How to manage mortgage stress in Australia in 2026 is the question keeping couples up at night. New data shows 62% of Australian households have cut lifestyle spending,

including romance and dining out, to protect their mortgage buffer. If that sounds familiar, here’s exactly what you need to do about it.

1. The Trigger: Why 62% of Respondent Couples Are Choosing Mortgage Over Meals

The honeymoon period of 2025’s rate cuts is officially over.

Following the RBA’s decision on February 3rd to hike the cash rate to 3.85%, new data from the Mortgage Choice Home Loan Report (February 11, 2026) reveals a startling socialcost: 62% of respondent Australian couples have sacrificed their lifestyle, specifically romance and discretionary spending, to maintain their mortgage buffer or save for a deposit. Even more critical: 13% of Australian households are now classified as “at risk’, meaning they are just one more hike away from draining their core savings entirely.

Key stat to know

62% of respondent couples have cut discretionary spending due to mortgage pressure in 2026. 13% are classified as "at risk" of depleting core savings entirely.

Source: Mortgage Choice Home Loan Report, February 2026.

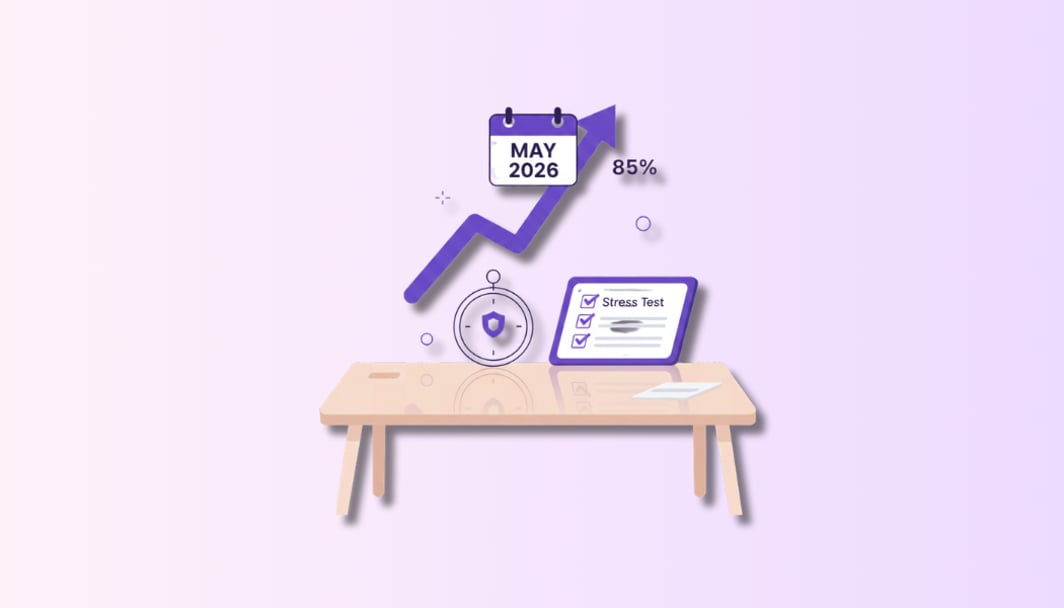

2. How Buffer Erosion Works: The Mortgage Stress Maths Explained

Understanding the mechanics helps you act. Here’s the core problem.

Lenders currently test your serviceability with a 3% buffer above the current rate. With the cash rate at 3.85% and retail variable rates hovering around 6.50%–6.80%, you are likely being stress-tested at nearly 10%.

What does that mean in practice? When you “stay in instead of going out” to pay an extra $200 a month into your loan, you aren’t just saving interest, you are defending that 3% safety margin.

However, there’s a trap many households fall into: if you are simply letting that money sit in a standard redraw facility, you may be losing liquidity. In a high-inflation environment, cash accessibility is just as important as debt reduction.

Quick answer: What is mortgage buffer erosion?

Buffer erosion occurs when rising repayments force households to draw down their savings buffer the cash reserve used to absorb unexpected rate hikes or income shocks. Once eroded, a single rate rise can push a household into financial stress.

