Navigating the world of borrowing can be tricky, especially for Australians with foreign income. Understanding how foreign income affects your borrowing capacity is crucial for making sound financial decisions. This article will break down what foreign income shading means and provide practical tips to help you improve your borrowing power while managing your unique financial situation.

Key Takeaways

- Understanding your borrowing capacity is vital when you have foreign income since lenders might see it differently.

- Foreign income shading means lenders could consider only part of your foreign earnings and this might impact how much you can borrow.

- Documenting your foreign income well can help lenders trust your application, so keep ALL proof of your income handy—like payslips and bank statements.

- To maximise your borrowing power, maintain a good credit score and show consistent job history.

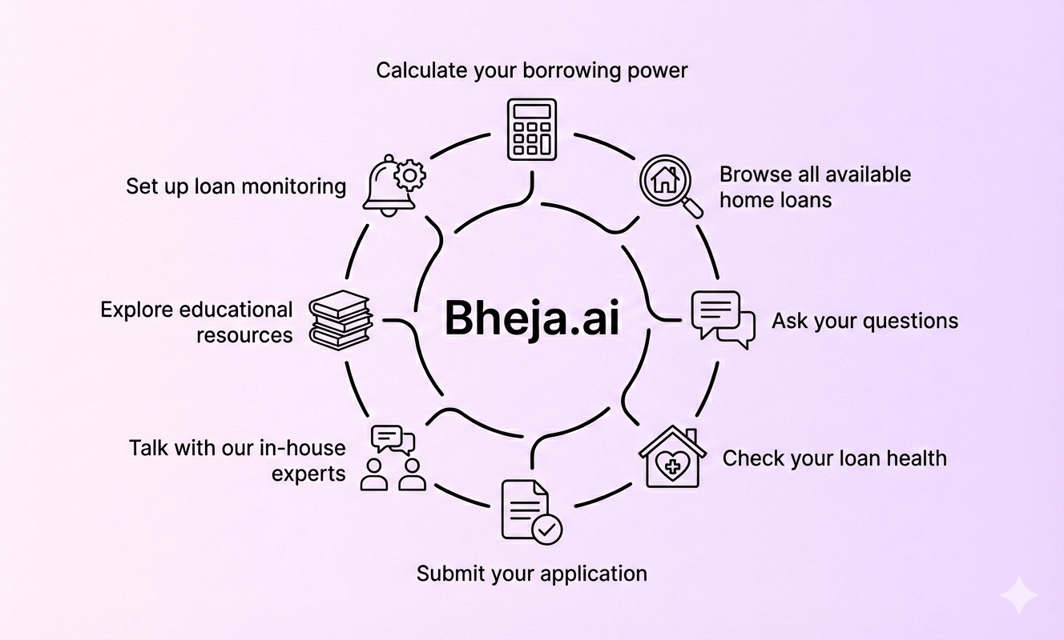

- Navigate home loans with AI-driven insights from Bheja.ai. Compare over 100 brands, get proactive alerts, and make smarter financial decisions effortlessly.

Borrowing Capacity Foreign Income Shading

Understanding Borrowing Capacity and Its Significance

Borrowing capacity is a crucial aspect for anyone looking to secure a home loan, particularly in Australia. It's essentially the amount of money a lender is willing to lend based on various factors, including income, credit history, and existing debts. For Australian residents with foreign income, understanding how this income is assessed can make a significant difference in achieving home ownership.

When assessing an application, lenders will look at the total household income, which can include salaries, bonuses, and any foreign income sources. However, lenders sometimes apply "shading" to foreign income, which may reduce its perceived value in the context of your overall borrowing capacity. This shading effect can be limiting but also manageable with the right information and strategies.

What is Foreign Income Shading?

Foreign income shading refers to the practice of lenders applying a reduction to the value of income earned outside Australia. This can affect the total income assessed for your borrowing capacity. Multiple factors contribute to this shading:

- Currency Fluctuations: Changes in the exchange rate can impact the amount of foreign income when converted into Australian dollars.

- Stability of Employment: Lenders may view foreign jobs as less stable compared to local employment.

- Documentation Challenges: Proving the consistency and reliability of foreign income can be more complicated, leading lenders to err on the side of caution.

Understanding these aspects can help borrowers navigate the complexities of foreign income when applying for loans.

