We need to talk about what just happened this week.

On February 3, the Reserve Bank raised interest rates by 0.25%. Within 36 hours, the Big Four banks announced they'd be passing on the full increase to us mortgage holders. The kicker? Most of these hikes take effect on February 12/13 just 9-10 days after the RBA's decision.

Sound fast? It is. And that's exactly the problem.

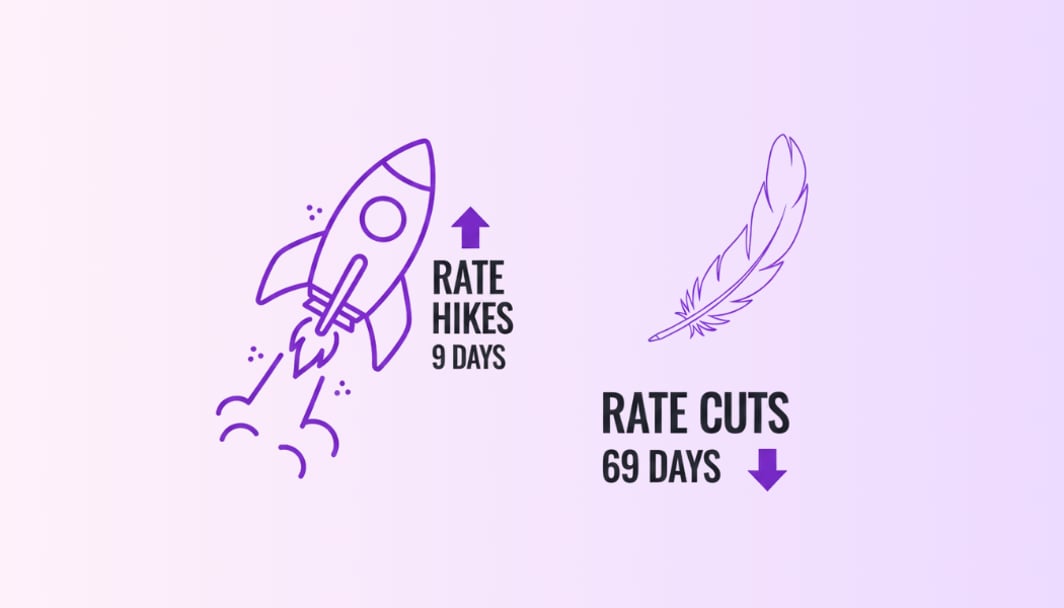

The asymmetry we're all living with

Here's what makes this infuriating: when the RBA cut rates by 0.25% back in May 2025, those same banks took an average of 68 days to pass the benefit through to our actual mortgage repayments.

Let's be clear about what that means. Rate goes up? We're paying more in 9 days. Rate goes down? We wait over two months for relief.

That's not a coincidence. That's how the system works.

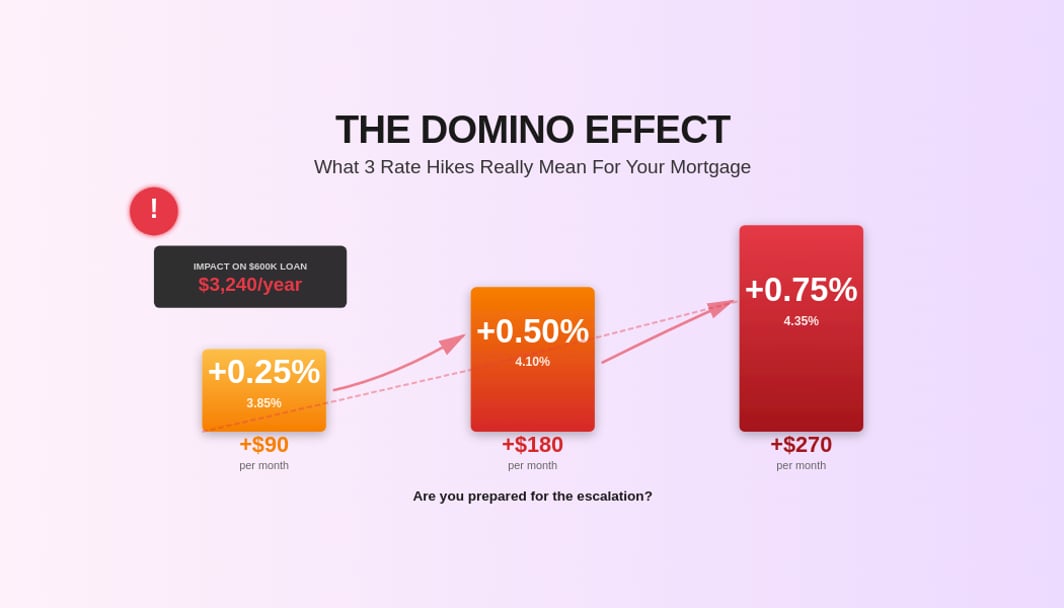

The cost of the lag

During those lag periods when rates drop, we're essentially paying interest at the old, higher rate while the bank's own costs have already fallen. For those of us with a $600,000 mortgage, that 60-day delay in the May 2025 rate cut cost around $250, money that simply stayed in the bank's pocket.

Now multiply that by millions of mortgage holders across Australia, and you start to see why banks aren't exactly rushing to change their systems.

And it's not just mortgages. Banks are lightning-fast to increase what we owe, but remarkably slow to increase what they pay us. Our savings account rate increases will likely take effect sometime in late February or March, weeks after our mortgage payments increase on February 13.

The perfect cover story

This morning, RBA Governor Michele Bullock noted that consumer demand is "stronger than expected" and services inflation remains "sticky." Convenient timing, isn't it?

That statement gives banks the perfect cover story: "We must act quickly to manage risk." Meanwhile, when it comes to raising our savings rates or passing on a cut? Suddenly, they need "product review cycles" and "funding cost assessments."

What we can actually do

We don't have to accept this quietly. Here are a few things worth considering this weekend:

Have the conversation. If you've been a loyal customer, call them. Point out the asymmetry. Ask for a loyalty discount increase to offset the hike, or at a minimum, fee waivers. Retention teams have more power than we think, especially when we're prepared to mention the word "refinance."

Check your offset account. If we've got savings sitting in a separate account earning 4.5%, and our mortgage rate is about to hit 6.3%, every dollar in our offset is effectively earning us that higher rate. Right now, before banks increase savings rates, our cash is worth more in the offset than anywhere else.

Look around. Non-bank lenders often move more slowly, and some have better ongoing rates anyway. Even if we don't refinance, getting a quote gives us leverage in that retention conversation.

The bigger picture

This isn't just about 0.25% or a few hundred dollars. It's about a structural imbalance where the institutions that hold our mortgages operate under one set of rules when it benefits them, and another set when it benefits us.

Banks will tell us the delays are about "system complexity" or "customer communication requirements." But somehow, those systems and requirements vanish when rates are moving in their favour.

The truth is simpler: they move fast when it makes them money, and slow when it costs them money. And until enough of us push back, nothing changes.

The February 13 rate hike is coming for all of us. We've got a few days to decide whether we're just going to accept it, or whether we're going to make that phone call.

If you’d like to discuss ways to optimise your home loan, feel free to book a no-obligation call with me.

Takes less than a minute to complete

What You'll Get

Free 30-minute consultation

Get expert advice from our licensed brokers with no cost or obligation

Personalized recommendations

Tailored loan options based on your unique financial situation

Market insights

Latest rates, trends, and opportunities in the current market

No pressure approach

Honest, transparent advice with no high-pressure sales tactics