The Data Drop That Changes Everything

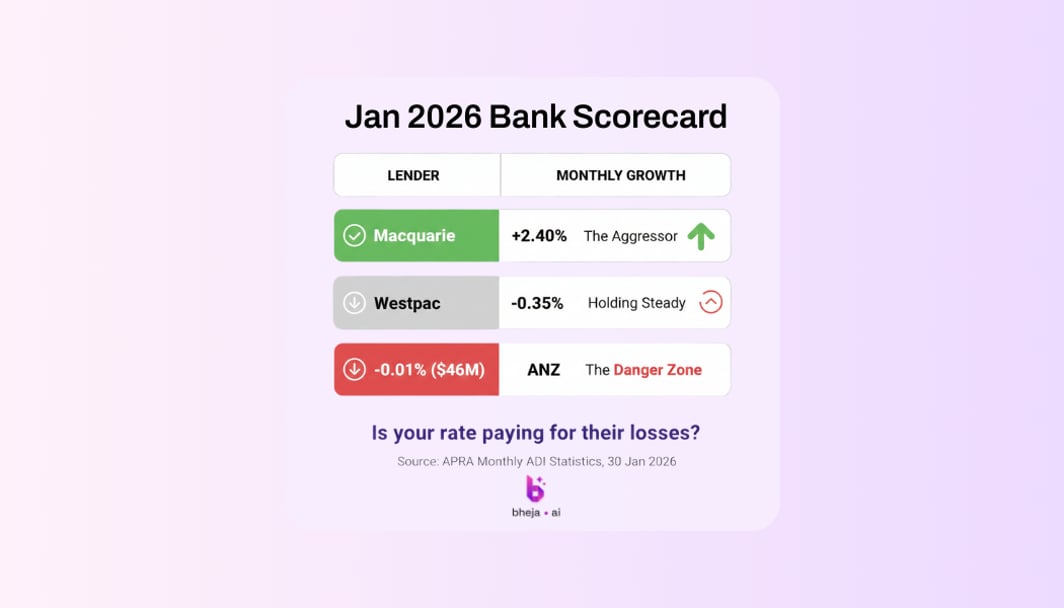

The APRA Monthly ADI Statistics (released January 30, 2026) reveal a seismic shift: while total Australian residential lending hit $2.43 trillion, the Big 4's dominance is cracking.

The standout signal? Macquarie grew by $1.8 billion this month alone—expanding at 4x the rate of the major banks. Meanwhile, ANZ's loan book contracted by $46 million.

This isn't random noise. High-net-worth borrowers are "voting with their feet," and the data proves it.

The Lender Scorecard: January 2026

What this means for you:

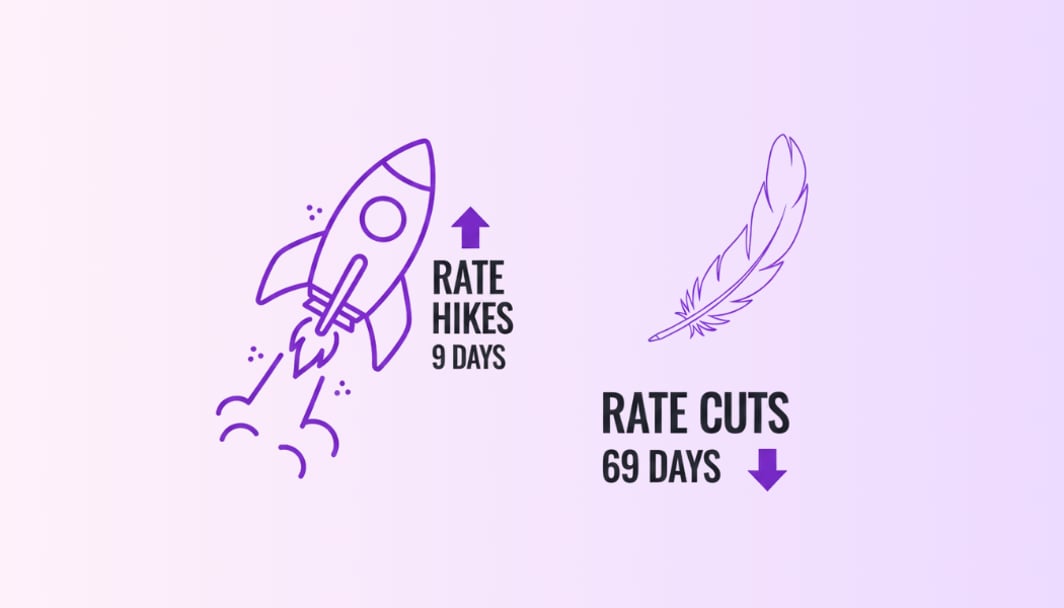

Banks with shrinking loan books often enter "Retention Mode". They have a budget to keep you, but only if you force their hand.

