What Is the Consumer Data Right?

The Consumer Data Right (CDR) is an Australian law that puts you in charge of your personal and financial data. It lets you safely access and share your information with trusted, accredited companies. This means you can take advantage of open banking, compare products more easily, and get financial services that fit your needs. The CDR is overseen by the ACCC, the OAIC, and other government agencies focused on protecting your data and encouraging digital innovation.

Learn more about your rights: Visit cdr.gov.au for official information and updates.

Open banking and the Consumer Data Right (CDR) are related but not the same thing.

CDR is the broader Australian law that gives consumers the right to access and share their data with accredited third parties in a secure way. It applies to multiple sectors — banking, energy, telecommunications and more in the future.

Open banking is just the banking sector’s application of the CDR. It lets customers securely share their banking data — like account details, transactions and product information — with other providers to compare products, switch banks or use budgeting tools.

Example: If you use a money management app to track spending across multiple bank accounts, open banking under the CDR allows the app (if it’s accredited) to access your transaction data directly from your bank, with your permission. This means you don’t have to give the app your bank login details — the sharing is secure and regulated under CDR rules.

Open banking and the Consumer Data Right (CDR) are related but distinct concepts. For official information, updates, and a full list of accredited CDR providers, refer to the table above for direct links to government resources.

CDR is the broader Australian law that gives consumers the right to access and share their data with accredited third parties in a secure way. It will apply to multiple sectors, including banking, energy, telecommunications, and others, in the future.

Open banking is how the banking sector uses the CDR. It lets you securely share your banking data, like account details, transactions, and product information, with other providers. This makes it easier to compare products, switch banks, or use budgeting tools.

For example, if you use a money management app to track spending across different bank accounts, open banking under the CDR lets the app (if it’s accredited) access your transaction data directly from your bank, with your permission. You don’t need to give the app your bank login details. The sharing is secure and follows CDR rules.

What types of banking data are impacted by the CDR?

In banking, the Consumer Data Right (CDR) involves two main types of data. These work together to give you more control over your finances. Knowing the difference between them helps you make the most of your rights.

What is Personal Transaction Data?

What is Transaction Data?

This is your personal banking history, including every transaction, balance, and account detail associated with you. It's like a financial diary that you control.

Your transaction data covers everything from your morning coffee to your mortgage payments. It’s a full record of how money moves in and out of your accounts, giving you a clear view of your financial life.

What are the pros and cons of sharing your transaction data?

How transaction data transforms your banking experience

Before CDR, accessing your own data was surprisingly difficult. You'd have to manually download statements, often in PDF format, and either enter data manually into budgeting apps or share your login credentials with third parties – a risky practice that violated most banks' terms of service.

With CDR, you can securely authorise apps and services to access your transaction data directly from your bank through official, regulated channels. This means budgeting apps like Pocketbook can automatically categorise spending, financial advisors can see your complete picture across multiple banks, and loan applications can be processed faster with automatic income verification.

Real-World applications that matter

Smart Budgeting: Imagine your phone alerting you that you're about to exceed your dining out budget before you even order dessert. CDR-enabled apps can track your spending in real-time and provide intelligent insights about your financial habits.

Seamless Account Switching: When you find a better bank account, CDR can streamline the switching process by automatically identifying your regular payments and helping transfer them to your new account.

Instant Loan Approvals: Instead of gathering months of bank statements for a personal loan, you can authorise the lender to verify your income and expenses directly from your bank, potentially getting approved in minutes rather than days.

What is Product Reference Data (PRD)?

What is Product Reference Data?

Product Reference Data is different from your personal transaction data. Transaction data is about you, but PRD is about the products. It’s public information on every financial product in Australia, shown in a standard format.

Think of PRD as a live, up-to-date catalog for every bank account, credit card, loan, and investment product in Australia. Every bank has to describe its products using the same categories and terms.

Reference Data: a game-changer?

For years, comparing financial products was like comparing cars when each company used different terms. One might list fuel efficiency, another kilometers per liter, and another running costs. PRD addresses this by requiring all banks to use the same categories and formats.

Pros and Cons of the PRD System

How broad is PRD coverage?

PRD covers virtually every financial product available to Australian consumers. This includes traditional products such as savings accounts and home loans, as well as specialized offerings like foreign currency accounts, business credit facilities, and investment products.

How do these CDR data types work together?

You get the most value when your personal transaction data is combined with detailed Product Reference Data. Together, they make new types of financial services possible.

