How high will interest rates go in 2026?

Interest rates in 2026 are expected to rise from the current 3.60% cash rate, with all major banks and economists now forecasting at least one 0.25 percentage point increase after December 2025 Consumer Price Index (CPI) data showed inflation at 3.8% (above the RBA's 2-3% target)

Big 4 Banks' 2026 cash rate forecasts:

Most major financial institutions have revised their forecasts following recent CPI data, which showed inflation climbing back above the RBA’s 2–3% target range.

Here’s what Australia’s major banks predict:

- CBA: 0.25% increase, February 2026

- NAB: 0.50% total increase (0.25% February + 0.25% May 2026)

- ANZ: 0.25% increase, February 2026

- Westpac: 0.25% increase, February 2026

Will the RBA hold rates in February 2026?

A rate hike is still the most likely outcome. But a hold is now a real possibility.

All four major banks expect the RBA to lift the cash rate by 0.25% to 3.85%. However, economists agree the decision is close. It is no longer a certainty.

Why the RBA may pause

Inflation is easing. Core inflation is trending lower, and earlier rate hikes are already slowing spending.

Households are under heavy pressure. Mortgage repayments have risen sharply, and financial conditions are tight.

Global uncertainty is also a factor. Slower growth overseas gives the RBA room to wait and assess how the economy responds.

Several economists believe the RBA may choose to pause and review the data before making the next move.

Why a hike is still likely

Inflation remains above the RBA’s target range. The board has made it clear its priority is getting inflation under control.

Recent RBA messaging has been firm. This keeps the door open for another hike.

Markets are still priced for a rise, meaning the RBA may act to avoid surprising households and lenders.

The bottom line

This is a close call.

A 0.25% hike remains slightly more likely. But a rate hold is firmly on the table.

If the RBA does pause, it will likely warn that more rate rises could still come. That means mortgage pressure is not over yet.

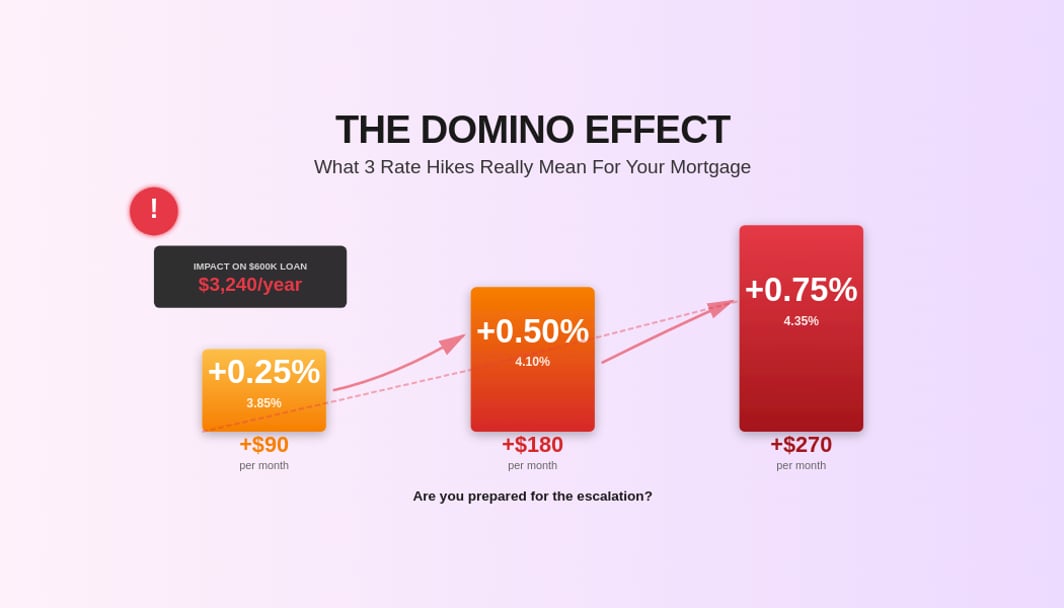

The Domino Effect: What 2-3 rate rises really mean

Most forecasts focus on a single 0.25% rate rise. But history shows the Reserve Bank of Australia is willing to move decisively when inflation remains stubborn.

That means borrowers should prepare for more than just one increase.

Understanding how multiple rate rises stack up helps you plan for what could become Australia’s new normal over the next 6–12 months.

Why Multiple Rate Rises Matter

One rate hike may seem manageable. But several in quick succession can create serious financial pressure.

Each increase compounds the impact of the last. Over time, small rises turn into large repayment jumps.

This is where many households feel the strain.

The escalation ladder: Your mortgage under pressure

Here’s how consecutive rate rises affect a typical $600,000 mortgage on a 30-year principal and interest loan.

*Assumes full 0.25% increases are passed on by lenders. The figures shown in the table are estimates only and are provided for general information purposes. Calculations are based on a $600,000 loan over 30 years with principal and interest repayments. Actual interest rates, repayment amounts, and lender behaviour may vary. This information does not consider your personal financial circumstances and should not be taken as financial advice. Always seek independent advice before making financial decisions.

As you can see in the table, three rate rises would push monthly repayments up by around $270 more than today.

Over a year, that’s an extra $3,240.

For many families, this could mean cutting back spending, dipping into savings, or delaying major financial plans.

Impact on Australian Households of a cash rate hike

For many, a further rate hike is described by consumer advocates as a "bitter pill" or the "straw that breaks the camel's back".

