The $50,000 Question

If you saw $50 on the ground, you’d pick it up. But right now, millions of Australians are missing out on much bigger savings without even knowing it.

Here’s a key fact: On a $500,000 loan over 30 years, choosing an average rate instead of a top rate can cost you more than $50,000. For $1 million loans, common in Sydney and Melbourne, the difference is often over $100,000.

Why You Should Compare Before Applying

Many Australians skip comparing loans because it seems like a lot of work. It’s often been complicated and full of paperwork. But if you just take the first loan you find, you might end up with higher rates and less flexible terms. Comparing before you apply helps protect your credit score and makes sure you get a loan that fits your needs.

This guide will show you the basics of comparing loans. We’ll also explain how Bheja, an AI tool for home loans, makes things easier by handling tasks like checking your payslips and talking to lenders for you.

Understanding Home Loan Fundamentals

Before you start comparing rates, it’s important to understand how loans are set up. Picking the wrong type of loan can cost you more than just paying a higher rate.

1. Fixed vs. Variable Rate Loans

- Fixed Rate Loans: Your interest rate is locked for a set period (usually 1–5 years).

- Best for: Budgeters who need certainty and risk-averse borrowers who fear rate rises.

- The Trap: If official rates drop, you are stuck paying the higher fixed rate unless you pay a substantial "break cost."

- Variable Rate Loans: Your rate moves with the RBA cash rate and market conditions.

- Best for: Borrowers who want flexibility (offset accounts, extra repayments) and believe rates might fall.

- The Risk: Your monthly repayment can increase with little notice.

- Split Loans: The hybrid approach. You might fix 50% of your loan to secure your budget, while leaving 50% variable to utilise an offset account.

The Bheja Difference: Instead of guessing your split, AI models can now analyse your cash flow to recommend the optimal split ratio (e.g., 60/40 vs 50/50) based on your actual spending volatility. Check out in more detail here.

2. Understanding Loan-to-Value Ratio (LVR)

This is the single biggest factor in the interest rate you are offered.

Formula: LVR = (Loan Amount ÷ Property Value) × 100

- < 60% LVR: You are a "safe bet." You typically unlock the lowest tier of rates.

- > 80% LVR: You are "higher risk." You will likely be required to pay Lenders Mortgage Insurance (LMI).

Real-World Context: On a $700,000 property purchase with only a 10% deposit ($70,000), LMI could cost you roughly $12,000 - $15,000. This is a cost that protects the bank, not you.

The Comparison Process (Manual vs. AI)

Here is where the rubber meets the road. You can do this the traditional way, or the accelerated way.

Step 1: The Documentation Gathering

The Manual Way:

Traditionally, this involves downloading 6 months of PDF bank statements, hunting down your last 3 payslips, scanning tax returns, and manually highlighting expenses on a spreadsheet to guess your monthly spend.

The Bheja Way:

Modern comparison utilises CDR (Consumer Data Right) integration—the same bank-grade security used by major institutions. You simply connect your accounts, and the orchestration layer instantly categorises your income and expenses.

Step 2: Determine Your Requirements

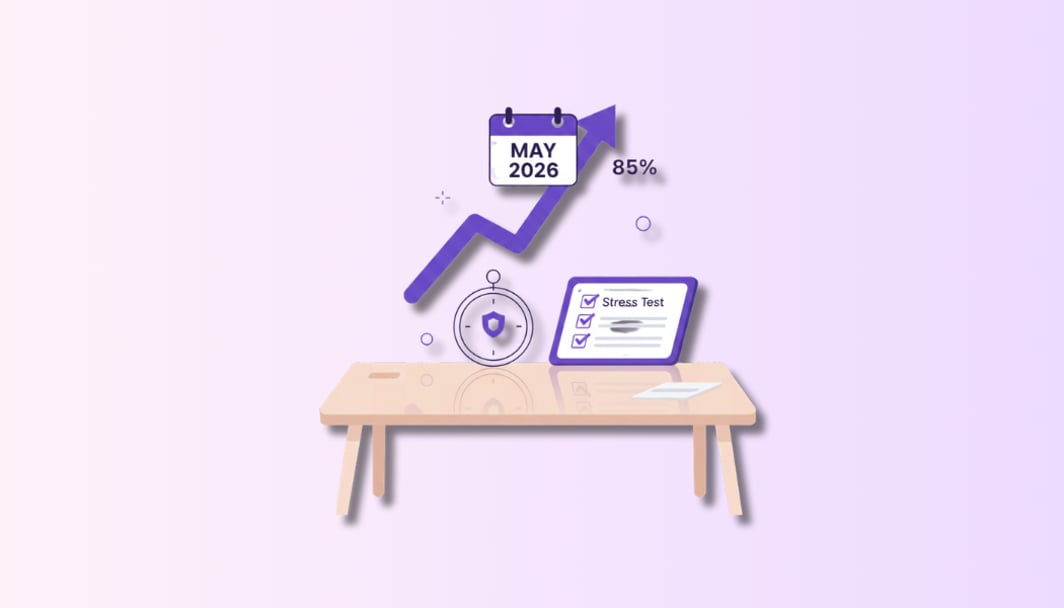

Lenders don't just look at what you earn; they look at what you spend. They will also "stress test" your ability to repay the loan at an interest rate 3% higher than the current rate.

Pro Tip: Be realistic about your living expenses. Underestimating them can lead to loan rejection; overestimating them reduces your borrowing power.

Step 3: Research Available Loans

This is the most critical step. Below is a live look at current market rates for high-credit borrowers.

