📊 Market Overview: What's Happening With Property Prices?

As of December 2024, the total value of Australia's residential dwellings reached $11.032 trillion, reflecting a modest increase of $26.4 billion (0.2%) from the previous quarter.

This growth occurred despite ongoing affordability constraints and high interest rates.

The number of residential dwellings rose to 11,294,300, up by 53,200 compared to the previous quarter, according to the ABS. However, the mean dwelling price saw a slight dip of $2,300, settling at $976,800.

🔝 Median Property Prices: A Historical Perspective

Over the past decade, Australian property prices have risen dramatically, especially in major capital cities.

Table 1: Current Median Dwelling Values (as of March 31, 2025)

Source: CoreLogic Hedonic Home Value Index – April 2025

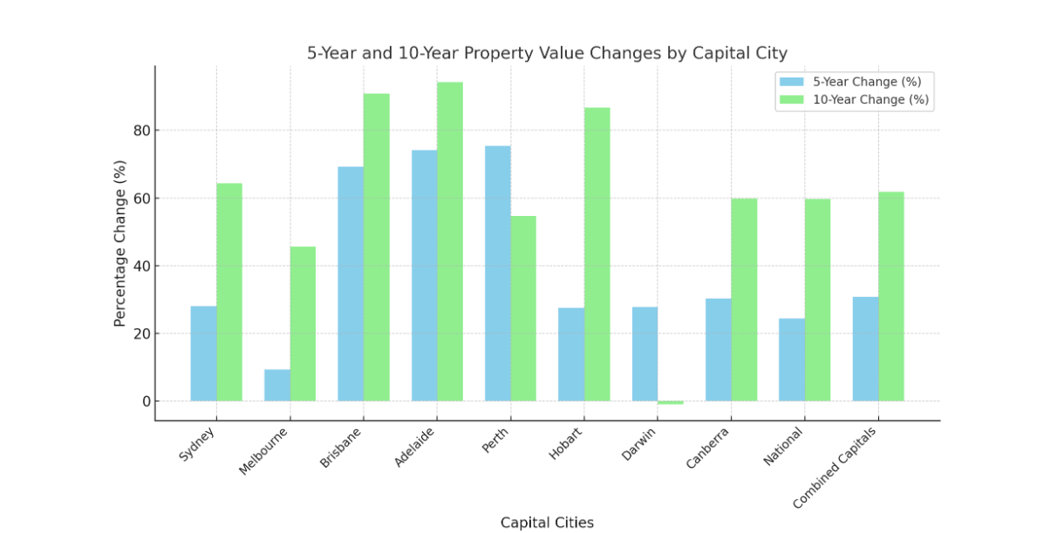

Table 2: 5-Year and 10-Year Growth from Peak

Source: CoreLogic Hedonic Home Value Index – April 2025

Market Trends and Insights

- Sydney: After a 1.4% decline from its September 2024 peak, Sydney's median dwelling value remains 28.0% higher than five years ago and 64.3% higher than ten years ago.

- Melbourne: Values are down 5.6% from the March 2022 peak. Over five and ten years, Melbourne has seen growth of 9.3% and 45.6%, respectively.

- Brisbane and Adelaide: Both cities are at their peak values as of March 2025, with Brisbane's median value increasing by 69.3% over five years and 90.8% over ten years. Adelaide has experienced similar growth, with 74.2% over five years and 94.3% over ten years.CoreLogic Australia

- Perth: Slightly below the October 2024 peak, Perth's values have risen by 75.4% over five years and 54.7% over ten years.

- Hobart: Values are 12.0% below the March 2022 peak but have increased by 27.6% over five years and 86.7% over ten years.

- Darwin: After a 4.1% decline from the May 2014 peak, Darwin's values have grown by 27.8% over five years and decreased by 1.0% over ten years.

- Canberra: Values are 6.8% below the May 2022 peak, with 30.3% growth over five years and 59.8% over ten years.

Here is a graph showing the 5-year and 10-year changes in property values across Australian capital cities.

The bars represent:

- Sky blue for the 5-year percentage changes.

