KPMG has just released its 2026 property forecast, and the headline number is a wake-up call: they predict a national property price rise of 7.7% in 2026.

For many potential buyers, the current strategy is "wait and see." The logic seems sound: Why buy now when interest rates are high? Let’s wait for the RBA to cut rates, then we’ll jump in.

As a mortgage broker and fintech founder, I look at the numbers daily. And the math tells a different story. Waiting for a 0.25% rate cut while property prices rise by nearly 8% isn’t a savings strategy—it’s a capital growth penalty.

Here is the breakdown of why waiting could cost you significantly more than you think.

The Prediction: What KPMG is Saying

According to the just-released KPMG Residential Property Market Outlook (January 2026), the market is defying higher rates due to a structural undersupply of housing. Their Chief Economist, Dr. Brendan Rynne, notes that despite affordability constraints, the "imbalance" of supply and demand is pushing prices up.

Here is their state-by-state forecast for house price growth in 2026:

- Perth: +12.8% (The standout performer)

- Brisbane: +10.9%

- Darwin: +10.5%

- Adelaide: +8.2%

- Melbourne: +6.8%

- Sydney: +5.8%

- National Average: +7.7%

Even in the more moderate markets like Sydney and Melbourne, the growth is significant in dollar terms because the entry price is higher.

The Math: Breaking Down the "Cost of Waiting"

Let’s look at a typical scenario for a dual-income family looking to upgrade or invest.

The Scenario:

- Target Property Price: $1,500,000

- Loan Amount: $1,000,000

Option A: You Buy Now (Early 2026)

You enter the market immediately. You pay the current higher interest rates, but you secure the asset at today's price.

- Market Growth (using KPMG's 7.7% national average): $1,500,000 x 7.7% = $115,500 in increased equity over 12 months.

- Even using a conservative Sydney forecast (5.8%), that is $87,000 in growth.

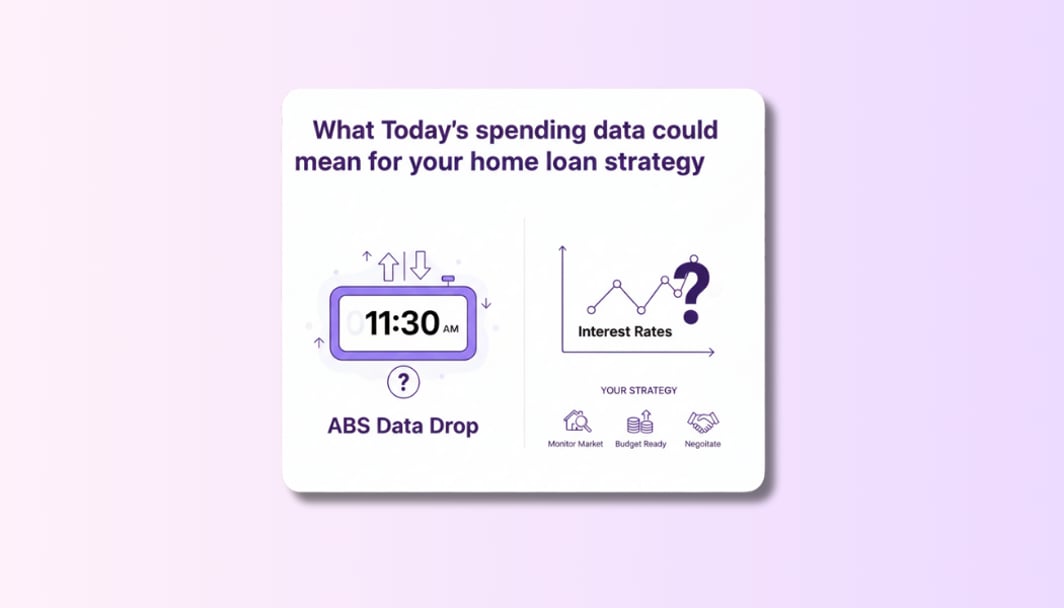

Option B: You Wait for a Rate Cut

You decide to wait 12 months for the RBA to cut rates. Let’s be optimistic and assume they cut rates by 0.50% over that year.

- Interest Saved: On a $1M loan, a 0.50% lower rate saves you roughly $5,000 in interest payments over the year.

- The Price Tag Change: That $1.5M house now costs $1.615M.

The Net Result

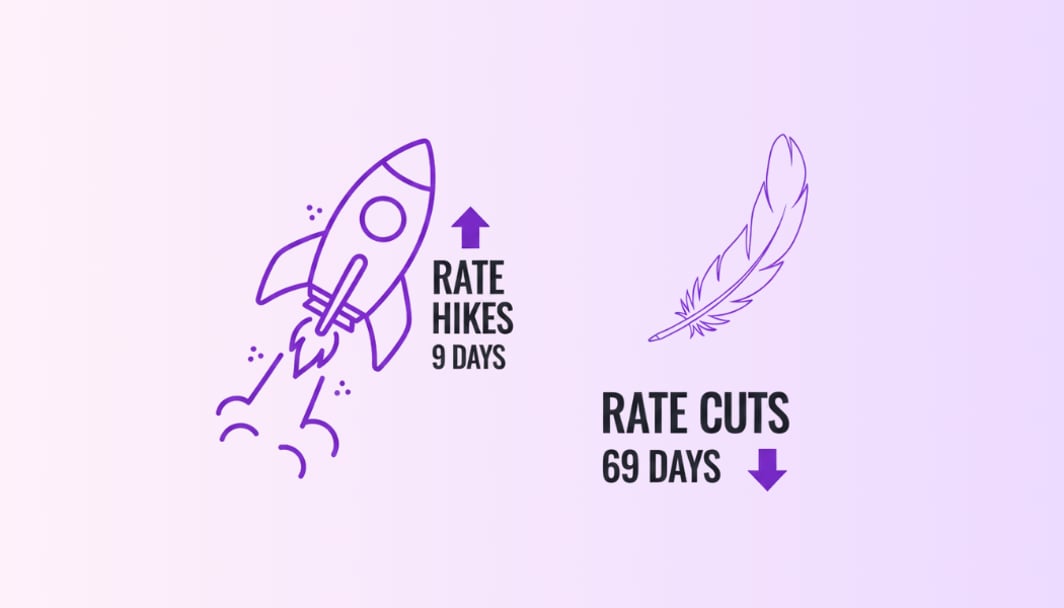

By waiting, you "saved" $5,000 in interest. But you "lost" $115,500 in capital growth (or had to borrow that much more to buy the same house).

The Cost of Waiting: ~$110,000

Even in a lower-growth scenario, the gap is stark. You are effectively stepping over dollars to pick up cents.

The "Borrowing Capacity" Trap

There is a secondary risk to waiting. When prices rise, your borrowing capacity doesn't automatically rise with them. If property prices jump 7-10% in 2026, but your income (and therefore your borrowing power) stays relatively flat, you might find yourself priced out of the suburb you could afford today. You end up paying more for a lesser property, simply because you waited for a slightly cheaper monthly repayment.

The Bottom Line

Interest rates are temporary; the purchase price is permanent. You can always refinance a loan when rates drop, but you cannot go back and buy a property at last year’s price.

If you have the capacity to service the loan now, the data suggests that "time in the market" will vastly outperform "timing the market" in 2026.