- Mortgage Stress: According to recent Roy Morgan data, a 0.25% hike could push 1.3 million households into mortgage stress.

- Repayment Increases: For a typical owner-occupier with a $600,000 mortgage, a 0.25% rate increase can add approximately $85-90 to monthly minimum repayments (30-year P&I at ~6.0% variable rate).

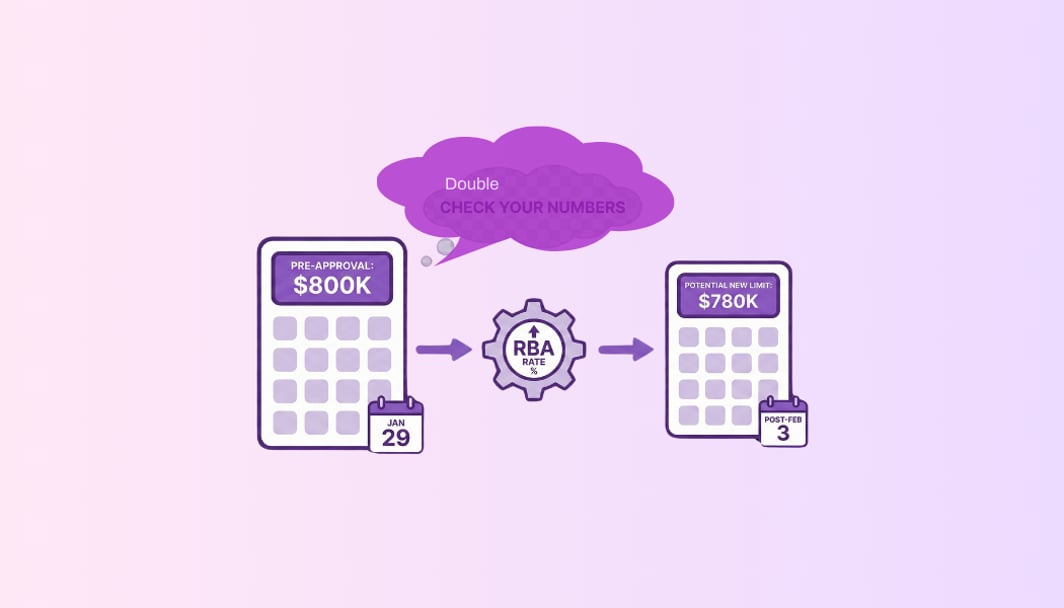

- Borrowing Capacity: As rates rise, the maximum amount new buyers can borrow will likely shrink, because higher repayments reduce their borrowing capacity.

How increased cash rate may impact your borrowing capacity

Higher interest rates directly reduce how much you can borrow. As rates rise, monthly repayments increase. A larger share of your income goes to interest, leaving less room to service the loan.

Every 1% rise in mortgage rates can cut borrowing power by about 10% to 15%. A household that once qualified for an $800,000 loan may now only qualify for $600,000 or less. This limits property choices and can force buyers into cheaper suburbs or smaller homes.

Even small rate rises have a noticeable impact. For example, a 0.25% increase can add $90 per month to repayments on a $600,000 loan and $150 per month on a $1 million loan. These increases quickly add up.

Banks apply stricter serviceability tests as rates climb. They assess loans at higher buffer rates to ensure borrowers can cope with future increases. As these test rates rise, fewer applicants pass affordability checks.

Fixed mortgage rates are rising as well. Lenders are pricing in future rate hikes, pushing fixed rates higher and reducing access to cheaper long-term loans.

How increased cash rate may impact the property market

Higher interest rates usually reduce buyer demand, as fewer people can afford large mortgages. This lowers competition, especially at auctions, and leads to slower sales.

With buyers having less spending power, sellers may need to adjust expectations. This can result in price softening, especially in areas where affordability is stretched.

However, the Australian housing market has remained resilient. A chronic shortage of homes, combined with strong population growth, continues to support prices. This supply-demand imbalance is limiting major price falls.

Most forecasts suggest higher rates will slow price growth rather than cause a major downturn. Prices are expected to keep rising, but at a more moderate pace.

However, sudden or sharp rate increases could weaken buyer confidence and trigger short-term price declines, especially in highly leveraged markets.

What should homebuyers and owners do?

In a rising and uncertain rate environment, waiting for the “right time” rarely works. A smarter approach can be to focus on what you can control. Building financial resilience now puts you in a stronger position, whatever happens to interest rates.

Stress-test your finances

Do not rely only on bank affordability checks. Run your own numbers using an interest rate 2% to 3% higher than your current rate. This shows how your budget holds up under pressure. Identify where you could cut spending if repayments rise. Even a 0.5% buffer can help expose weak points early.

Consider fixing part or all of your loan

Fixed rates provide certainty and protect you from future rate increases. While fixed rates have risen, they can still offer savings compared to variable loans that continue to climb. However, don’t just consider the interest rates. Check the cost of switching and whether a fixed rate suits your finances. Variable rate loans often offer more flexible features.

For instance, offset and redraw accounts can help reduce interest charges and improve cash flow. Keeping $50,000 in an offset account can save about $5,000 a year in interest on a $600,000 loan at 6%. Actively using these features can strengthen your position and shorten your loan term. Avoid the trap of setting and forgetting your loan.

Track key economic signals

Follow the indicators that influence Reserve Bank decisions. Inflation data, employment figures, and retail sales provide better insights than headlines. These signals help you anticipate rate movements and plan with confidence.