Home Loan Market Snapshot

Real-time insights from thousands of Australian home loan products

Updated: 26 Feb 2026, 11:58 am

Average Variable Rate

6.40%

Owner Occupied P&I

Average Fixed Rate

6.19%

3-year fixed

Best Available Rate

4.99%

Fixed • Owner Occupied

Total Products

5,983

Available in market

Most Competitive Lenders

Big 4 Banks Average

6.52%

Market Average

6.26%

Online Lenders Average

5.94%

gmcu

20 products

From

4.99%

Avg

5.34%

Fire Service Credit Union

5 products

From

5.14%

Avg

5.52%

SWSbank

10 products

From

5.20%

Avg

5.61%

First Option Bank

24 products

From

5.24%

Avg

5.61%

Unloan

4 products

From

5.44%

Avg

5.66%

Rate Comparison by Category

Variable vs Fixed

2,066 products

3,917 products

Owner Occupied vs Investment

3,019 products

2,940 products

Principal & Interest vs Interest Only

3,392 products

2,522 products

Market Features Overview

Products with Offset Account

Products with Cashback Offers

Average Cashback Amount

Products with No Fees

(No monthly, annual, or ongoing fees)

Data sourced from 5,983 home loan products

Analysis based on products supporting minimum $300K loan amounts over 25-year terms

Key Criteria for Comparison

When reviewing the table above, how do you choose? Use this three-pillar framework.

Pillar 1: The Rate Deception (Headline vs. Comparison)

- Advertise Rate: The "advertised" number (e.g., 5.89%).

- Comparison Rate: The real number (e.g., 6.15%). It combines the interest rate + upfront fees + ongoing fees into a single percentage.

Warning: If the Comparison Rate is significantly higher than the Headline Rate, the loan is loaded with fees. Always sort by Comparison Rate.

Pillar 2: Fees (The Silent Budget Killers)

Map out the "Total Cost of Ownership" by checking these four fees:

Pillar 3: The Offset Account

An Offset Account is a transaction account linked to your mortgage. Every dollar in it "offsets" the loan balance.

Monthly Impact : “Show me how my monthly repayments change if I keep $20,000 in my offset account for a $500,000 loan at 5.8%.”

Try different scenarios with our Home loan offset account calcualtor

How to Read a Lender Comparison Report

When you receive a comparison report (from a broker or Bheja), look for these three "Red Flags" immediately:

- Teaser Rates: Is the rate fixed for only 1 year before reverting to a high variable rate?

- The "Comparison Rate" Gap: As mentioned, a gap >0.30% suggests hidden fees.

- Assumptions: Check the loan term. Some reports default to 30 years; if you can afford to pay it off in 25, the "total cost" figures will look very different.

Calculation Tools & Methods

The "Total Cost" Formula

Don't just look at the monthly repayment. Look at the total interest paid over the life of the loan.

Formula:

Total Cost = (Monthly Repayment × 12 × 30 years) + Fees - Principal

Comparison Example ($500k Loan, 30 Years):

- Loan A (5.89% + $10/mo fee): Total Interest = $565,074

- Loan B (6.09% + No fee): Total Interest = $588,411

- The Difference: Loan A saves you $23,337, even with the monthly fee.

The Automated Approach:

Instead of running these calculations manually on Excel, Ask Bheja to run thousands of permutations instantly, factoring in your specific spending habits to predict your actual savings.

Special Considerations

Why Lenders Offer Different Rates

You might notice that "Bank A" offers a different rate to you than to your neighbor.

- New Customer vs. Existing: Banks aggressively discount rates to acquire new customers while leaving existing loyal customers on higher rates (the "Loyalty Tax").

- Risk Profile: A dual-income family with stable jobs and 70% LVR is "Gold" to a bank and warrants a tier-1 discount.

The "First Home Buyer" Discount

Lenders often offer exclusive discount rates to First Home Buyers (FHB). Why?

- Lifetime Value: Banks know that if they secure you for your first home, you are likely to stay with them for subsequent properties.

- Government Guarantee: With schemes like the First Home Guarantee, the government underwrites part of the loan, reducing the risk for the bank—savings they can pass on to you as a lower rate.

The Role of Regulation (ASIC) & Independence

When comparing loans, it is vital to know who is watching out for you.

- ASIC's Role: The Australian Securities and Investments Commission (ASIC) regulates all credit activities. They ensure lenders provide a standardised Key Facts Sheet, allowing you to compare "apples with apples." Always check that your lender or broker is licensed by checking their Australian Credit Licence (ACL) number on the ASIC Connect register.

- Independent brokers and Bheja are different from bank lenders, who can only offer their own products. Brokers and AI agents like Bheja work for you and must act in your best interests, giving you access to over 30 lenders instead of just one.

- Brokers are great for complex situations, like if you have bad credit or a family trust.

- AI tools like Bheja are best for speed and unbiased analysis, instantly checking all market data.

Making Your Final Decision

Decision-Making Checklist

Before you commit to a lender, check these boxes:

Conclusion: Your Action Plan

Comparing home loans is no longer about spreadsheets and phone calls. It's about data.

- Know your LVR: Calculate your equity.

- Gather your Data: Use CDR integration to do it instantly.

- Focus on Comparison Rate: Ignore the marketing fluff.

- Value the Features: An offset account is often worth paying a slightly higher rate for if you have savings.

Ready to stop overpaying?

Don't guess. Let Bheja’s AI check your income, organise your application, and find the lowest-cost loan for you, instantly.

FAQ

As of 2026, rates vary by LVR and loan type. A competitive variable comparison rate for an owner-occupier with <80% LVR is typically the benchmark to beat. Check the live tables above for today's data.