How to pay off your home loan faster: Strategies for Australian Homeowners

Owning a home is a big part of the Australian dream, but it often means taking on a big debt. For many people, paying off the mortgage can feel out of reach, like a finish line that’s far away. The good news is, with the right strategies, you could pay off your loan years sooner and save a lot on interest. It’s not about luck, but about making smart choices that fit the Australian market.

Many Australians attempt to pay off their mortgage more quickly by making extra repayments. But is that always the smartest move? If your mortgage rate is high, like 6% or more, you might actually come out ahead by investing your money in assets that usually earn 8-10% over time. Take Emma, for example. She has a $400,000 mortgage at an interest rate of 6%. If she pays an extra $500 each month, she’ll save on interest over 10 years. However, if she invests that $500 in something earning 8% annually, her returns could be even better. To figure out what’s right for you, compare the possible investment gains with the guaranteed savings from extra loan payments, and keep in mind how Australia’s tax rules could affect your profits. Also, remember that investing can be riskier. While it might offer higher returns, the market can go up and down, and you could lose money, unlike the certainty of loan savings. For instance, if the market drops, Emma’s investments may not perform as well as she had hoped, which could impact her plans. Think about your comfort with risk, your financial goals, and what’s happening in the market. Consulting with a financial adviser who understands your specific situation can help you make the best choice.

However, for most homeowners, the primary goal remains simple: to get the bank off your back as quickly as possible. Let's get into the nitty-gritty of how to do it.

1. The foundations: Simple changes, massive impact

Before exploring more complex options, it’s worth remembering that simple steps can often be the most effective. These basic strategies serve as the starting point for paying off your loan more quickly.

- Try adjusting the frequency of your repayments. Most home loans are paid monthly, but switching to fortnightly payments is a simple way to get ahead. By doing this, you make 26 payments a year, which adds up to 13 monthly payments instead of 12. That extra payment each year can help you pay off your loan faster and save on interest, especially when rates are going up.

- Use lump sums to pay down your main loan. If you get a tax refund, bonus, or inheritance, putting that money straight into your mortgage can really add up over time. For example, an extra $10,000 on a $500,000 loan can save you a lot in interest. This works because you’ll owe less, so future interest is lower. It’s a simple way to own more of your home sooner and pay off debt faster.

2. The great Aussie debate: Offset account vs. redraw facility

If you visit an Australian bank, you’ll often hear about offset accounts and redraw facilities. Both can help you save on interest, but they work differently, especially when it comes to flexibility and taxes. It’s important to understand the difference. Not all loans offer these features, and eligibility requirements or restrictions may apply based on the type of loan and lender policies. Be sure to ask your lender about the availability and specifics of these features to see if they align with your financial strategy.

An offset account is a day-to-day transaction account linked to your home loan. The magic is that any money sitting in this account is "offset" against your loan balance before the bank calculates your interest. So, if you have a $500,000 loan and $50,000 sitting in your offset account, you only pay interest on $450,000. The money is still yours to access at any time, just like a normal bank account.

A redraw facility, on the other hand, is a feature of the loan itself. It allows you to make extra repayments into your loan account, reducing the principal, and then "redraw" that extra money back out if needed.

It depends on your habits and future plans.

- Flexibility and Access: The offset account wins hands down. The money is in a standard transaction account, accessible via your debit card or online banking without any formal request. A redraw can sometimes involve a request process and may have fees or restrictions.

- Cost: Redraw facilities are often a standard feature with no extra cost. Offset accounts, however, can come with higher annual fees or require a package loan. For a disciplined owner-occupier who won't be tempted to spend, a redraw facility might be the more cost-effective option.

- Quantifiable Savings: Mathematically, the interest saved can be identical if you maintain the same amount of extra funds against the loan. Adding an extra $1,000 a month to a loan with redraw or to an offset account will have the same effect on your interest calculation. One analysis showed that this simple act could save around $47,000 in interest and shorten a 30-year loan by more than five years. The real-world difference comes down to behaviour and tax.

- The Crucial Tax Difference: This is where the separation becomes critical, especially if you ever plan to turn your home into an investment property. Money you put into a redraw facility is considered a repayment. If you later redraw that money for personal use (such as buying a car) and then rent out the property, you may have compromised the loan's purpose. The Australian Taxation Office (ATO) could argue that a portion of the loan is now for personal use, and therefore, the interest on that portion is no longer tax-deductible. For instance, if you originally borrowed $500,000 and later withdrew $50,000 for a car, only the interest on the remaining $450,000 that continues to serve the initial purpose of home purchase may be deductible. This could significantly impact your tax planning and financial goals by reducing the amount of interest you can claim as an expense.

An offset account avoids this mess entirely. The money in the offset account never technically repays the loan; it just sits alongside it. This means the original loan amount and its purpose remain pure. If you turn the property into a rental, the interest on the full loan amount remains deductible, making the offset account the overwhelmingly superior choice for potential investors.

3. Smarter loan structures and the refinancing game

Your loan can be changed. The deal you signed up for five years ago probably isn’t the best one available now. Reviewing your loan regularly and looking for better options is an important step in paying it off sooner.

