Don't Settle for "Good Enough" - Find YOUR perfect bank in 60 seconds

Choosing the wrong bank for your home loan isn't just about paying a slightly higher rate. It's about losing tens of thousands of dollars over the life of your loan, dealing with inflexible policies when life changes, and missing opportunities that could accelerate your financial goals.

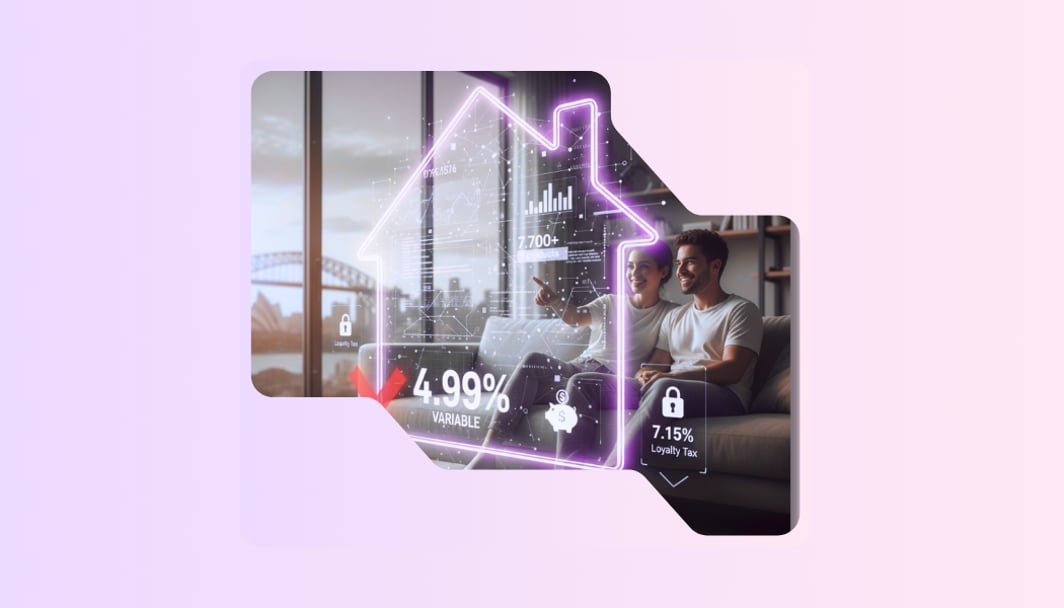

The good news? In 2026, you don't need to spend weeks researching or rely on outdated comparison sites. Our AI-powered tools analyse your specific situation against 7,000+ home loan products to find your perfect match - not just the "best" bank in general.

Why your bank choice matters more than ever in 2026?

The Australian home loan landscape has transformed dramatically. With the RBA maintaining higher cash rates through 2025 and into 2026, the difference between banks has never been more significant.

On a $600,000 loan:

- 0.10% rate difference = $7,800 over 5 years

- 0.30% rate difference = $23,400 over 5 years

- 0.50% rate difference = $39,000 over 5 years

But rates are just the beginning. The wrong bank can cost you through:

- Inflexible policies when refinancing or restructuring

- Poor rate reduction response when RBA cuts rates

- Limited offset account functionality

- Restrictive lending policies for investors or professionals

- Slow processing times (critical in competitive markets)

- Poor digital experience wasting your time

What is changing in 2026?

The home loan market has evolved significantly:

Rate Environment: Following RBA decisions through late 2025, banks are no longer moving in lockstep. Some pass on cuts within days, others take weeks. This creates unprecedented opportunity gaps.

Technology Integration: Leading banks now offer AI-powered loan management, but legacy systems at others mean you're stuck with 1990s technology.

Lending Criteria: Post-APRA changes, banks have diverged dramatically on how they assess borrowers - particularly professionals, migrants, and investors.

Competition Intensity: With over 100 lenders fighting for market share, loyalty is being punished. New customers get rates 0.3-0.8% better than existing ones at the same bank.

The Traditional approach is broken

Most Australians choose their home loan bank by:

- Going to their existing bank

- Asking friends/family

- Doing their own research

Here's the problem: None of these methods optimise for YOUR specific situation in real-time.

Your existing bank wants to keep you, not give you their best rate. Your friends' needs differ from yours. Brokers have commission biases (not always aligned with your best outcome). Manual research takes 40+ hours and data is outdated by the time you finish.

The 2026 Solution: AI-powered analysis that considers your unique profile against every available option, updated in real-time.

The Big Four Banks: complete 2026 analysis

Let's break down Australia's major banks with brutal honesty about who they're really good for (and who should look elsewhere).

Big Four Comparison: At-A-Glance

When smaller lenders beat the Big Banks?

Here's the truth the Big Four don't want you to know: for many borrowers, smaller lenders offer superior value, features, and outcomes.

The Smaller Lender Advantage

- Rate Savings: Non-major banks average 0.20-0.45% lower rates than Big Four equivalents. On a $500,000 loan, that's $16,000-$36,000 over five years.

