Securing a home loan is a pivotal step for many Australians, particularly first home buyers and existing homeowners looking to refinance. One critical factor influencing loan approval and the cost of borrowing is the credit score. Understanding how credit scores affect mortgage eligibility and interest rates in Australia—and knowing how to improve them—can empower borrowers to navigate the home loan process more confidently and cost-effectively. This article explores the multifaceted role of credit scores within the Australian mortgage market, regulatory environment, and lending practices, providing actionable tips for improving creditworthiness to secure better home loan outcomes.

Introduction to credit scores and mortgage lending in Australia

Role of credit scores in mortgage approval and interest rates

In Australia, credit scores serve as a fundamental metric lenders use to assess the risk profile of borrowers applying for home loans. They influence both the likelihood of loan approval and the interest rates offered. Lenders interpret credit scores as indicators of a borrower's past financial behaviour and ability to repay debt reliably. A higher credit score generally reflects strong creditworthiness, resulting in more favourable loan terms, including lower interest rates.

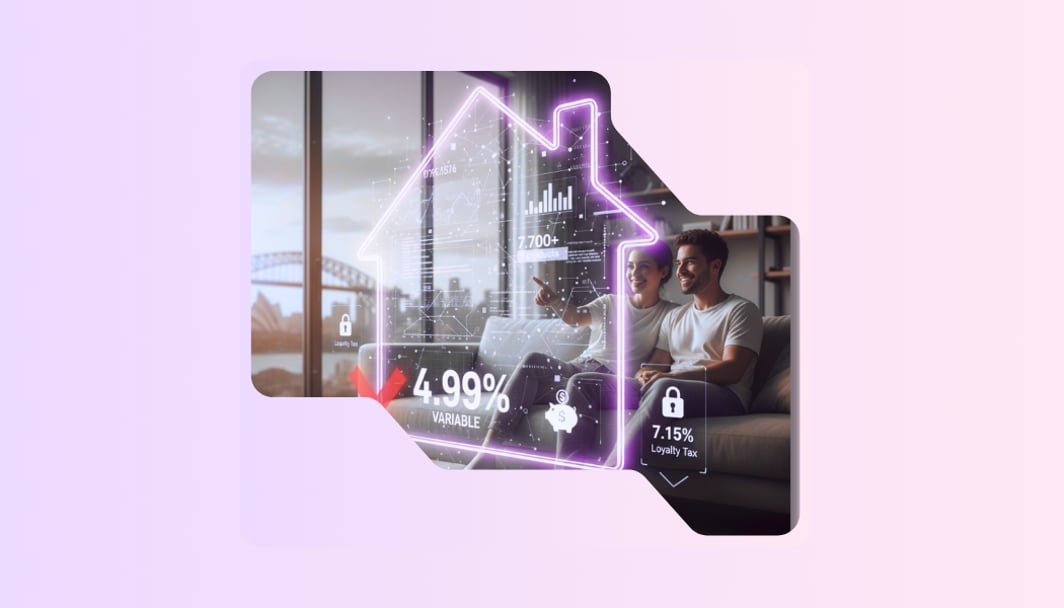

Mortgage interest rates in Australia are typically priced as a spread over lenders' funding costs. These funding costs have risen significantly in recent years due to monetary tightening by the Reserve Bank of Australia (RBA). Between May 2022 and December 2023, outstanding mortgage rates increased by approximately 320 basis points. Despite this, lenders’ risk margins - the additional amount charged over funding cost, have remained relatively stable at about 190 basis points, reflecting cautious but steady lending conditions. Within this framework, individual borrower risk, as reflected in credit scores, remains a key determinant of final mortgage pricing.

A low credit score increases perceived risk, leading lenders to either reject applications or impose higher interest rates to compensate for the elevated default risk. Borrowers with poor credit profiles may also face stricter loan conditions such as higher deposits or the requirement for guarantors. These practices help lenders mitigate potential losses, affecting affordability and accessibility for borrowers.

Australian mortgage market and regulatory environment

The Australian mortgage market operates under a comprehensive regulatory framework involving agencies such as the Australian Securities and Investments Commission (ASIC), the Australian Prudential Regulation Authority (APRA), and the RBA. These bodies oversee lending standards, credit reporting, and financial stability. Post-global financial crisis (GFC) and pandemic, regulatory tightening has emphasised prudent lending, including serviceability buffers and capital requirements, to ensure banks maintain robust portfolios.

Macro-prudential policies by APRA, including capital buffers and serviceability tests, influence lenders’ risk appetite and pricing strategies. These policies aim to prevent excessive risk-taking and ensure borrowers can service loans even under adverse economic conditions. Consequently, credit scores are integrated within broader risk assessments that reflect both individual creditworthiness and systemic stability objectives.

