Three major factors are converging right now that could slash your borrowing power overnight.

Today, thousands of Australians are walking into auctions with pre-approval letters that became 'zombies' overnight. Between a new APRA 'quota' system that launched at midnight and a looming RBA hike on Tuesday, your 'Max Bid' isn't what it was on Friday. If you don't adjust your numbers by 10 AM, you're not just bidding for a house, you're bidding for a bank decline.

1. The "Quota Queue": Why your income just lost its power

The Signal

As of today, February 1, 2026, APRA's new 20% cap on high Debt-to-Income (DTI ≥ 6) loans is officially live.

Banks are now legally restricted: only 1 in 5 new loans can go to people borrowing more than 6x their gross income. If you're an investor with a portfolio or a high-leverage buyer in Sydney or Melbourne, you aren't just competing against other bidders—you're competing for a spot in the bank's quarterly "High DTI" allowance.

Reality check:

Your application might be perfect, but if you're applicant #21 this week and the bank has already approved 20 high-DTI loans, you're getting declined. Not because you're unqualified, but because of timing.

The Action:

If your ratio is over 6.0, we need to shift your application to non-bank lenders (who aren't bound by this cap) before you sign a contract.

Also we covered about it since Nov 2025, have a How will APRA’s "Quiet Cap" affect your next home loan?.

2. The 48-Hour "Serviceability Cliff"

The Signal

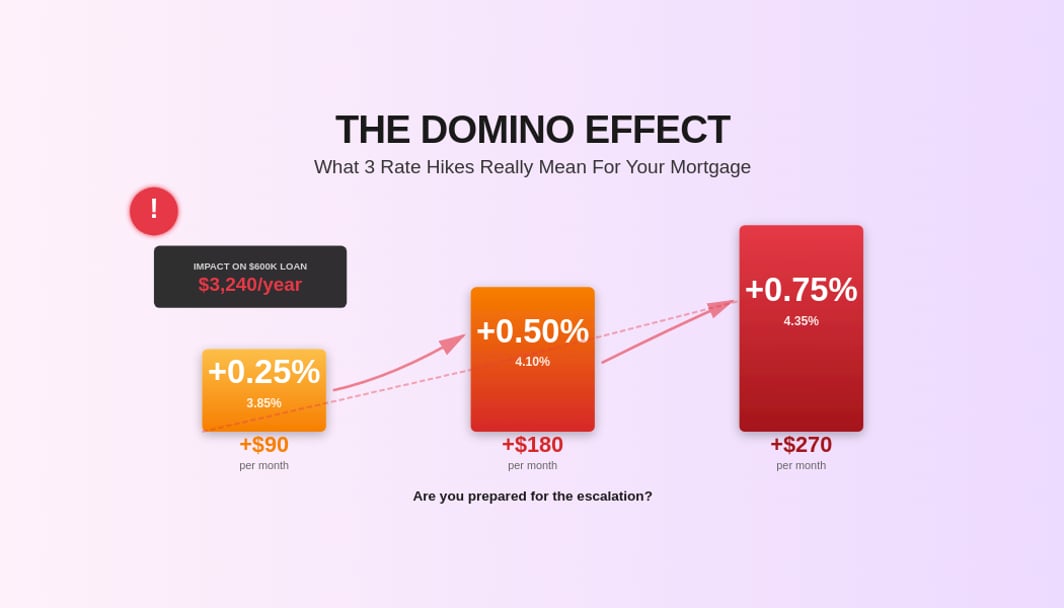

The RBA meets this Tuesday. Markets are currently pricing in a 67% probability of a 0.25% hike to 3.85%.

ASX Market Data (January 29, 2026):

ASX 30-Day Interbank Cash Rate Futures February 2026 contract:

• Probability of NO CHANGE to 3.60%: 33%

• Probability of INCREASE to 3.85%: 67%

Note: This represents a dramatic shift from just 8 days earlier when the probability of an increase was only 25%. The market repriced rapidly following recent economic data releases.

A 0.25% hike is a "double hit." It increases your monthly interest AND forces the bank to test your "repayment buffer" at a higher floor. This can slash a $1.2M borrowing limit by $25,000+ in a single afternoon.

The Action

If you're heading to an auction this week, your Friday pre-approval is high-risk. Run a Borrowing Power Calculator at 3.85% + 3% buffer.

3. The "Scarcity Trap": Why "Stale" is the New "Shiny"

The Signal

Listing volumes in major hubs have plummeted 16.6% below the 5-year average.

Market Data Source:CoreLogic/REAA January 2026 Property Market Report

Melbourne listings: -16.6% vs 5-year average

Extreme scarcity is driving "panic bidding" on "shiny" new listings, leading to record-high prices for average properties. Meanwhile, "stale" listings (on market 45+ days) are being ignored, despite having motivated sellers who are terrified of Tuesday's rate decision.

Additional Context (KPMG Jan 2026):

• National house prices rose 8.6% in 2025 (strongest since 2021)

• Net housing supply forecast to fall 30% short of government targets

• Housing momentum accelerated dramatically in 2025H2, with some cities recording 60-76% of their annual growth in just the last 6 months

• Median house now 8.9x average income (up from 6.6x five years ago)

The opportunity

While everyone fights over fresh listings at 20+ bidders per auction, properties that have been sitting for 6+ weeks are essentially invisible. These sellers are watching the calendar and sweating the RBA meeting. They'll negotiate.

Key Takeaways for This Week

If you're planning to buy in the next 7 days:

✓ Verify your DTI ratio and understand if you're affected by the 20% cap

✓ Confirm your pre-approval is current with your broker

✓ Understand your borrowing capacity at different rate scenarios

✓ Have a clear maximum bid that includes a safety buffer

✓ Know that Tuesday's RBA decision could affect future borrowing, not your existing approval

Disclaimer

This blog post provides general information and market commentary only. It is not financial advice. Individual circumstances vary significantly. All estimates are indicative and subject to lender assessment. Before making any property purchase decisions, verify regulatory changes through official sources (e.g., APRA, RBA) and consult a licensed financial advisor.