Key points:

- On 12 August 2025, the Reserve Bank of Australia (RBA) delivered a 25 basis point cut, bringing the cash rate down to 3.60%.

- The last time the cash rate was at this level was around April to June 2023 when it hovered near 3.60%

- Borrowers with variable-rate home loans will see immediate relief, with potential savings of around $100 a week on a $500,000 loan if lenders pass the cut on in full.

RBA Rate Cuts in 2025: How they affect you?

The Reserve Bank of Australia has cut the official cash rate by 0.25 percentage points to 3.60%, marking its first move down since rate hikes paused earlier this year. The decision will save Australian homeowners billions in interest and give household budgets much-needed breathing room.

The RBA’s move follows inflation staying within its 2–3% target since May, slowing domestic spending per capita, and weaker global growth among key trading partners.

Example: On a $500,000 home loan, a 0.25% cut could save around $100 a week — over $5,000 a year.

Why the RBA is cutting rates now?

After lifting rates above 4% to cool inflation, the RBA now sees room to loosen policy. The decision is driven by:

- Inflation returning to target since May.

- Softening global growth, especially among major trading partners.

- Domestic spending growth per capita slowing in 2025

Still, the RBA is cautious. A bigger or faster drop could weaken the currency or stoke inflation again.

Mortgage repayments: The direct impact

Variable-rate borrowers feel changes almost immediately. With fixed-rate loans now at historic lows, most borrowers are exposed to cash rate shifts.

In early 2025, the average pass-through of a 0.25% cut was near full—saving households hundreds a month. Yet repayments still take about 10% of disposable income on average, the highest since 2012.

Savings from a 0.25% rate cut

*Based on 6% variable rate over 30 years before cut; repayments rounded.

Winners and losers

- Lower-income borrowers: Get the biggest relief as repayments take a larger share of income.

- Savers and retirees: Face lower deposit returns, which can offset any borrowing benefits.

- High-debt households: Gain large dollar savings but remain vulnerable if rates rise again.

Behavioural and psychological impact

Rate cuts don’t just alter budgets — they alter behaviour. Research shows:

- Wealth effect: Lower repayments make people feel wealthier, prompting more discretionary spending.

- Debt risk: Easier credit can tempt households into taking on more debt than they can handle.

- Confidence lift: When cuts are seen as a sign of economic stability, optimism rises and spending follows.

The RBA knows these shifts matter — it uses forward guidance to influence confidence before changes take effect.

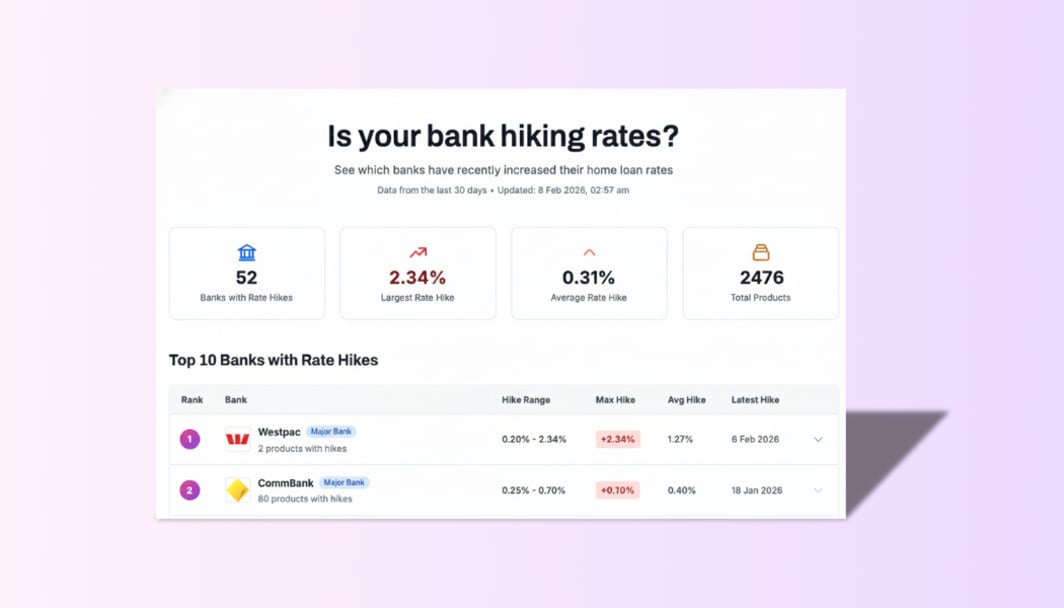

How banks pass on cuts

The RBA sets the cash rate; banks decide what to do with it.

- In early 2025, big banks passed on cuts in full within two weeks.

- Smaller banks sometimes act faster or offer bigger discounts to win customers.

- Some lenders quietly delay passing on savings to existing customers while using sharper rates to lure new ones.

This means checking your rate is critical — you might not get the cut unless you ask.

Action plan: Maximise savings from a rate cut

- Check your current rate: Compare it to average rates published by RBA and online lenders.

- Call your lender on announcement day: Ask when and how much of the cut will be passed on.

- Negotiate: Quote lower rates from competitors. Lenders often match or beat these to keep you.

- Shop around: Smaller banks and credit unions may pass on the cut faster and in full.

- Refinance if needed: Refinancing costs are often outweighed by long-term savings.

- Use savings strategically: Make extra repayments now to shorten your loan term and cut total interest paid.

Risks to keep in mind

- Inflation risk: Too many cuts could push inflation back up, forcing sharp hikes later.

- Global headwinds: Weak growth abroad could limit the benefits of cheaper credit.

- Personal risk: Over-borrowing in a low-rate environment can lead to stress when rates rise.

Don’t assume your bank is giving you the best deal

A home loan health check could reveal you’re overpaying by thousands each year. Check your rate. Negotiate or refinance. Every basis point matters.