How does CDR enable personalised product matching?

Take Maria, a recent graduate who earns money from freelance work. Usual comparison tools might suggest high-interest savings accounts, but a CDR-enabled app sees that she often goes below the minimum balance. It then suggests a fee-free account with no minimum balance, saving her money on penalty fees.

How does CDR help with intelligent financial planning?

David runs a small café and struggles with seasonal cash flow. By analysing his transaction data alongside PRD information about business loan products, a CDR-enabled service can predict when he'll need additional funding and pre-approve him for a line of credit at competitive rates, available exactly when he needs it.

Market-wide optimisation

Sarah switches jobs and her salary increases by $20,000. Her CDR-enabled banking app automatically identifies that she now qualifies for premium account packages with better interest rates and fewer fees. It can even calculate exactly how much she'll save by switching, taking into account her specific usage patterns.

What is the current state of CDR: progress and challenges?

What is working well with CDR?

Australia’s Consumer Data Right (CDR) has reached important milestones that help everyday consumers. More than 150 accredited CDR providers, including major banks, fintech startups, and energy companies, are part of the system. Millions of open banking data requests are processed each month, showing that more people are using and trusting secure data sharing under Australian law. See the table above for links to the latest government updates.

The rules around CDR are strong, and the government is serious about making sure they are followed. Recent ACCC reviews have found areas to improve, but they also show that consumers are already getting better deals and services.

What are the current challenges for CDR?

Recent ACCC compliance reviews have uncovered some significant challenges that affect the quality of services you can access:

Data Quality Issues: Some banks haven't maintained accurate or current Product Reference Data. This means comparison tools sometimes display outdated interest rates or incorrect fee information, potentially misleading consumers making important financial decisions.

Implementation Gaps: Particularly among larger financial institutions, legacy banking systems struggle to keep pace with the requirements of CDR. This can result in delays when product information changes or temporary service disruptions.

Inconsistent Compliance: Not all banks adhere to the same standards, creating an uneven playing field that can disadvantage consumers and legitimate businesses seeking to establish reliable services.

How is the government responding to and enforcing CDR?

The government is not just pointing out these problems. They are taking real action. In April 2024, HSBC Bank Australia was fined $33,000 for giving out inaccurate data. This shows that regulators have the tools and the will to enforce the rules.

The ACCC has also published public compliance reports that name institutions failing to meet standards, creating reputational pressure for improvement. This transparent approach enables consumers to make informed decisions about which banks are genuinely committed to the CDR vision.

How can you start using your CDR rights today?

What are your first steps into using CDR?

You don’t need to be a tech expert to get started with the Consumer Data Right (CDR) in Australia, but it helps to have a plan. Check the table above for the official government list of accredited CDR providers. Look for CDR-enabled apps, open banking tools, or services that fit your needs, like better budgeting, finding a new bank account, or planning a big purchase.

To help you get started, here are a few simple steps:

1. Choose a budgeting app that requires read access to your transaction data.

2. Verify the app's accreditation to make sure it meets security and privacy standards.

3. Try viewing a summary of your spending to get a feel for how managing your finances under CDR could work for you.

Start Small: Consider beginning with a budgeting app that only needs read access to your transaction data. This lets you experience the benefits of CDR without feeling overwhelmed by too many new tools at once.

Choose Wisely: Only use CDR-accredited providers. These companies have undergone rigorous security and privacy audits, giving you confidence that your data will be handled responsibly.

Stay In Control: Remember that you can revoke access to your data at any time. Most CDR-enabled apps make this easy through their settings. Look for a "Revoke" or "Disconnect" button under Data Sharing or Privacy Settings within the app. Alternatively, you can call your bank’s customer service for assistance. This reassurance helps you maintain control over your personal data.

What are some recommended starting points with CDR?

What are your rights and protections under CDR?

What are your entitlements under CDR?

The CDR provides you with specific, enforceable rights that exceed what banks traditionally offer. You have the right to access your complete banking data in a usable digital format, to share it with accredited providers for specific purposes, and to revoke that access whenever you choose.

These rights are not just theoretical. There are real penalties for institutions that do not follow the rules. The government has invested over $88 million in building and enforcing this system, demonstrating its commitment to making these rights a reality and accessible to everyone.

What should you do if things go wrong with CDR?

What does the future hold for CDR in Australia?

How will CDR expand beyond banking?