Credit Score impact on borrowers and lending criteria

Effects of low credit scores on loan approval and interest rates

Borrowers with low credit scores face significant challenges in obtaining home loans at competitive rates. Lenders’ risk-based pricing models increase interest rates for these applicants to offset the higher likelihood of default. For example, borrowers with poor credit histories may pay interest rates several percentage points higher than those with strong credit profiles.

Loan approval chances also diminish as credit scores decline. Lenders may reject applications outright or require compensating factors like larger deposits, guarantors, or additional documentation. These strict conditions are especially prevalent following the tightening of lending standards post-pandemic, as lenders remain cautious about increasing exposure to potentially risky borrowers.

Furthermore, low credit scores can trigger stricter loan terms, including reduced loan-to-value ratios (LVRs) and compulsory lenders mortgage insurance (LMI), increasing upfront costs and limiting borrowing capacity.

Credit Score influence on Loan-to-Value ratios and mortgage insurance

LVR thresholds represent the ratio of the loan amount to the property’s value and are critical in loan approval and pricing. Typically, Australian lenders allow an LVR up to 80% without requiring LMI, which protects lenders against losses if a borrower defaults. However, borrowers with lower credit scores often face tighter LVR limits, sometimes well below 80%, to reduce lender risk exposure.

For first home buyers, who often have limited deposits, this means either saving larger amounts or paying higher LMI premiums when credit scores are suboptimal. Refinancing applicants with lower credit scores also encounter similar constraints, affecting their ability to restructure or increase loan amounts without incurring additional insurance costs.

Variations in Credit Score distributions across demographics

Credit score distributions vary across Australian demographic groups, influencing differential access to credit. Younger borrowers, including many first home buyers, often have shorter credit histories and may face higher financial stress or job insecurity, contributing to lower average credit scores.

Lower-income households and regional borrowers may also carry lower scores due to economic vulnerabilities. These demographic disparities translate into varied loan approval rates and interest rate offers, with disadvantaged groups often facing more restrictive lending conditions.

Credit Reporting, Scoring Models, and Regulatory Developments

Recent changes in credit reporting standards and alternative data use

Australian credit reporting standards have evolved to improve the accuracy and inclusiveness of credit assessments. Recent reforms encourage the inclusion of alternative data sources—such as rental payments and utility bills—beyond traditional credit histories. This broadens the evaluation base, potentially benefiting first home buyers and others with limited or non-traditional credit records.

The upcoming introduction of Buy Now, Pay Later (BNPL) credit reporting (effective June 2025) further expands the data available to lenders, though its impact on credit assessments remains to be fully seen.

Regulatory frameworks governing credit score usage

ASIC, APRA, and the RBA collectively oversee the credit reporting ecosystem to ensure responsible use of credit scores in lending decisions. ASIC enforces transparency and compliance, including enhanced breach reporting and record-keeping requirements for financial service providers. APRA maintains macroprudential buffers and serviceability requirements, influencing how lenders weight credit risk.

These frameworks aim to balance consumer protection with financial stability, shaping how credit scores factor into mortgage approvals and pricing.

Impact of macro-prudential policies and capital requirements

APRA’s macro-prudential policies, including mortgage serviceability buffers and countercyclical capital buffers, constrain excessive risk-taking by lenders. These policies require banks to hold additional capital against mortgage exposures, especially for riskier loans.

Consequently, lenders apply cautious risk weightings to home loans, incorporating credit scores alongside macro-prudential buffers in pricing and approval decisions. This environment maintains tight lending standards, particularly affecting borrowers with lower credit scores who face higher hurdles and pricing.

Credit Score Improvement Strategies and Behavioural Considerations

Effective credit repair and improvement practices

Improving credit scores before applying for a mortgage is crucial, particularly for first home buyers and refinancing homeowners. Key strategies include:

- Managing Loan-to-Value Ratios: Reducing LVR below 80% by saving for a larger deposit or repaying existing loans can lower risk premiums and improve creditworthiness.

- Timely Repayments: Consistently meeting repayment obligations on all debts, including credit cards and personal loans, positively impacts credit scores.

- Addressing Financial Hardship Proactively: Engaging with lenders early when facing financial difficulties can prevent negative credit events and support credit repair.

- Leveraging Professional Advice: Consulting mortgage brokers or financial advisors helps borrowers understand their credit status and plan effective improvement strategies tailored to their circumstances.

Behavioural barriers to credit score improvement

Despite available strategies, several behavioural factors hinder credit score improvement:

- Financial Illiteracy: Many Australians lack sufficient understanding of credit management and its impact on mortgage eligibility.

- Cognitive Biases: Present bias and inertia lead to procrastination or reluctance to change existing financial behaviours.