3. How to Manage Mortgage Stress in Australia in 2026: A Household Audit

The best time to audit your loan structure was six months ago. The second best time is today. Here are three actions you can take right now.

Step 1: The 3-Month Lookback

Review your bank statements from the last 90 days. If your "Discretionary" category (dining, gifts, travel) has dropped by more than 30% while your mortgage repayments have risen, you are in what we call the Sacrifice Zone.

This isn't just a budgeting problem it's a relationship risk. Sustained financial stress is one of the most common triggers for relationship conflict in Australian households.

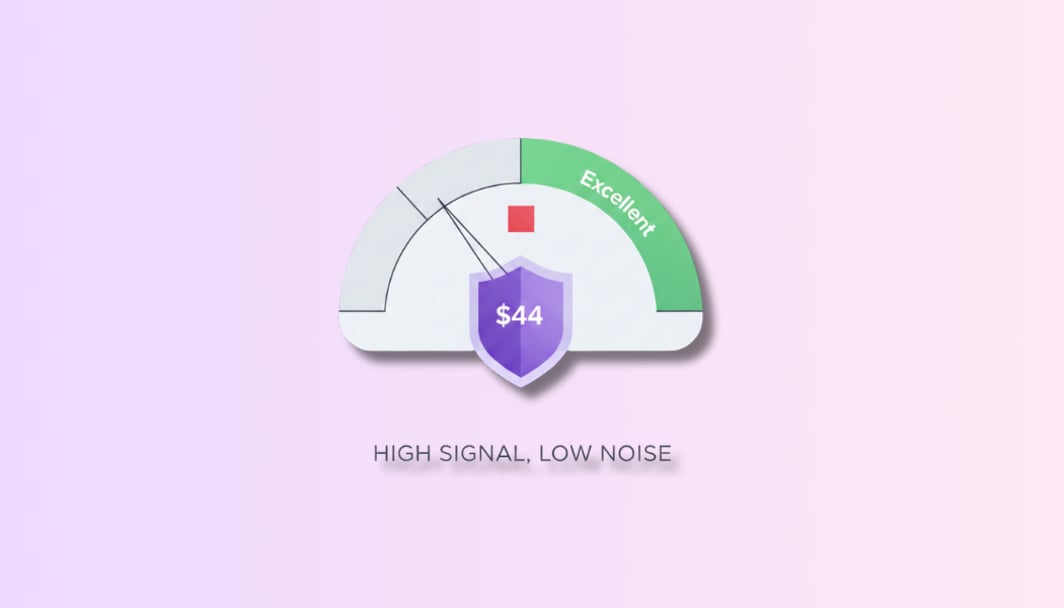

Step 2: Audit Your Offset vs. Redraw

This is the most overlooked distinction in Australian mortgage management.

- An offset account reduces the interest calculated on your loan and keeps funds instantly accessible like a transaction account.

- A redraw facility also reduces interest, but accessing those funds requires a formal request to your lender, which can take days and may be refused in certain circumstances.

Our Tip: Liquidity is king in 2026 If your extra repayments are sitting in redraw, move them to an offset account. This gives you instant access to that cash if an emergency or a much-needed date night arises, without re-applying to your bank.

Step 3: Model a 60/40 Split Loan

Contact your broker to model a 60/40 split or any other % that works for you:

- 60% fixed rate: locked in at today's rate for budget certainty

- 40% variable: keeping this portion flexible so you can use an offset account

This structure stops the mental drain of wondering whether next month's RBA meeting will cancel your weekend plans. You get rate protection on the bulk of your loan, without sacrificing liquidity on the rest.

Frequently Asked Questions

With the cash rate at 3.85%, most variable home loan rates are sitting between 6.50% and 6.80%. On a $600,000 loan over 25 years, each 0.25% rate rise adds roughly $90–$100 to your monthly repayment. Lenders are also stress-testing new borrowers at nearly 10%, meaning your serviceability buffer is tighter than it looks.