4. Consider a split loan: Why go all-in on fixed or variable?

A split loan lets you have a bit of both. You can fix a split loan, which lets you have both options. You can lock in part of your mortgage, ensuring your payments stay the same, which is particularly helpful when interest rates are fluctuating significantly. The other part can have a variable rate, so you can take advantage if rates go down and, most importantly, make as many extra repayments as you want without any penalty, which is often not allowed on fixed-rate loans. This mixed approach provides both safety and the flexibility to pay off your loan faster. Doesn’t always pay off. Lenders often offer better rates and deals to attract new customers. When the Reserve Bank of Australia lowers rates, it can be a good time to look at refinancing your loan.

A mortgage broker can be a big help here. They can bargain for you and find deals you might not get on your own. The aim is to secure a lower interest rate and a loan with features that benefit you, such as an offset account with no fees. Even a small rate cut, like 0.25%, can save you thousands of dollars. On a $500,000 loan, it could mean saving over $45,000 in interest over the 30-year term. Just make sure to check any fees for leaving your old loan and starting the new one to see if switching really saves you money.

5. Mindset matters: How to stay motivated to pay off your mortgage

Having the right tools is important, but your mindset matters just as much. Many Australians feel stressed about their mortgage, which can make it hard to take action. Try turning that stress into a small, achievable goal. For example, set a 90-day challenge to make one change to your payment strategy and celebrate your progress. This can help you turn worry into motivation and make better choices. To stay motivated, track your progress on a chart or timeline, and share your goals with a friend or family member for extra support.

6. Change how you think about it

Instead of focusing on paying off debt, think about building equity in your home. Each extra payment doesn’t just lower what you owe; it increases your share in your property. This positive outlook can make the process feel more rewarding.

7. Use technology to help you

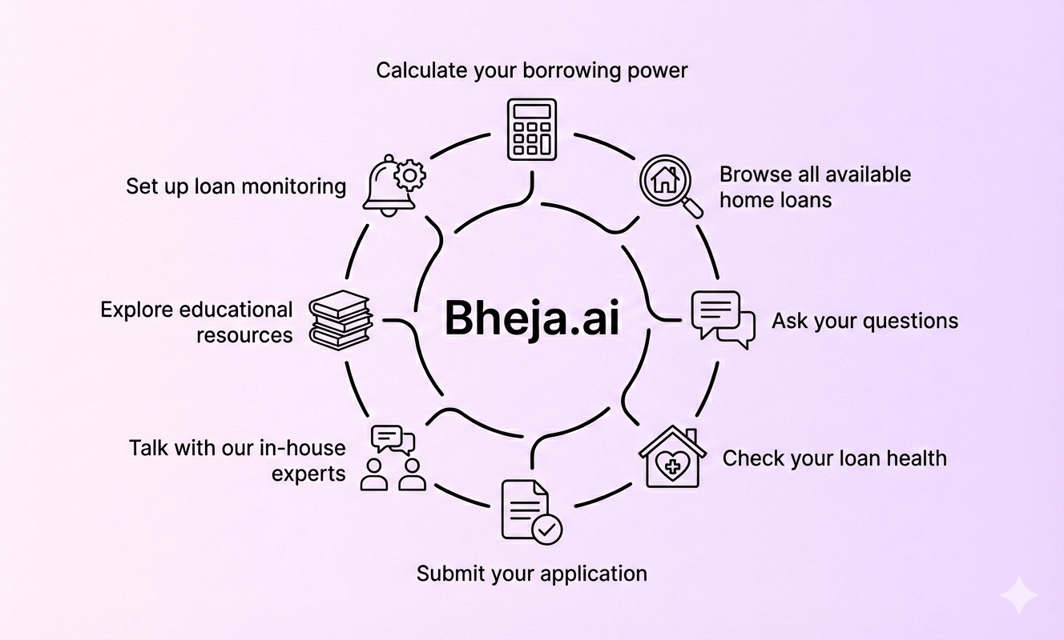

Many banking apps now allow you to track your progress as you pay off your loan, which can help keep you motivated. Look for features like repayment calculators to try out different payment options and see how much interest you could save. Progress trackers can show how your loan balance drops over time. Setting up automatic extra repayments, even small ones, helps you stay on track without requiring extra effort. Tools like ASIC’s Moneysmart can also help you stay on track.

8. Financial education is power

Understanding the mechanics of your loan is empowering. Knowing how your loan works gives you more control. Programs from groups like the Extra Foundation and Good Shepherd are designed to help people learn. Learning how your loan works gives you more control over your finances. Groups like the Extra Foundation and Good Shepherd offer programs to help people better understand money, so you can feel less stressed and more confident. When you see how much an extra $50 a week can save, it’s easier to make small changes, like skipping a coffee and putting that money toward your loan. There’s no single best way to pay off your home loan faster. The best plan is to use a mix of the strategies above that fit your own finances and goals. Provide immediate clarity on where improvements can be made, offering professional advice that aligns with your personal aspirations.

For a diligent saver who might one day rent out their home, a loan with a feature-rich offset account is a no-brainer, even if it incurs a slightly higher annual cost. For someone who struggles with the temptation to spend, a more restrictive redraw facility might provide the necessary financial guardrails.

The key is to stay proactive. Don’t let your mortgage go for 30 years without checking in. Review your loan annually, ask your bank for a better deal, and consider strategies such as adjusting your repayment frequency or utilising an offset account. With these steps and a positive attitude, you could own your home much sooner. For a practical step, write your current loan end date in your calendar and set a goal to bring it forward by five years. With determination and the right approach, you can reach that finish line sooner and turn your dream of owning your home into a real plan.