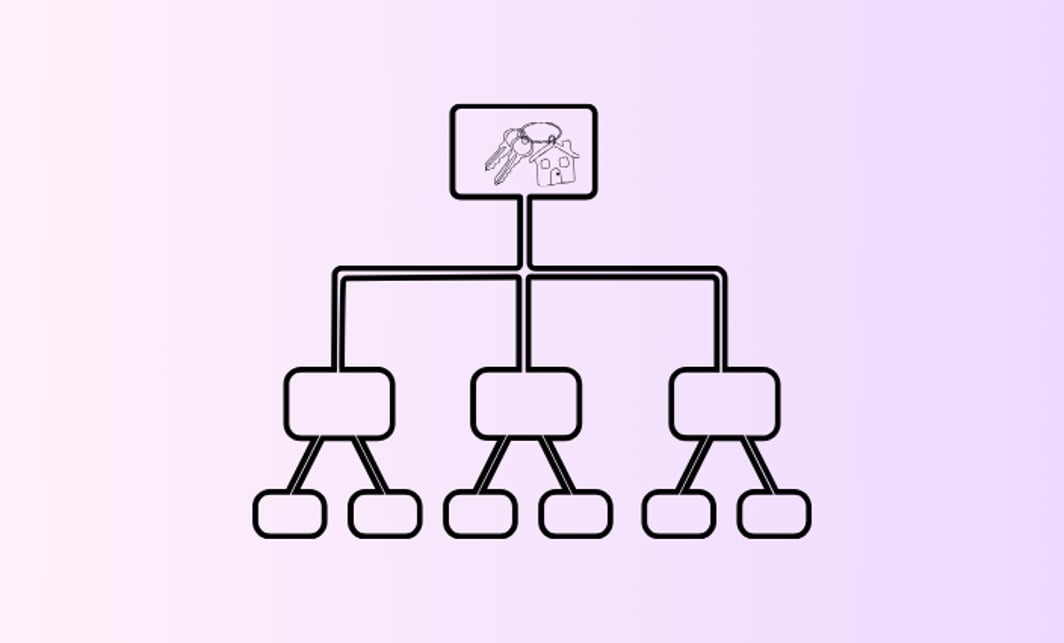

When deciding how to hold property or business interests in Australia, selecting the optimal ownership structure is a crucial step. The choice affects legal rights, tax obligations, estate planning, asset protection, and operational management. This article explores common ownership structures—individual ownership, joint tenants, tenants in common, companies, trusts, and Self-Managed Super Funds (SMSFs)—and provides a practical, actionable analysis tailored to your specific needs.

Introduction to ownership structures

Overview of common ownership structures

Ownership structures define the legal arrangement by which property or business interests are held. Common options include:

- Individual Ownership: Single ownership by a person who holds full control and responsibility.

- Joint Tenants: Co-owners hold equal shares with a right of survivorship; when one dies, their interest automatically passes to surviving owners.

- Tenants in Common: Co-owners hold distinct shares that can be transferred or bequeathed independently.

- Companies: Separate legal entities that own assets; shareholders own shares but not the assets directly.

- Trusts: Legal arrangements where trustees hold assets for beneficiaries, providing flexibility in income distribution and asset protection.

- Self-Managed Super Funds (SMSFs): Superannuation funds where members act as trustees, holding assets for retirement benefits under strict regulatory oversight.

Each structure serves different purposes and suits different scenarios, especially in property and business ownership.

Legal rights and obligations

Australian property and business ownership are governed by a complex legal framework:

- Trusts impose fiduciary duties on trustees to manage assets fairly and transparently for beneficiaries, requiring compliance with trust deeds and legislation.

- Companies operate under the Corporations Act 2001, with governance overseen by ASIC, requiring transparent operations and statutory compliance.

- Joint Tenants and Tenants in Common differ primarily in succession rights, with joint tenancy involving automatic survivorship and tenants in common allowing separate estate planning.

- Strata and Tenancy Laws add layers of compliance, such as mandatory insurance of common property and tenant protections.

Understanding these rights and obligations helps ensure lawful management and effective use of ownership structures.

Taxation and Financial Implications

Tax obligations and benefits across structures

The ownership structure selected profoundly impacts tax obligations:

- Individuals and Joint Owners pay tax on income at personal marginal rates, with capital gains tax (CGT) applying on asset disposals. Joint tenants are treated as owning equal shares for tax purposes.

- Trusts provide flexibility by distributing income to beneficiaries, potentially utilising lower marginal tax rates and income streaming, but require detailed tax reporting.

- Companies pay corporate tax rates, generally at 25-30%, with profits distributed as dividends subject to dividend imputation.

- SMSFs benefit from concessional tax rates—15% on earnings and gains—with specific compliance rules to maintain concessional status.

