Is your "credit character" ready for a mortgage?

Did you know that 80% of home loan rejections in Australia are avoidable? Many borrowers assume eligibility is just about their salary, but in 2026, lenders are looking at a much broader picture.

From the RBA's cash rate holding at 3.60% to the new APRA debt-to-income limits introduced in February 2026, the goalposts have moved.

In this guide, we break down the exact criteria banks use to assess you. Plus, we’ll show you how Bheja AI Copilot can simulate a bank’s assessment of your finances in real-time, giving you a "pre-assessment" before you even apply.

🚀 Bheja Action: Don't rely on guesswork. Try it now and check eligibility across 30+ banks instantly.

The Core Eligibility Criteria

What are the eligibility criteria for a home loan in Australia?

To qualify for a home loan in Australia, you must generally meet four core requirements:

- Age: You must be at least 18 years old.

- Residency: You must be an Australian Citizen, Permanent Resident, or acceptable Visa holder.

- Income (Serviceability): You must prove you can afford repayments + a 3% "buffer".

- Credit History: You must have a clean credit file (or explainable defaults).

However, "meeting" these is just the start. Lenders grade you on a curve. A borrower with a 20% deposit and stable income is "Prime," while others may need "Specialist" lending.

What documents are required for home loan eligibility in Australia?

Lenders need proof of your financial "character." The standard "Full Doc" checklist includes:

- ID: Passport / Driver’s Licence.

- Income: 2 recent payslips + most recent Group Certificate (PAYG summary).

- Savings: 3-6 months of bank statements showing "Genuine Savings."

- Liabilities: Statements for all credit cards, personal loans, and HECS/HELP debt.

💡 Pro Tip: Using Bheja, you can connect your bank accounts via CDR (Consumer Data Right). Our AI automatically categorises your expenses and generates this document pack for you, highlighting any "red flag" transactions before the bank sees them.

How does age affect home loan eligibility in Australia?

While the minimum age is 18, there is no official "maximum" age. However, lenders must ensure you can repay the loan before you retire.

- Under 45: Standard 30-year loan terms are easy to get.

- Over 50: You may need to provide an "Exit Strategy"—a plan showing how you will pay off the remaining debt if you retire before the loan term ends (e.g., using Superannuation).

Income, Debts & The "New Rules"

How does income level impact home loan eligibility in Australia?

It’s not just how much you earn, but how you earn it.

- Base Salary: Accepted at 100%.

- Overtime/Bonuses: Often "shaded" (discounted) by lenders to 80% to account for volatility.

- Casual Work: Most banks require you to be in your role for at least 12 months.

What is the debt-to-income ratio requirement for home loans in Australia?

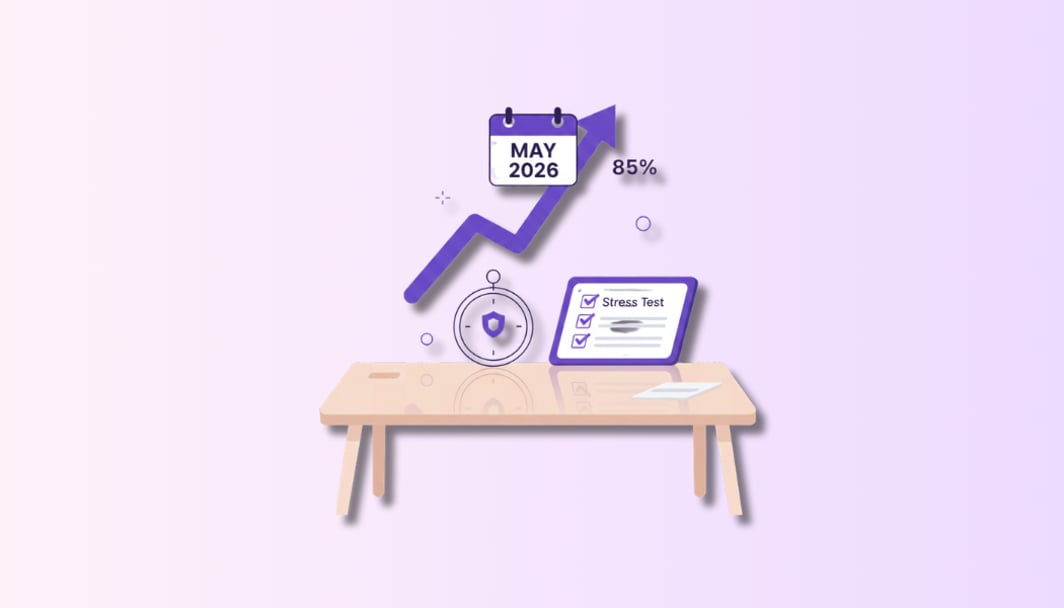

⚠️ New Rule Alert (Feb 2026): The Australian Prudential Regulation Authority (APRA) has introduced stricter limits. Banks must now cap new loans with a Debt-to-Income (DTI) ratio of 6 or higher to just 20% of their total lending.