- Light green for the 10-year percentage changes.

These trends indicate a strong long-term growth trajectory for most capital cities, with recent fluctuations influenced by economic factors and market cycles.

Housing Market Outlook

- KPMG forecasts national house prices to rise by 3.3% in 2025, a slowdown from the 5.1% growth seen in 2024. However, growth is expected to rebound to 6% in 2026 as the effects of lower interest rates flow through the market.

- Unit prices are projected to outpace houses, with a 4.6% rise in 2025 and 5.5% in 2026. This trend is driven by affordability constraints, especially in capital cities, which are pushing more buyers toward units as a more accessible entry point.

Regional Variations

- Perth is forecast to lead house price growth in 2025 with a 4% increase, while Darwin is expected to see the smallest rise at 1.2%. Sydney, Melbourne, and Canberra are projected to see moderate gains of 3.3–3.5%, and Brisbane is forecast at 3.1%.

- Unit price growth will also vary, with Sydney and Perth units expected to rise by 5% in 2025, while Darwin units are forecast to increase by 3.8%.

Key Market Drivers

- Supply shortages and population growth remain dominant forces. KPMG highlights a projected shortfall of 95,000 dwellings between 2023 and 2026, with population growth continuing to outpace new housing completions. This imbalance is expected to keep upward pressure on prices and maintain affordability challenges.

- Affordability constraints are shifting demand toward units. As detached houses become less attainable, more buyers are seeking units and townhouses, supporting stronger price growth in that segment.

- Construction industry bottlenecks persist. While building approvals have shown some recovery, labour shortages and high material costs continue to delay new supply, further exacerbating the supply-demand imbalance.

Impact of the Rate Cut

- The February 2025 rate cut is expected to provide some relief to borrowers and improve sentiment, but its impact on prices is likely to be gradual. KPMG notes that price growth is expected to be more pronounced in the second half of 2025 as the effects of lower rates are fully felt.

- Despite the rate cut, affordability remains a significant barrier for many, with mortgage stress and high entry costs limiting the ability of some buyers to participate in the market.

Tips for First Home Buyers Amid Rising Property Prices in 2025

1. Leverage Government Schemes and Incentives

- Take advantage of schemes like the First Home Guarantee or similar government-backed programs that reduce deposit requirements and lower upfront costs.

- Explore state-specific benefits such as stamp duty concessions or interest subsidies, which can improve affordability.

- Stay informed about new initiatives aimed at affordable housing, as these can provide financial relief or access to emerging micro-markets.

2. Focus on Emerging and Peripheral Locations

- Consider buying in newer micro-markets or peripheral suburbs of major cities where prices are rising moderately but remain more affordable than prime urban areas.

- Improved infrastructure projects and urban expansion are making these areas more attractive and likely to appreciate over time.

3. Get Mortgage Pre-Approval and Understand Your Budget

- Secure pre-approval to know your exact borrowing capacity, which strengthens your position when negotiating. You can ask Bheja to help calculate how much you may be able to borrow.

- Factor in not just the purchase price but also additional costs like stamp duty, legal fees, and moving expenses to avoid surprises.

4. Prioritise Property Types with Better Affordability

- With detached houses becoming less affordable, look at units, townhouses, or apartments, which are expected to see relatively stronger price growth but remain within reach.

- These options may also offer better rental yield potential if you consider investment aspects.

5. Act on Interest Rate Movements

- Monitor the RBA cash rate announcements carefully, as even modest reductions can improve loan eligibility and reduce monthly repayments.

- Lock in competitive mortgage rates early if possible, to avoid paying higher interest if rates rise again.

6. Be Realistic About Price Growth and Timing

- Experts forecast moderate single-digit price growth in 2025, slower than previous years but still positive, so expect prices to rise steadily rather than drop.

- Avoid waiting for significant price corrections, as affordability pressures and demand are likely to keep prices stable or rising in most markets.

7. Work with Trusted Professionals

- Consider engaging experienced real estate agents, mortgage brokers, and financial advisors who understand the current market dynamics and can guide you to the best deals and financing options.