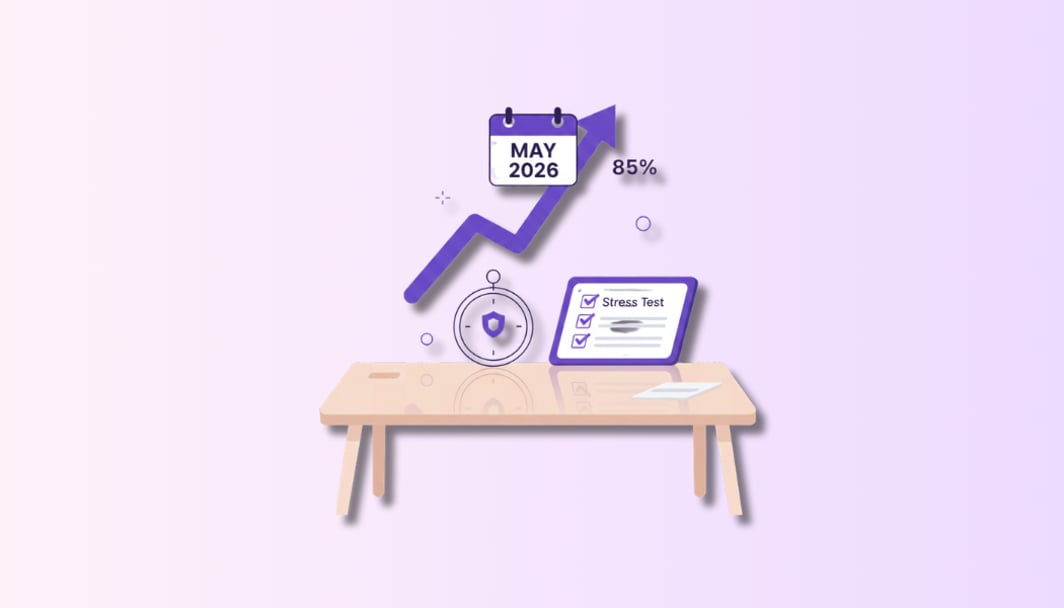

The success of CDR in banking is paving the way for expansion into other essential services. Energy sector integration is expected in 2025, meaning you'll soon be able to compare electricity and gas plans with the same ease and transparency you can now compare bank accounts.

Telecommunications will follow, potentially revolutionising how we choose phone and internet plans. Future sectors under consideration include insurance and superannuation – imagine being able to compare insurance policies or super funds with complete transparency about fees, performance, and features.

What innovation opportunities does CDR create?

The combination of personal transaction data and comprehensive product reference data is enabling entirely new categories of financial services. We're seeing the emergence of AI-powered financial advisors that can provide personalised recommendations based on your actual spending patterns, not generic assumptions.

Small businesses are benefiting from cash flow analysis tools that can predict funding needs and automatically connect them with appropriate lenders. Even traditional banks are utilizing CDR capabilities internally to gain a deeper understanding of customer needs and develop more targeted products.

How can you make CDR work for you?

What are your options with CDR?

To get the most out of CDR, make the most of your new options. Your banking data is no longer locked away. Now, it can work for you across different services and providers. You can get better financial advice or just understand your spending better. CDR tools can give you insights and opportunities that used to be available only to people with personal financial advisors.

How can you build your CDR strategy?

Begin by identifying your most significant financial frustrations. Are you paying too much in bank fees? Struggling to stick to a budget? Are you wondering if you could get a better mortgage rate? There are CDR-enabled solutions available to address all of these challenges.

The most successful CDR users typically begin with a specific goal, such as reducing banking fees or improving their budgeting, and gradually expand their use of CDR services as they become more comfortable with the system and see tangible benefits.

The main point is that you now have more choice, control, and convenience.

The Consumer Data Right changes how you interact with financial institutions. For the first time, you own and control your financial data and have the legal right to use it in ways that help you. That's when you're ready to make financial decisions: you have access to complete, accurate, and current information about every option available to you. Combined with your personal transaction data, this creates unprecedented opportunities to optimise your financial life.

The system is not perfect yet. Some banks are still working on improving their data quality, and new apps and services are continually emerging. Still, the foundation is strong, government oversight is solid, and consumers are already seeing the benefits.

Frequently Asked Questions (FAQ)

Only accredited third-party providers that you explicitly authorize can access your data. You are always in control and can revoke access at any time.