up to five years for customers who buy or build homes that meet or exceed a minimum of 7 stars under NatHERS. Greenbanknetwork For many borrowers, this serviceability shift translates into $15,000 to $25,000 of additional borrowing capacity.

How Do I Know If My Home Qualifies?

Follow this four-step check before your next rate review or purchase.

Step 1: Find your certificate. If your home was built after 2023, a NatHERS certificate was required at approval stage. Check your settlement documents or ask your builder. If your home is older, only assessors trained and accredited by one of the two nationally operating Assessor Accrediting Organisations, the Australian Building Sustainability Association (ABSA) and the Building Designers Association Victoria (BDAV), can issue an official NatHERS certificate. Certified Energy Expect to pay around $500 for a new assessment.

Step 2: Go all-electric. Most green loan products require zero gas appliances. Bank Australia's Eco Plus Clean Energy Home Loan offers an increased 0.30% per annum discount for new homes achieving a NatHERS rating of 7.5 stars with the addition of solar panels.

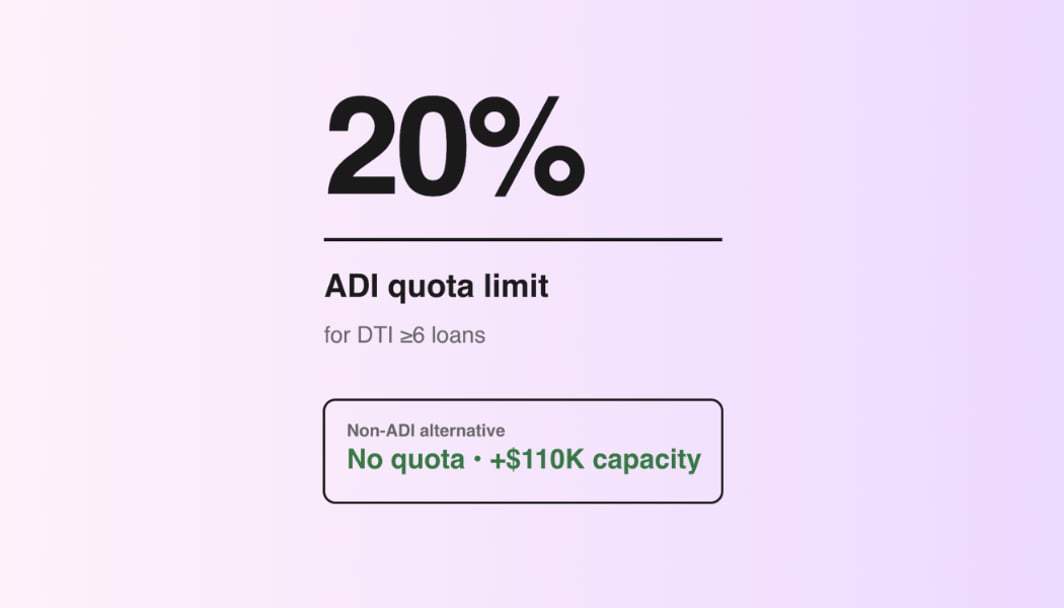

Step 3: Ask about LVR-neutral green discounts. Some lenders allow borrowers to access a higher LVR allowance on a green home loan than a standard mortgage. Hunter Galloway This means that with a 15% deposit and a qualifying star rating, some lenders will still give you the 80% LVR rate, saving you lender's mortgage insurance costs on top of the interest discount.

Step 4: Review your current rate today. In most locations, 7-star homes need 20 to 25% less energy than 6-star homes for heating and cooling. Sustainability Victoria If your home meets this standard and your rate still starts with a 6, you are paying for an energy risk profile your home no longer carries. That is a conversation worth having with a broker today.