- Personalised Service: Smaller lenders compete on service. You're a valued customer, not account number 4,572,891.

- Innovative Features: Digital lenders like Athena, Homestar, and Unloan offer features the Big Four are years away from implementing.

- Transparent Pricing: No loyalty tax. Most smaller lenders offer the same great rates to new and existing customers.

- Faster Processing: Many digital lenders approve in hours (not days) and settle in under 10 days.

When to Consider Smaller Lenders

✅ You have straightforward employment (PAYG, stable income)

✅ Your property is standard (house/apartment in major city)

✅ You're rate-focused and don't need extensive branch services

✅ You're comfortable with digital-first banking

✅ You want honest, transparent pricing

When to Stick with Big Four

❌ Complex income (self-employed, contractors, business owners)

❌ Large portfolio requiring sophisticated serviceability

❌ Unusual property (rural, land, unusual construction)

❌ Need for branch services and face-to-face support

❌ Integrated banking (business accounts, international transfers)

Don't limit yourself to the Big Four. See ALL your options.

Find Your Borrower Profile

The "lowest rate" isn't always the right loan. A self-employed business owner needs a completely different strategy than a first home buyer. If you pick the wrong loan structure, you could face hidden fees or rejection, even with a great credit score.

Use the table below to identify your profile and the specific "hack" you should be asking your broker for.

The AI Advantage: Stop manually comparing

Let's be honest: comparing home loans manually in 2026 is like using a paper map when you have GPS. Sure, it works, but why would you?

Why Manual Comparison Fails

- Data Overload: There are 7,000+ home loan products in Australia right now. Comparison sites show you maybe 20-30. You're missing 99% of options.

- Outdated Information: By the time you finish research, rates have changed. Banks adjust pricing daily based on funding costs and competition.

- Generic Advice: Comparison sites rank loans for "average" borrowers. But you're not average - your income, property type, goals, and situation are unique.

- Hidden Criteria: You can't see lending policy differences. Two banks offering 5.99% might have vastly different approval likelihood for YOUR situation.

- Time Cost: Quality research takes 30-50 hours. At minimum wage, that's $900+ of your time. At professional rates? $3,000-$5,000 of opportunity cost.

- Cognitive Bias: You'll naturally gravitate toward familiar brands or recent ads, not optimal outcomes.

How AI Changes Everything

Our AI-powered tools solve every manual comparison problem:

- Complete Market Coverage: We analyze all 7,000+ products, not a curated subset. You see every option you're eligible for.

- Real-Time Data: Our systems update rates, policies, and features continuously. You always get current information.

- Personalised Matching: AI considers your specific income, employment type, property, goals, and preferences to rank options for YOUR situation.

- Approval Prediction: We predict your likelihood of approval with each lender based on their actual lending policies and your profile.

- 60-Second Analysis: What takes you weeks takes our AI 60 seconds. Same depth, 10,000x faster.

- Unbiased Results: No commissions, no featured listings, no hidden agendas. Just optimal matches for you.

The Three AI Tools You Need

1. Ask Bheja (Start Here)

Answer five questions about your situation, and AI instantly recommends your top 3 bank matches with personalised reasoning.

Use this when: You're starting your home loan journey and want to know which banks to focus on.

2. Home Loan Health Check (For Existing Loans)

Already have a home loan? Our AI analyses your current deal against all 7,000+ products to show exactly how much you're overpaying and your best refinance options.

Use this when: You've had your loan for 12+ months, or it's been 2+ years since you reviewed.

What you'll discover:

- Exact dollar amount you're overpaying annually

- Best 5 refinance options personalised to your situation

- Break-even analysis (is refinancing worth the effort?)

- One-click refinance start if you want to switch

3. AI Loan Monitoring (Set and Forget)

Connect your loan (read-only, bank-level security), and our AI monitors 24/7 for:

- Rate drops at your current bank or competitors

- Policy changes that affect you

- Refinance opportunities that save $5,000+

- When to refinance (timing optimisation)

Use this when: You want to ensure you always have the best deal without constant manual checking.

How it works:

- Connect your loan securely (2-minute setup)

- AI monitors your loan + entire market daily

- Get notifications only when action can save you $5,000+

- Decide whether to refinance (we show exact savings)

Why it matters: Banks raise rates for existing customers hoping you won't notice. AI notices for you.

Decision Matrix: Which tool to use when?

The new way to choose

The days of choosing your home loan bank based on where your parents banked, which branch is closest, or who has the catchiest ad campaign are over.

In 2026, you have access to:

- 7,000+ loan products (not just the 4 Big Four options)

- AI-powered analysis that considers your unique situation

- Real-time rate data updated daily

- Transparent comparison without commission bias

- Instant calculations for borrowing power, savings, and scenarios

The only question is: will you use these tools, or settle for "good enough"?

The difference between "good enough" and "optimised" is $20,000-$50,000+ over your loan term.

That's a new car. A renovation. Your kids' education fund. An early retirement contribution.

Don't leave it on the table.