- Complexity and Perceived Costs: The mortgage application process can seem daunting and expensive, discouraging proactive credit management.

- Inadequate Support for Hardship: Insufficient lender assistance for those in financial distress reduces motivation and capacity to improve credit scores.

Evidence-Based interventions and behavioural nudges

Programs aimed at overcoming behavioural barriers include:

- Financial Literacy Initiatives: Government platforms like MoneySmart and CreditSmart educate consumers on credit management.

- Mortgage Broker Support: Brokers serve as trusted advisors, simplifying loan processes and motivating positive financial behaviour.

- Government Schemes: Programs such as the Help to Buy shared equity scheme encourage disciplined savings and timely credit management.

- Digital Tools and Data Access: Consumer Data Right (CDR) initiatives and fintech platforms provide borrowers with tools to monitor and improve credit health through reminders and goal-setting.

Post-Loan approval credit score monitoring and management

Maintaining a good credit score after loan approval safeguards favourable mortgage terms. Best practices include:

- Regular Credit Report Checks: Disputing inaccuracies promptly and tracking credit status.

- Budgeting and Timely Repayments: Ensuring all debts, including mortgage repayments, are serviced on time.

- Managing Credit Utilisation: Keeping credit card balances low relative to limits.

- Limiting New Credit Applications: Avoiding multiple enquiries that can lower scores.

- Adapting to Market Changes: Planning repayments in response to interest rate shifts.

Market Dynamics and Credit Score Trends Influencing Housing Demand and Refinancing

Influence of credit score trends on housing demand

Aggregate credit score trends affect overall housing demand by influencing borrower access and willingness to pay. Higher average credit scores enable more Australians to qualify for home loans, supporting increased demand. Conversely, tighter lending standards and lower credit scores restrict access, dampening demand.

Recent data indicates a pickup in housing credit growth despite high borrowing costs, suggesting that credit conditions and average credit scores remain pivotal in sustaining market activity.

Credit Score and Interest Rate effects on different borrower segments

Borrower risk profiles evolve over time, with credit scores playing a central role in determining interest rates and loan approval likelihood. Demographic groups with higher credit scores—typically higher income and more financially stable borrowers—access better rates and larger loans.

Lower credit score segments, including many first home buyers and lower-income households, face tighter borrowing limits, higher interest rates, and increased scrutiny amid rising interest rate environments.

Impact of housing market fluctuations on refinancing and loan restructuring

Rising mortgage rates and affordability pressures since 2022 have increased scheduled repayments, straining household budgets. Existing homeowners with loans taken during low-rate periods face higher refinancing risks, especially if credit scores have deteriorated.

Regional demand patterns and regulatory capital requirements further influence lenders' willingness to approve refinancing or loan restructures. Borrowers with lower credit scores or higher indebtedness may find refinancing options limited, affecting their ability to manage repayments effectively.

Summary

Credit Score impacts and lending environment

Credit scores remain a cornerstone of mortgage lending decisions in Australia, directly affecting loan approval chances, interest rates, and lending conditions. The interplay of creditworthiness with regulatory frameworks and market dynamics shapes borrower experiences, especially for first home buyers and refinancing homeowners.

Prudent credit management and awareness of lending criteria empower borrowers to improve eligibility and secure better loan terms, while lenders balance risk-based pricing with regulatory compliance to maintain financial system stability.

Emerging trends and regulatory directions

Future developments include:

- Greater integration of alternative data and AI in credit scoring to enhance inclusiveness and accuracy.

- Continued regulatory adjustments to support hardship management and equitable lending.

- Expansion of financial literacy programs and digital tools to overcome behavioural barriers.

These trends promise improved access and tailored credit solutions for diverse borrower profiles.

Recommendations for Borrowers and Stakeholders

- For Borrowers: Proactively monitor and improve credit scores through disciplined repayment, debt management, and professional advice. Engage early with lenders if facing financial hardship.

- For Mortgage Brokers and Lenders: Enhance borrower education and support, leveraging technology and behavioural insights to facilitate credit improvement.

- For Regulators: Continue refining policies that balance consumer protection with financial stability, promote transparency, and encourage responsible lending practices.

Collectively, these actions will foster a more inclusive and resilient housing finance market in Australia.

FAQs

Low credit scores increase interest rates due to higher perceived default risk and reduce loan approval chances, often requiring higher deposits or guarantors. Lenders price loans with risk margins reflecting borrower creditworthiness within the context of rising funding costs and conservative lending post-pandemic.

By understanding the critical role of credit scores in the Australian mortgage landscape and adopting recommended improvement strategies, both first home buyers and refinancing homeowners can enhance their loan prospects, reduce borrowing costs, and navigate the home ownership journey with greater confidence.