- The Math: If you earn $100,000 and have $600,000 in total debt (mortgage + credit cards), your DTI is 6.

- The Impact: If your DTI is above 6, you are now considered "high risk" and may face fewer lender options or higher rates.

🟢 Bheja Widget: DTI Calculator Input your income and debts below to see your current DTI Ratio. Result: "Your DTI is 5.2. You are in the 'Safe Zone' for major banks."

How does the RBA cash rate influence home loan eligibility in Australia?

When the RBA sets the cash rate (currently 3.60%), banks don't just test if you can afford the current interest rate (e.g., 6.00%). They are required by APRA to add a 3% Serviceability Buffer.

- The Test: If the bank's rate is 6.00%, they assess your ability to repay the loan at 9.00%.

- The Consequence: Every 1% rise in rates reduces your borrowing capacity by approximately 10%.

Deposits & Government Help

What is the minimum deposit required for a home loan in Australia?

- Standard: 20% of the property value (plus stamp duty) to avoid Lenders Mortgage Insurance (LMI).

- Low Deposit: 5% - 10% is possible, but you will pay LMI (which can cost $10k-$30k).

- Government Schemes: 2% - 5% with no LMI if eligible.

What are the eligibility criteria for first home buyers in Australia?

🎉 Major Update (Oct 2025): The Australian Government has expanded the Home Guarantee Scheme (now the "5% Deposit Scheme").

- Income Caps Removed: You no longer need to earn under $125k/$200k to qualify.

- Price Caps Increased: e.g., Up to $1.5M for homes in Sydney/NSW capital regions.

- Unlimited Places: The "first come, first served" waitlists are gone.

Read our full guide: The First Home Buyer’s Handbook & New 2026 Rules.

Troubleshooting & Niche Scenarios

How to improve home loan eligibility in Australia?

If Bheja's AI indicates a low "Confidence Score," take these steps immediately:

- Slash Credit Limits: A $10,000 credit card limit reduces your borrowing power by ~$45,000, even if the balance is zero.

- Clean Bank Statements: For 3 months before applying, avoid "Buy Now Pay Later" (Afterpay), gambling transactions, and excessive discretionary spending.

- Close Unused Accounts: "Zombie" accounts with small overdrafts can hurt your credit file.

🟢 Bheja Simulation: Use our Borrowing Capacity Calculator to see how cancelling your credit card today could increase your home loan limit tomorrow.

Why is my home loan application rejected despite meeting eligibility criteria?

Common "hidden" reasons for rejection include:

- Undisclosed Liabilities: The bank found an Afterpay account you didn't mention.

- Credit Scoring: You failed the bank's internal score (different from your Equifax score) due to job instability or moving house too often.

- Valuation Issues: The bank didn't accept the property itself as good security (e.g., too small, high-density area).

How to get a home loan with a part-time job in Australia?

You can qualify, but consistency is key.

- Requirement: Most lenders want to see 12 months of continuous employment history.

- Tip: If you have a second job, ensure you've held it for at least 6-12 months for that income to be counted.

What are the eligibility criteria for home loans with a low credit score in Australia?

- Good Score: 661+ (Equifax).

- Low Score (<500): You may be rejected by major banks but accepted by Specialist Lenders.

- Trade-off: Specialist lenders charge higher rates (often 1-2% higher) but may ignore paid defaults or one-off life events (divorce, illness).

Advanced Scenarios

- Self-Employed? It’s a different ballgame. Learn about "Alt-Doc" loans and how to use BAS statements instead of tax returns in our Self-Employed Borrower Guide.

- Investing? Learn how to use "Rental Shading" and "Negative Gearing" to boost your eligibility in our Property Investor Hub.

- Student? Learn how Guarantor Loans can help you use your parents' equity to buy a home with $0 deposit.

Ready to Check Your Eligibility for Real?

Static articles can only tell you the rules. Bheja.ai applies them to your life.

Our AI Copilot connects directly to your financial data (securely via CDR) to:

- Audit your expenses just like a bank credit officer.

- Highlight eligibility gaps before you apply.

- Match you with the lenders most likely to say "Yes."

FAQ

Most Permanent Residents (PR) have the same eligibility as citizens. Temporary residents (e.g., 482 visa) can borrow but usually need a larger deposit (20-30%) and FIRB approval, unless buying with an Australian spouse.