If you’re house hunting in Australia, you’re probably focused on finding the right place. But as you’ve been looking, the financial situation has just changed.

Yesterday, the Australian Bureau of Statistics (ABS) released important data showing that inflation is higher than expected. The Consumer Price Index (CPI) rose to 3.8% over the year to December.

This might sound like just numbers, but it has real and immediate effects for anyone with a mortgage pre-approval.

Here’s why this news could mean you have less to spend by next Tuesday.

The RBA’s Next Move: Tuesday, Feb 3

The Reserve Bank of Australia (RBA) has said it will do what’s needed to bring inflation back to its 2-3% target. With inflation still at 3.8%, many expect the RBA to raise the official cash rate at its meeting next Tuesday, February 3rd.

The expectation is a 0.25% hike, taking the cash rate to 3.85%.

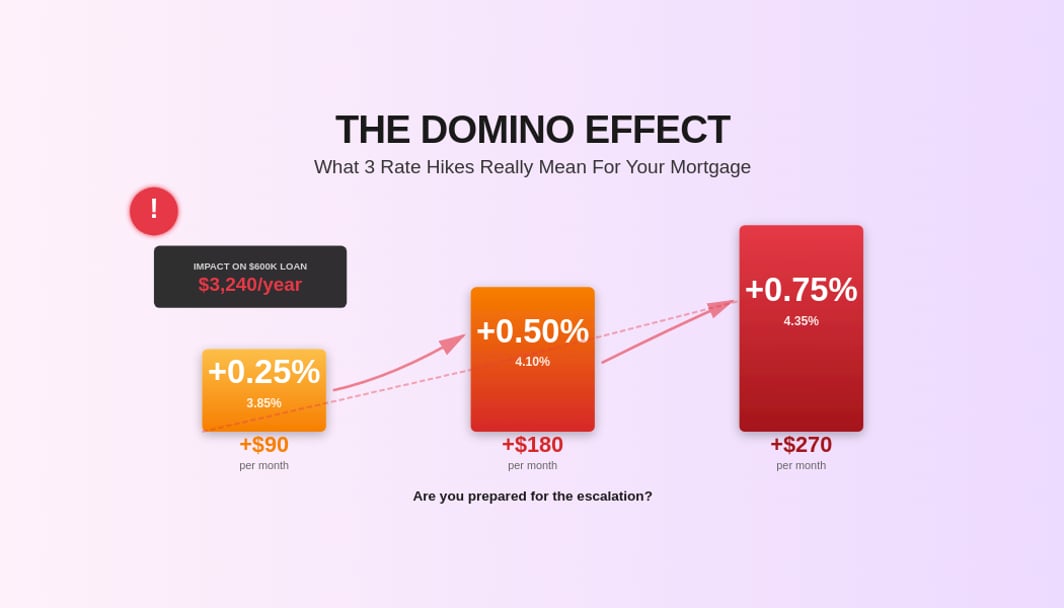

For existing homeowners, this means a painful bump in monthly repayments. But for aspiring buyers, the impact is different and immediate. It’s about serviceability.

Many buyers assume that if the cash rate rises by 0.25%, their repayments will just cost a little more.

But lenders don't just calculate what you can afford today. By law, they must apply a "serviceability buffer," usually at least 3% above the actual loan rate, to ensure you won't go broke if rates rise in the future.

Here’s the catch: If the RBA raises rates next Tuesday, your lender’s base rate will also go up. That means the "buffered" rate they use to test you will increase as well.

As the test becomes tougher, the maximum amount you can borrow goes down.

The Impact: What Does a 0.25% Hike Look Like?

Everyone’s finances are different, but a 0.25% rate increase can make a big difference to how much you can borrow.

Let’s look at a hypothetical scenario:

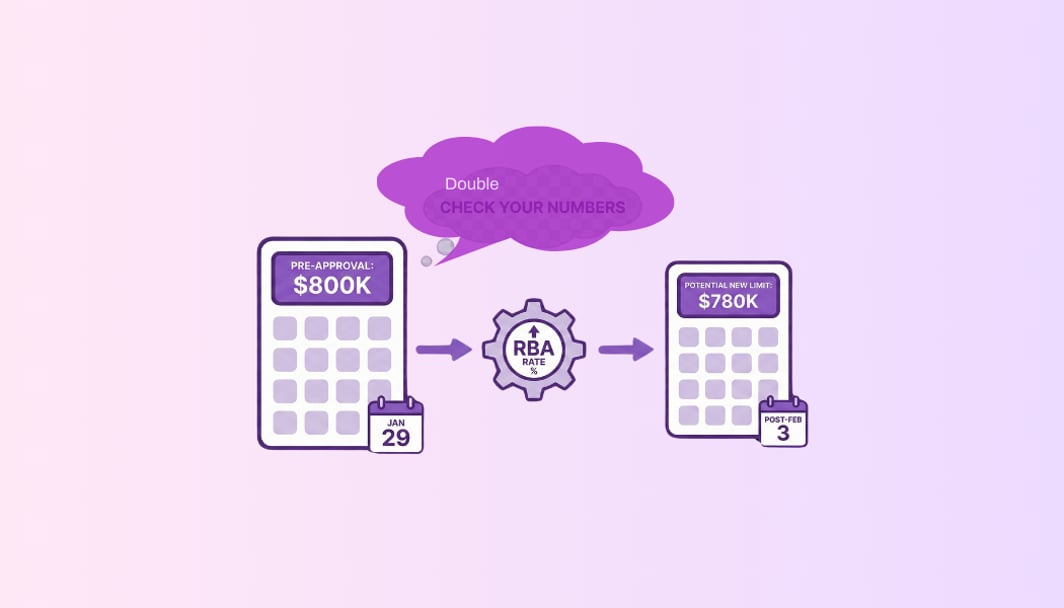

- Today (Thursday, Jan 29): You have a valid pre-approval for $800,000. At today’s rates, you pass the bank’s stress test.

- Next Tuesday (Feb 3): The RBA raises rates by 0.25%. Lenders update their calculations.

- Next Wednesday (Feb 4): Since the stress test is now tougher, your pre-approval might only be for $780,000, or even less, depending on your debts and income.

That is a potential $20,000 vanishing from your budget overnight, through no fault of your own.

Your 5-Day Action Plan

At Bheja.ai, we believe responsible lending means being transparent about risks. If you are actively looking to buy, here is how to protect yourself over the next few days:

1. Do NOT bid to your limit this Saturday. If you are attending an auction this weekend, do not stretch yourself to the absolute maximum of your current pre-approval letter. Leave yourself a safety margin. If you win the auction at your max limit on Saturday, and rates rise on Tuesday, you could face a very stressful formal approval process.

2. Check any older pre-approvals. If your pre-approval is over 30 days old, assume the numbers need updating. Call your broker or lender and ask them to check the figures with a possible rate increase in mind.

3. Ask the important question. Don’t just ask, "How much can I borrow?" Instead, ask, "If rates go up 0.25% next week, what’s my new maximum?" Make sure you know the lower number before making an offer.

Why Transparency Matters

We created Bheja.ai because we believe the mortgage process should be clear and open. In a changing economy, using old numbers isn’t just risky; it’s not responsible.

Whether you’re a borrower figuring out your real budget or a broker looking out for your clients, you need technology that not only calculates numbers but also anticipates changes.

Be careful in this market, and make sure your finances are checked against what could happen next week, not just today.