The Offset Account Paradox

For Australian families, the offset account feels like financial security. But it's also the chain that keeps you locked into suboptimal rates.

The Math That Banks Hope You Don't Do

Scenario: You have a $1.2M mortgage with $200k sitting in offset.

- Your current rate: 6.45% (typical ANZ back-book rate)

- Market-leading rate: 5.95% (current Macquarie offering)

- Rate gap: 0.50%

The cost of inertia: $5,000 per year

That offset account is giving you flexibility, but you're paying $5,000 annually for that "convenience."

The Retention Discount Reality

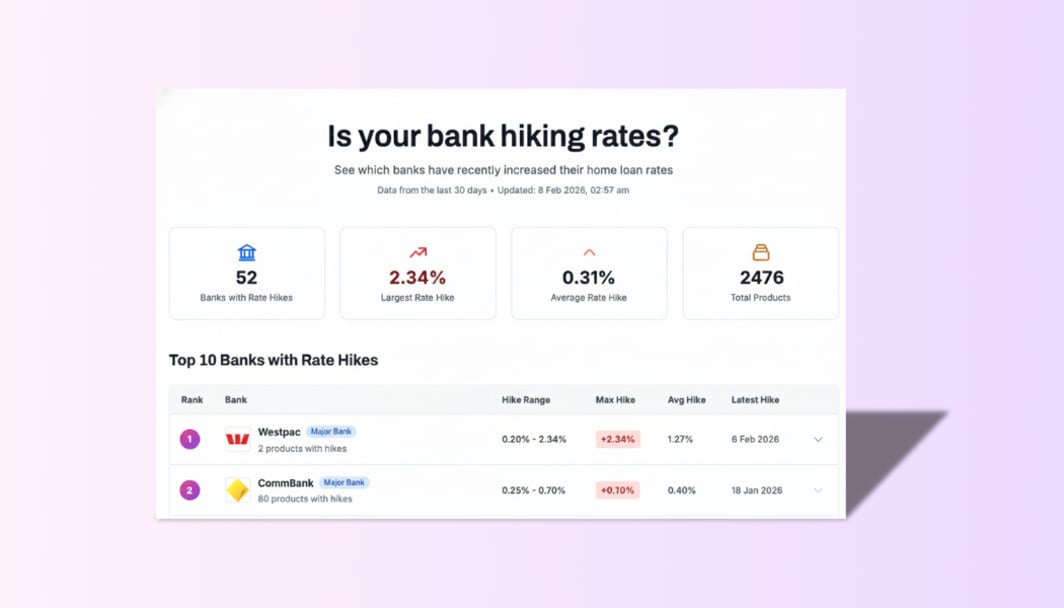

Banks routinely offer 0.20-0.40% retention discounts to customers who threaten to leave.

On a $1.2M loan, a 0.25% retention discount saves you $3,000/year—or $250 every single month.

The catch? You have to ask. And more importantly, you have to be ready to walk.

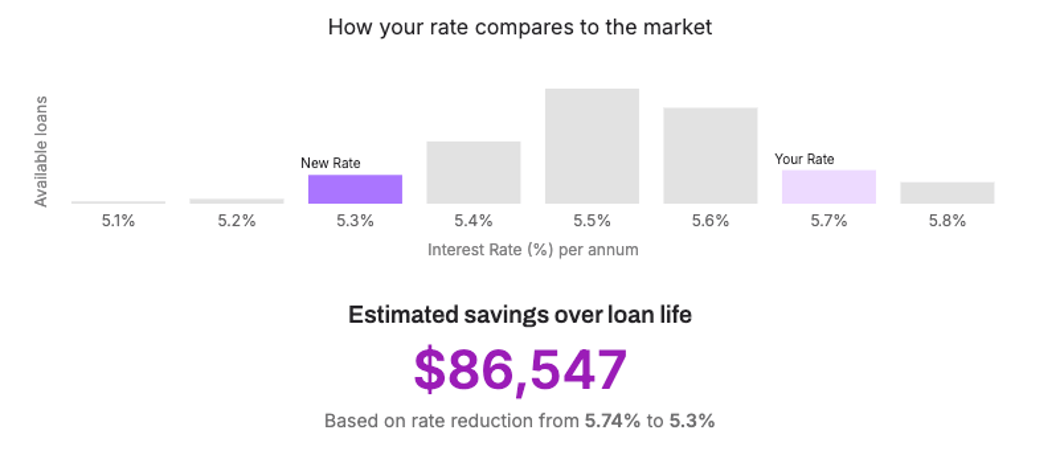

Real-World Proof: The $86,547 Case Study

Background:

