If you hold a humanitarian visa (200-204) in Australia and dream of owning a home, you might wonder about your eligibility for a home loan. This guide helps you understand what lenders look for and what steps you need to take to secure financing. With the right information, your journey to homeownership can be much smoother.

Key Takeaways

- As a Humanitarian visa holder, you can apply for a home loan in Australia.

- Having the right documents like proof of income and bank statements is important for a smooth application process.

- Different lenders have different rules, so it's smart to check around for the best options available for you.

- Your income, credit history, and time in Australia will impact your eligibility for a home loan.

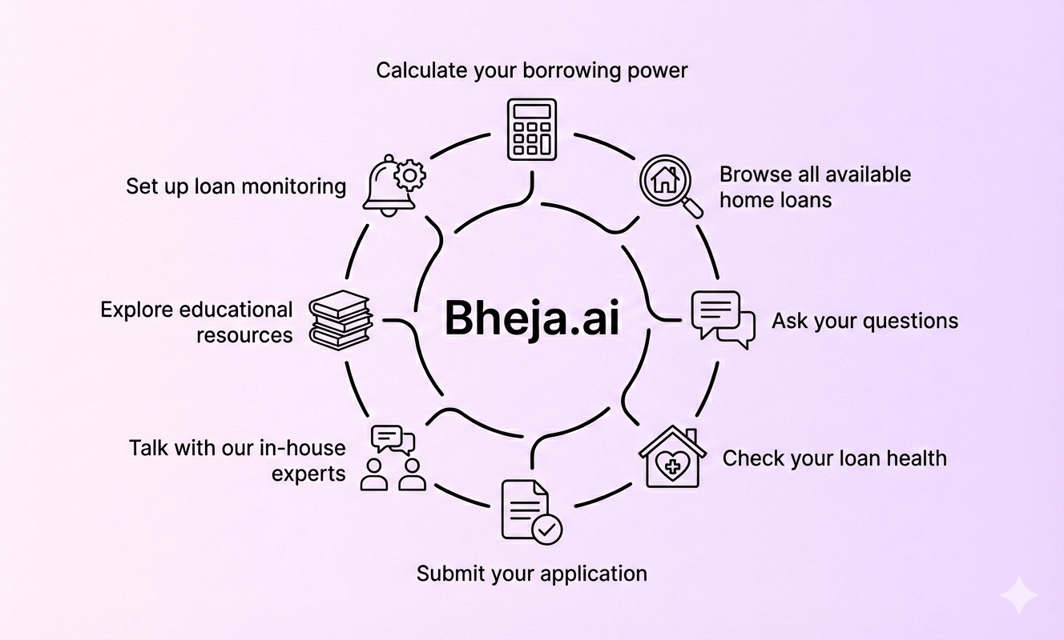

- With Bheja.ai, you can effortlessly navigate various home loans using AI-driven insights. Compare 100+ brands, get proactive alerts, and make smarter financial choices easily.

Home Loan Eligibility Guide for Humanitarian (200-204) Visa Holders

Overview of Humanitarian Visas 200-204

The Humanitarian Visa subclass 200, 201, 203, and 204 are designed to provide refuge to individuals in need of protection. These visas allow humanitarian entrants to live in Australia permanently. To be eligible for any of these visas, applicants must meet specific criteria including:

- Being outside Australia when applying

- Fulfilling health and character requirements

- Demonstrating a genuine need for protection

Home Loan Eligibility Criteria for Humanitarian Visa Holders

Securing a home loan as a humanitarian visa holder may differ from standard loan procedures. Here’s what you need to know:

General Eligibility Requirements

- Visa Status: Must hold a valid Humanitarian Visa (subclass 200, 201, 203, or 204).

- Age: Generally, applicants must be at least 18 years old.

- Income: Lenders typically require proof of a stable income to assess repayment ability.

- Credit History: Lenders will check your credit history, which might be limited for some humanitarian entrants.

Key Documentation Needed

When applying for a home loan, you'll likely need the following documents:

- Proof of Income: Recent payslips, bank statements or financial documents showing income streams.

- Identification: Passport, driver’s license, or other government-issued ID.

