Key Takeaways

- Income isn't everything: Unused credit cards and HECS debt reduce your borrowing power significantly.

- The "Buffer" Rule: Banks test if you can afford your mortgage at interest rates +3% higher than today's rate.

- Credit Score: A low score doesn't just mean "no"; it often means you can borrow less.

- 2026 Update: Lenders are tightening rules on high debt-to-income ratios (DTI > 6).

What is Borrowing Capacity & Why It Matters

Borrowing capacity is the maximum amount a lender will approve for your home loan based on your income, expenses, credit score, and financial commitments. In Australia, most lenders use a serviceability buffer of 3% above current rates to ensure you can afford repayments if interest rates rise.

In Australia’s competitive housing market, knowing your borrowing capacity is essential since it affects:

- How much can you borrow?

- The properties you can realistically consider

- Your chances of loan approval

- Your general financial health

Lenders use borrowing capacity to make sure you can repay your loan and avoid financial trouble. Knowing your limit before you apply can save time, lower your chances of rejection, and help you make better property choices. Want to skip the theory and see your numbers? Use our Free Borrowing Capacity Calculator to get an estimate in minutes.

Main Factors Influencing Borrowing Capacity

Several main factors decide how much you can borrow in Australia’s home loan market:

- Credit quality and Income Factors: Credit scores, employment stability, income verification, and inclusion of non-traditional incomes.

- Lending Policies and Regulatory Environment: Debt-to-income ratios, serviceability buffers, contingent liabilities, and prudential regulations by APRA and ASIC.

- Collateral Valuation and Local Factors: Property valuations, loan-to-value ratios, and regional economic and climate risks.

- Borrower Behaviour and Financial Strength: Cash flow management, emergency funds, risk tolerance, financial literacy, and behavioural biases.

This article analyses each of these items, providing practical insights customised to the current Australian home loan context.

Credit Score & Income Factors Affecting Borrowing Capacity

Impact of credit score on borrowing capacity

Credit scores play a big role in how lenders judge risk. A high score shows you’re responsible with money, so you can borrow more and get better interest rates. A low score makes borrowing harder because lenders see you as a bigger risk.

Recent data from the Reserve Bank of Australia (RBA) shows that credit quality has dropped in recent years. Because of this, lenders are tightening their standards, especially for people with weaker credit. More late payments on home loans also make lenders cautious, which can make it harder to get a loan even if you have good credit.

To borrow more, it’s important to keep your credit score high or improve it. Mortgage brokers should remind clients to check their credit reports regularly, resolve any late payments, and avoid actions that could harm their credit.

Employment stability and income verification

Lenders care a lot about steady jobs and clear proof of income. Having a permanent or long-term job makes it easier to borrow because your income is more reliable. If you have a casual or contract job with changing pay, it can be harder to borrow as much.

Since 2019, lenders in Australia have become stricter about checking income. If you can show steady pay slips or tax returns, you look less risky to them. People earning under AUD 93,000 together often find it harder to save or modify their budgets, which makes them more vulnerable.

Mortgage brokers should help clients gather all their income documents and, if possible, look for jobs that offer steady pay before applying for a loan.

Using Gig Economy, Overtime & Rental Income

Non-traditional income sources, such as gig-economy earnings, rental income, investment dividends, and government payments, are increasingly considered by lenders. However, these require stringent documentation:

- Rental Income: Verified through rental statements or bank deposits.

- Gig Economy Income: Supported by tax returns, bank statements, and contracts.

- Investment Income: Documented via dividend statements or interest receipts.

- Government Payments: Verified by official letters or payment summaries.

Lenders use additional safety margins, called serviceability buffers, when evaluating these incomes. They check if you could still repay your loan if interest rates went up by 3%.

Mortgage brokers should help clients collect strong proof of these income sources to boost their borrowing capacity.

Meeting minimum credit and income thresholds

Most banks need you to have a certain credit score and enough income documents to get a loan. The exact numbers can vary by lender and loan, but if you don’t meet the minimums, you might get less money or be turned down.

Mortgage brokers help match borrowers with lenders whose guidelines align with their credit and income, so clients have a better chance of getting the loan they want.