Understanding Lenders’ Perceptions of Foreign Income

Lenders often have a critical view of foreign income for several reasons:

- Verification: Lenders require clear and documented proof of income for all sources. Often, foreign income lacks the same easy verification as domestic salaries.

- Tax Implications: Foreign income may have different tax rules, making lenders cautious since tax obligations can affect net income.

- Market Awareness: Lenders may not fully understand your foreign market, potentially leading to an undervaluation of your income.

As a borrower, engaging with lenders that have experience dealing with foreign incomes can make a notable difference. It is important to choose your lender wisely, aiming for those who apply favourable guidelines regarding foreign income.

Rules Around Income Verification

To boost your chances of obtaining a loan that accounts for your foreign income, it is essential to understand the rules concerning income verification. Here are the typical requirements:

- Proof of Employment: You should provide documents showing employment status, like contracts or statements from your employer.

- Income Statements: Regular pay slips or bank statements showing deposits from your foreign income will help establish a clear earning record.

- Tax Returns: Copies of tax documentation from your foreign income can reinforce proof of income and offer transparency regarding tax obligations.

Taking steps to have these documents organised and easily accessible is key when you're ready to apply for a mortgage.

Strategies for Maximising Borrowing Capacity with Foreign Income

Knowing how to navigate the system can allow you to maximise your borrowing capacity. Here are some strategies that might help:

1. Document Income Sources Thoroughly

- Collect All Necessary Documentation: Organise documents that prove your foreign income's consistency. This includes contracts, pay stubs, and possibly tax returns from your foreign employer.

- Use Professional Accounting Services: Consider hiring an accounting service that understands both Australian tax laws and those of your foreign income source. This can help in correctly accounting for income.

- Consider Currency Exchange Rates: Be aware of current exchange rates and how they can influence the valuation of your foreign income.

2. Mitigate Currency Risks

Understanding and managing the risks associated with currency fluctuations is vital. Here are ways to do that:

- Regular Transfers to Australian Accounts: If possible, regularly transfer your foreign earnings to an Australian bank to mitigate currency risk and establish consistent income figures.

- Hedging Options: Explore financial products that can help hedge against currency fluctuations.

3. Work with Experienced Mortgage Brokers

Engaging with a mortgage broker who has experience with clients in similar situations can be a significant advantage:

- Tailored Advice: They can provide insights into which lenders are open to considering foreign income positively.

- Navigating Paperwork: Brokers often know the ins and outs of the paperwork required and can guide you through the process to avoid any pitfalls.

Resources to Check Out

For Australian residents with foreign income, several resources can help you understand the implications and provide guidelines:

- Australian Government's Foreign Income Tax Implications: Familiarise yourself with the tax implications of foreign income. You can find more about it on the Australian Taxation Office.

- Mortgage and Finance Association of Australia (MFAA): They provide resources on lending guidelines that can benefit borrowers navigating foreign income. Check out more at MFAA.

- Australian Bureau of Statistics' Migration Data: This can help you grasp demographic trends that may influence foreign income. Visit the Australian Bureau of Statistics for data insights.

Tools and Templates

Consider utilising some online tools and templates to streamline your borrowing process and calculations. Here are a few that can be beneficial:

- Debt-to-Income (DTI) Ratio Calculator: This tool can help you assess your borrowing capacity against your income and debts. Use this calculator available at How to Use a Debt-to-Income (DTI) Ratio Calculator for Your Finances.

- Income Documentation Checklists: Create a checklist for all the necessary documents you need for your loan application, including proofs of foreign income and tax statements.

- Borrowing Capacity Factors: How Much Can I Borrow? (2026 Guide)

Navigating the world of borrowing can be tricky, especially when you’re dealing with foreign income. Proper planning, documentation, and understanding of lender perceptions are crucial. With the right strategies and resources, you can make the most of your financial situation and pursue your homeownership goals effectively.

Conclusion

In summary, understanding how foreign income affects your borrowing capacity is important for making good financial choices. We've looked at how foreign income shading can impact your loan prospects, the importance of thorough documentation, and ways to boost your borrowing power.

With Bheja AI, you can navigate home loans easily. Our AI-driven insights help you compare over 100 brands, get proactive alerts, and make smarter, effortless decisions. Start your journey towards better financial health today!

Frequently Asked Questions (FAQs)

Borrowing capacity is how much money a lender will allow you to borrow based on your income and expenses. If you have foreign income, lenders may look at it differently. Some might apply a shading factor, meaning they may reduce the amount they consider when calculating your borrowing capability.