- Residence Status: Visa details showing your current status in Australia.

- Employment Verification: A letter from your employer or recent tax returns can help validate your employment.

The Process of Applying for a Home Loan

Applying for a home loan involves several steps. Below is a simplified version of the process:

Step 1: Assess Your Financial Situation

- Calculate your combined income and expenses.

- Understand your credit score and whether it meets lender requirements.

Step 2: Research Potential Lenders

- Look for lenders who are familiar with humanitarian applicants.

- Research various home loan products that might suit your needs.

Step 3: Obtain Pre-Approval

- Pre-approval gives you an estimate of what you can borrow.

- Complete an application with necessary documents to start the process.

- Home Loan Pre-Approval in Australia: A Step-by-Step Guide

Step 4: Submit Your Full Application

- After pre-approval, submit a complete application for an actual loan.

- Be prepared to provide supplementary documents if requested by the lender.

Step 5: Wait for the Outcome

- Lenders will assess your application and financial history.

- Expect a decision generally within a few days, but sometimes longer.

Tips for Dealing with Lenders

- Be open about your circumstances. Some lenders may offer tailored support.

- Ask questions if you're unclear about terms or requirements.

- Consider seeking assistance from financial advisors familiar with humanitarian scenarios.

Challenges Humanitarian Visa Holders Might Face

Several challenges can arise for humanitarian visa holders seeking home loans:

- Limited Credit History: If you are new to Australia, you might not have a credit report, making it hard to secure loans.

- Employment Gaps: Long periods without formal work can raise red flags for lenders.

- Documentation Barriers: Gathering sufficient paperwork may be difficult if you have recently moved or faced trauma.

Available Government Support and Programs

The Australian government offers various support options for humanitarian entrants, which can ease the home-buying process:

First Home Owner Grant

Eligible first-time home buyers may receive financial assistance through the First Home Owner Grant, depending on the state or territory. Checking Australian Government - Home Loan Assistance can provide specific details based on your location.

Low Deposit Home Loan Options

Many lenders offer low deposit home loans for those without a substantial savings history. These loans allow you to secure a home even with a deposit as low as 5%.

Settlement Services International (SSI)

SSI provides tailored support services for those on humanitarian visas. They can help navigate the home loan process and assist with necessary paperwork.

Real-Life Case Studies and Testimonials

Case Study 1: Ahmed's Journey

Ahmed arrived in Australia under a Humanitarian Visa. With the help of a local community organisation, he learned how to manage his finances and build his credit score. After several months of employment, he applied for a low deposit home loan and successfully bought a modest home within a year. Ahmed’s story emphasises that with patience and support, home ownership is attainable.

Testimonial: Sarah’s Experience

Sarah, a 204 visa holder, said: “Navigating home loans was tough as I didn’t have much understanding of the systems here. But with the help of Settlement Services International and some tailored advice from my lender, I was able to get a loan approved. It felt like a dream come true to own my own home.”

Useful Tools and Resources

Navigating the home loan landscape can be streamlined using various tools:

- Home Loan Calculators: Use online calculators to estimate repayments, affordability, and borrowing power.

- Mortgage Brokers: Engaging a mortgage broker can save time and provide personalised loan options.

- Bheja.ai Insights: Leverage AI-driven insights at Bheja.ai to compare over 100 brands and get proactive alerts on the best home loans available for your situation.

Taking the first step towards home ownership can be challenging, especially for humanitarian visa holders. However, understanding the eligibility criteria and leveraging available resources can significantly ease the journey.

Conclusion

Navigating home loans as a Humanitarian visa holder can seem tough, right? But you’ve learned key things, like understanding your eligibility factors, preparing your documents well, and considering your options carefully. Remember, you’ve got support! Bheja AI’s expertise in navigating home loans with AI-driven insights from Bheja AI can help you compare over 100 different brands, get proactive alerts, and make smarter financial decisions effortlessly. So take the next step and start exploring your home loan options today!

Frequently Asked Questions (FAQs)

Yes, as a Humanitarian visa holder, you can apply for a home loan in Australia. Lenders often look at your income, credit history, and savings to determine your eligibility.