Australian Lending Rules, APRA Guidelines & Borrowing Limits

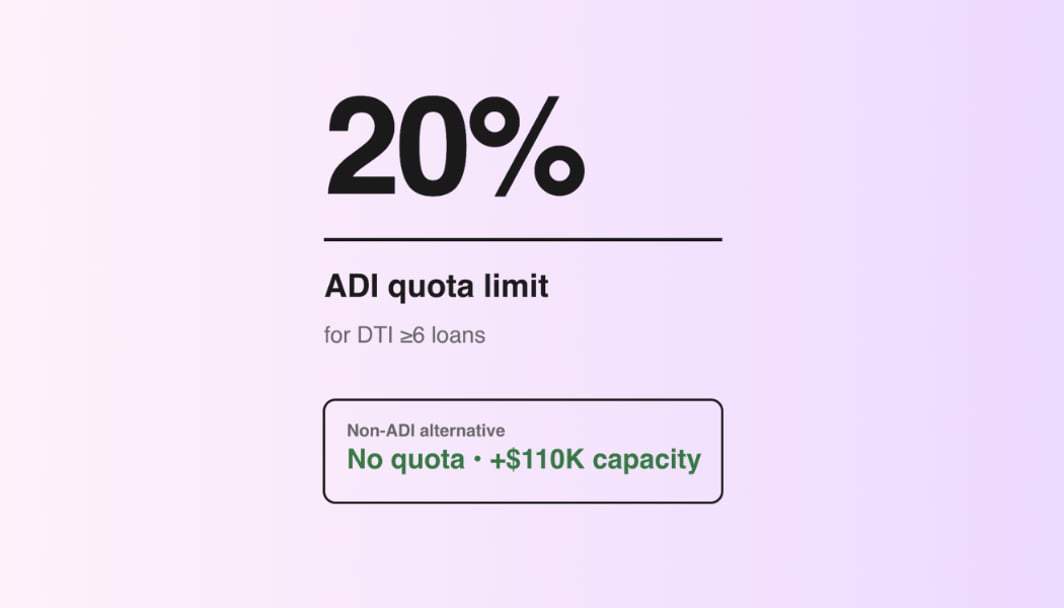

Debt-to-Income ratios and serviceability buffers

Lenders use debt-to-income (DTI) ratios and serviceability buffers to check if you can repay your loan. APRA rules say banks should make sure you could still pay your loan if interest rates were 3% higher than your loan rate. This helps protect you from future rate increases.

Some non-bank lenders have made their rules a bit more lenient to attract more customers, but banks still maintain strict safety margins. If you have a high loan-to-value ratio (over 80%) or a high loan-to-income ratio (over 4), or if your income is low, you’ll find it harder to borrow as much because you’re seen as more at risk.

Mortgage brokers should remind clients to keep their debt at a manageable level and help them figure out realistic borrowing limits based on what they can afford.

On Thursday, 27 November 2025, APRA announced a limit on "High Debt-to-Income" (DTI) lending. You can read more details about it here.

How Credit Cards & Debts Lower Your Borrowing Power?

Things like credit card limits and personal guarantees count as possible future debts and can lower how much you can borrow. APRA and ASIC rules say lenders must check these carefully, often using set formulas to guess how much you might end up owing.

For example, even if you haven’t used your credit card, the limit still counts against you because you could use it later, which would mean more to repay.

Borrowers should be honest about all possible future debts and talk with their broker to see how these might affect how much they can borrow.

Regulatory guidelines on income verification and lending practices

ASIC and APRA frequently revise their rules to ensure lending remains safe, including careful checks of income, especially for non-traditional sources. They want lenders to use reliable electronic documents and test if borrowers can handle tough economic times.

Mortgage brokers should stay up to date on rule changes to remain compliant and provide clients with accurate advice.

Effects of economic cycles, along with regulatory updates, on lending standards

When the economy slows or unemployment rises, economic signals such as GDP prompt lenders to become more cautious. The RBA expects slower growth and more job losses, so lenders are setting decreased borrowing limits and being more careful about who they lend to. It also tightened credit reviews to safeguard financial well-being, resulting in more cautious loan approvals and stricter collateral requirements.