- Current rate: 5.74% (with their existing lender)

- Market-leading rate: 5.3% (available today)

- Rate gap: 0.44%

- Loan scenario: Standard variable home loan

The Bheja.ai Health Check Result: When this borrower ran their loan through our system, the data was clear:

Estimated savings over loan life: $86,547

This isn't a hypothetical. This is actual money being left on the table by staying on a 5.74% rate when 5.3% is readily available in the market.

Breaking down the math:

- Rate reduction: 5.74% → 5.3% (0.44% improvement)

- Annual savings: ~$4,000-$5,000 (depending on loan size)

- Lifetime savings: $86,547 (compounding over full loan term)

The Action Required: This borrower now has three options:

- Call their current lender with this data and request a rate match to 5.3%

- Accept a retention discount (typically 5.5-5.6% if the lender won't fully match)

- Refinance to a 5.3% product and lock in the full $86,547 in lifetime savings

Time to complete this review: 5 minutes

Potential lifetime savings: $86,547

Return per minute invested: $17,309

They don't need to switch banks if they don't want to. They just need to show their current lender this data and ask for market parity.

The Best Interests Duty Advantage

Here's the legal asymmetry that's driving the APRA data shift:

What Banks Are Required To Do:

❌ Provide you with their best available rate

❌ Proactively notify you when better rates exist

❌ Prioritise your savings over their profit margins

Answer: None of the above. Banks have zero legal obligation to optimize your loan.

What BID-Compliant Brokers Must Do:

✅ Recommend the loan that saves you the most money

✅ Document why they chose that specific product

✅ Legally prioritise your interests over lender commissions

This is why informed borrowers are increasingly using brokers to force banks into competitive retention offers.

Your 3-Step Action Plan

Step 1: Benchmark Against the Growth Data

Check if your bank's loan book is shrinking (like ANZ this month). Shrinking banks are often in "Retention Mode"—they have budget allocated to keep high-value customers, but you need to trigger the process.

Action: Review the APRA data table above and note your lender's position.

Step 2: Run a Free Rate Health Check

Instead of navigating confusing bank websites and calling multiple lenders, get a simple market comparison.

What to compare:

- Your current interest rate

- Best new-customer rate from your current bank

- Best market rate from competitors (including Macquarie)

- Total switching costs (fees, time, complexity)

Time required: 5-10 minutes

Potential discovery: $2,000-$5,000/year in savings

The "Legal Loyalty" Guarantee

If your bank refuses to provide a market-competitive rate, don't stress.

Under the Best Interests Duty (BID), licensed brokers are legally required to help you move to a lender that prioritizes your savings over their profit margins.

The process:

- Pre-approval from a competitive lender (usually 48-72 hours)

- Present pre-approval to your current bank (triggers retention team)

- Accept best offer (retention rate or refinance)

- Lock in $3-5K/year in permanent savings

Bheja.ai specialises in this exact workflow. Our AI-powered BID review handles the comparison, pre-approval coordination, and negotiation leverage—so you don't have to become a mortgage expert to save thousands.

Why The APRA Data Matters to You Personally

The numbers tell a clear story:

Macquarie +$1.8B. ANZ -$46M.

This isn't just market movement. It's a referendum on how banks treat existing customers.

The borrowers moving to Macquarie aren't getting exotic products. They're getting the same mortgage with a 0.30-0.60% better rate.

That's $3,000-$6,000 per year on a $1M loan. Every year. Compounding.

The Inertia Tax

Most borrowers stay with their bank because:

- Switching seems complicated (it's not)

- They value their offset account (you can keep it or replicate it)

- They assume loyalty is rewarded (data proves it's penalised)

- They're busy (this is exactly what banks count on)

The result? You subsidise your bank's new customer acquisition with your "loyalty tax."

The Bottom Line

If you haven't reviewed your mortgage in the last 12 months, you're statistically likely to be overpaying.

Not because you made a bad decision when you first took the loan—but because the market has moved and your bank hasn't called you.

The APRA data is your leverage.

Banks with shrinking loan books (like ANZ) are vulnerable. They need to retain high-quality borrowers. They have budget allocated for retention discounts.

But they won't offer it unless you ask.

And they won't negotiate seriously unless you're ready to walk.