The RBA hits pause again

The RBA board decided to leave the cash rate unchanged at 3.60%, matching what markets and economists expected. The decision to hold rates steady comes after last week’s unexpected data showing inflation rose much more than the RBA had forecast for the September quarter.

The Board added that:

Financial conditions have eased since the beginning of the year, but it will take some time to see the full effects of earlier cash rate reductions.

What does this mean for homeowners?

For many borrowers, today’s news may feel like a relief since repayments won’t change right now. But there’s a bigger message to consider:

Even if the RBA holds steady, your home loan doesn’t have to stay the same.

Here’s why:

- Lenders don’t always adjust rates as quickly as the RBA does, whether rates change or not.

- Your current loan might not be competitive anymore, even if the main rates stay the same.

- As economists at the big four banks noted, a cut in November is now “all but certain” to be off the table.

For more details on the RBA’s key indicators and our insights, visit our RBA cash rate page.

Don’t wait. Give yourself a rate cut!

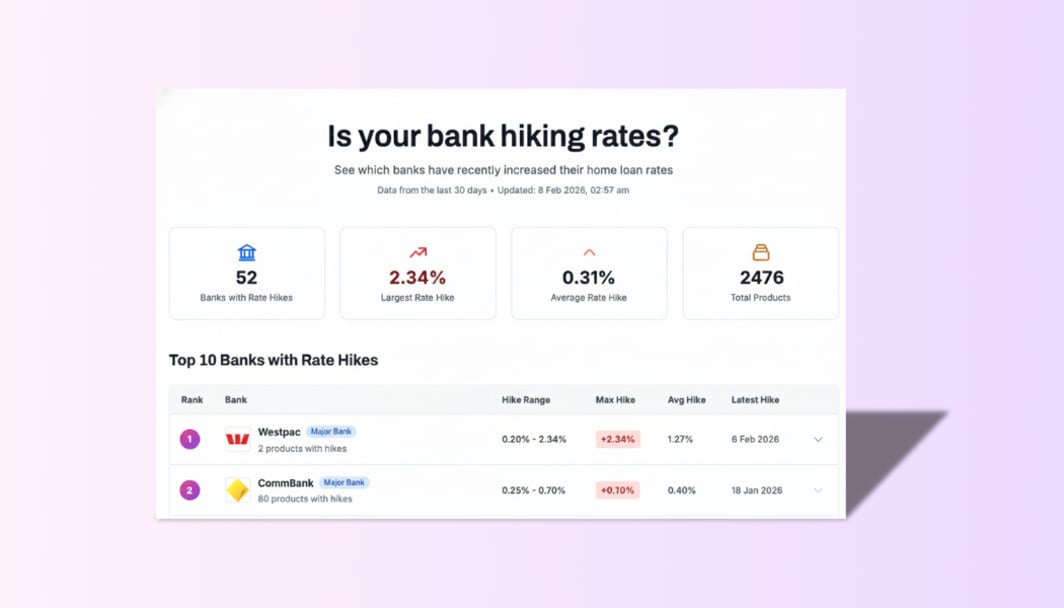

If you wait for the RBA to cut rates before reviewing your loan, you could miss out on valuable opportunities:

- Lenders are still competing. Many now offer better variable and refinance rates to attract new customers.

- Even small rate differences matter. A 0.25% difference can save you thousands over your loan’s lifetime.

- You lose time. Each month you wait, you might miss opportunities to move to a better home loan deal and reduce your financial stress.

In short, the RBA may be on pause, but your savings don’t have to be.

Several lenders have cut their variable rates in the past month, but many offer these reduced rates only to new customers. The ‘loyalty tax’ is real—and it could be quietly eating into your budget if you’re not keeping an eye on your mortgage.

Let Bheja do the heavy lifting

At Bheja, we believe staying informed should be easy.

Our Home Loan Health Check helps you:

- Review your current loan structure, including the interest rate and repayment terms.

- Compare against what’s available in the market right now.

- Understand the impact of staying put vs refinancing.

- Plan for what’s next so you can act, not just react, when policies change.

Don’t wait for the next rate decision; get clarity now.

The Bigger Picture

The RBA’s decision to hold shows cautious optimism. Inflation is improving, but there’s still work to do. According to Mr. Pravin Mahajan, founder of Bheja.ai,

The message for homeowners is clear: Don’t wait for the RBA to decide your next move, take control of your home loan now.

Whether you’re refinancing, buying, or just curious about your rate, taking action now can help protect your repayments in the future.

Financial stability starts with awareness, and that means asking the right questions:

- Is my current rate still competitive?

- Could I do better if I acted now rather than later?

- What is the cost of staying put vs the cost of moving?

Bheja was created to help you answer those questions simply and with confidence.

Start today, your home loan future depends on it.