Borrowers and brokers should keep these big-picture economic movements in mind when planning to apply for a loan or buy property.

Property Valuations, LVR & Regional Borrowing Factors

Impact of property valuations on maximum loan amounts

Property values help decide the biggest loan you can get, using something called the loan-to-value ratio (LVR). If a property is worth more, you can usually borrow more. If values drop or are unstable, lenders will let you borrow less to avoid the risk of owing more than the property is worth.

Studies show that even if house prices drop by 30%, lenders still stick to strict LVR rules. In a worst-case scenario, about 9% of loans could end up with negative equity.

Mortgage brokers should ensure clients understand how property values affect their loans and encourage them to borrow conservatively, based on realistic price expectations.

Regional valuation adjustments and climate risks

Lenders adjust how they value properties across regions based on local price trends and risks such as climate change. Homes in areas with floods, bushfires, or other climate risks are seen as riskier, so lenders may lower their valuations or even limit lending in those places.

If you’re looking to buy in these riskier regions, expect stricter borrowing limits and talk to an expert about the risks to your property.

Borrower Behaviour, Fiscal Endurance, and Risk Management

Effects of loan repayments on cash flow and savings goals

Paying back your loan, especially if interest rates go up, affects how much money you have left each month and how much you can save. People with variable-rate loans and high debts feel this the most, but financial stress is expected to improve by mid-2026, as repayment burdens and limits on savings demand thorough budgeting and repayment planning.

Mortgage brokers should help clients develop cash flow models and recommend repayment strategies, such as increasing repayment frequency, to reduce long-term interest costs and economic stress.

Emergency fund benchmarks for high-leverage borrowers

As household debt rises, people with high debt ought to maintain an emergency fund that covers 6 to 12 months of basic expenses. This helps protect against sudden changes in interest rates or income.

Financial planners now suggest saving more than the usual 3-6 months’ expenses to be safer.

Mortgage brokers should promote emergency fund planning as an integral part of sustainable borrowing.

Borrower risk tolerance and its influence on borrowing decisions

Borrower risk tolerance shapes borrowing decisions by influencing loan size preferences and product choices. Higher risk tolerance may lead to borrowing more or opting for variable-rate loans, while lower risk tolerance favours conservative borrowing and fixed-rate loans.

When brokers understand a client’s risk comfort, they can suggest loans that fit their needs and help them stay financially stable in the long run.

Financial literacy, optimism bias, and borrowing Behaviour

Knowing about finances helps people gauge how much they can borrow, but excessive optimism can lead them to borrow too much. Lately, more people are borrowing as much as they’re allowed, which raises the risk of default, especially for those with lower incomes and little savings.

Mortgage brokers should include financial education and honest talks about risks when meeting with clients to help prevent over-optimism.

Effectiveness of financial literacy initiatives

Programs like Saver Plus have helped low-income borrowers make better borrowing choices, even though there aren’t many full studies yet. Teaching people about optimism bias can help them borrow more safely and build financial strength. Brokers and policymakers need to support and include custom education programs as part of the lending process.

Personalised risk messaging techniques

Personalised risk messages that consider clients’ thinking and stress can help them better judge how much to borrow and lower their mortgage stress. Clear, bespoke counsel makes it easier to understand and leads to smarter borrowing choices.

Mortgage brokers should create ways to talk with clients that directly address over-optimism and clearly explain the risks involved.

How to Increase Your Borrowing Capacity in 2026

- Pay down existing debts and close unused credit accounts.

- Improve your credit score with timely bill payments.

- Provide complete and accurate income documentation.

- Consider joint applications if financially viable.

- Choose properties that correspond with strong valuation potential.

Summary

How much you can borrow depends on your income consistency, credit score, lending rules, property values, and your own money habits. If you work on these before you apply, you can borrow more and get better loan terms.

If you want to know exactly how much you can borrow, use our Free Home Loan Borrowing Power Calculator or talk to a lending expert today.

Frequently Asked Questions

Borrowing capacity is the maximum amount a lender will allow you to borrow for a home loan. It determines which properties you can realistically afford, increases your loan approval chances, and helps ensure you preserve financial health. Use our Free Borrowing Capacity Calculator to get an instant estimate.