Capital gains and income tax treatment

- Individuals and Joint Tenants: Capital gains are calculated based on ownership shares. Joint tenancy’s right of survivorship means deceased owners’ interests pass outside the estate, potentially avoiding CGT triggers at death.

- Tenants in Common: Each owner can transfer or bequeath their share independently, triggering CGT events accordingly.

- Trusts: CGT is managed within the trust, with distributions affecting beneficiaries’ tax positions. Trusts may have access to CGT concessions, but income is taxed at beneficiary rates.

- SMSFs: CGT is generally taxed at 15%, with exemptions applying during pension phases. From 1 July 2025, unrealised gains on super balances above $3 million will be taxed, impacting SMSF strategies.

Stamp duty and transfer taxes

Stamp duty varies by state and ownership structure:

- Individuals generally pay stamp duty on property transfers at state-specific rates.

- SMSFs may access exemptions on transfers within the fund under certain conditions, but transfers to or from beneficiaries usually attract duty.

- Trusts face complex rules, especially in Victoria, where economic entitlement changes are scrutinised, and recent reforms tighten exemptions.

Estate Planning and Succession

Impact of ownership structures on asset transfer

Ownership structure determines the ease and legal process of passing assets to heirs:

- Individual Ownership requires probate, potentially delaying asset transfer.

- Joint Tenancy bypasses probate via right of survivorship, allowing automatic transfer to surviving owners but limiting testamentary control.

- Tenants in Common enable each owner to will their share, providing greater flexibility.

- Trusts facilitate probate avoidance and controlled succession via trust deeds, offering asset protection and tax planning benefits.

Joint tenancy vs tenants in Common: Succession Rights

Recent case law (e.g., Whitty v Talia [2023]) clarifies severance of joint tenancy through conduct, allowing transition to tenants in common, which may be preferable for blended families or complex estates. Legislative reforms affect transfer costs and succession planning, highlighting the need to align ownership type with estate objectives.

Trusts for long-term estate succession

Best practice for trusts includes:

- Drafting clear, comprehensive trust deeds.

- Regularly reviewing trust terms and governance.

- Ensuring compliance with fiduciary duties.

- Using trusts to protect assets and provide structured wealth transfer.

Self-Managed Super Funds (SMSFs) and Trustee Considerations

Trustee structures: Corporate vs Individual

- Corporate Trustees offer limited liability, simplified administration (only one entity to update), and enhanced asset protection.

- Individual Trustees bear personal liability and require all members to be trustees, complicating changes in fund membership.

- Both structures must meet strict compliance standards; failure risks disqualification and penalties.

Recent Legislative Changes and Compliance Requirements

- Changes in trustee declaration requirements, increased ATO auditing, and ASIC focus on SMSF advice demand rigorous compliance.

- From 2024–25, trusts and SMSFs face updated tax reporting rules, requiring careful documentation and governance.

Asset Protection Strategies within SMSFs and Trusts

- Corporate trustees and testamentary trusts enhance protection against creditor claims and bankruptcy.

- Recent family law and insolvency reforms strengthen asset shielding, but require careful planning.

Operational and Investment Considerations

Management, Decision-Making, and Dispute Resolution

- Individual Ownership offers simplicity but concentrates decision-making and risk.

- Joint Tenancy requires consensus; disputes may arise without formal agreements.

- Companies and Trusts provide formal governance structures, facilitating clear decision-making and dispute resolution mechanisms.

Flexibility in adding or removing investors

Companies generally offer the greatest flexibility for investor changes, suitable for dynamic investment groups.

Financing and lender perspectives

- Individuals and Joint Tenants may find financing straightforward but bear full personal liability.

- Companies and Trusts offer asset protection but lenders often require more documentation and impose stricter criteria, sometimes with higher interest rates.

- SMSFs face tighter lending conditions due to regulatory compliance and limited borrowing options.

Summary

Aligning ownership structure with personal and investment goals

Choosing the best ownership structure requires balancing:

- Legal Considerations: Fiduciary duties, governance, and succession.

- Tax Efficiency: Income tax, CGT, and stamp duty implications.

- Estate Planning: Ease of asset transfer and probate avoidance.

- Asset Protection: Shielding from creditors and family law claims.

- Operational Needs: Management control, flexibility, and financing.

For individuals seeking simple control and direct ownership, individual or tenants in common structures may suffice. Joint tenancy suits those prioritising survivorship rights but limits estate planning flexibility. Companies and trusts provide enhanced asset protection, tax planning advantages, and operational flexibility, ideal for complex or multi-investor scenarios. SMSFs serve retirement-focused investments but require strict compliance and limit investor changes.

Importance of professional advice

Given the complexity and evolving landscape of Australian property and business ownership law, tax, and compliance, it is essential to consult legal, financial, and tax professionals. Expert advice ensures structures align with personal circumstances, legislative changes, and investment goals, maximising benefits and minimising risks.