Navigating the home loan process can seem daunting for those holding a Visa 189 or 190 in Australia. However, understanding your options can make a big difference. This guide will walk you through everything you need to know about securing a home loan as a skilled visa holder, from eligibility requirements to practical tips for a smooth application process.

Key Takeaways

- Visa 189 and 190 are great pathways for skilled workers wanting to live and work in Australia and can also lead to homeownership.

- Many lenders have special home loan options just for visa holders, making it more accessible to own a home.

- Prepare all necessary documents like income proof, employment details, and visa information to speed up the loan application process.

- Know that securing a home loan as a visa holder may come with challenges, so understanding the local market is essential.

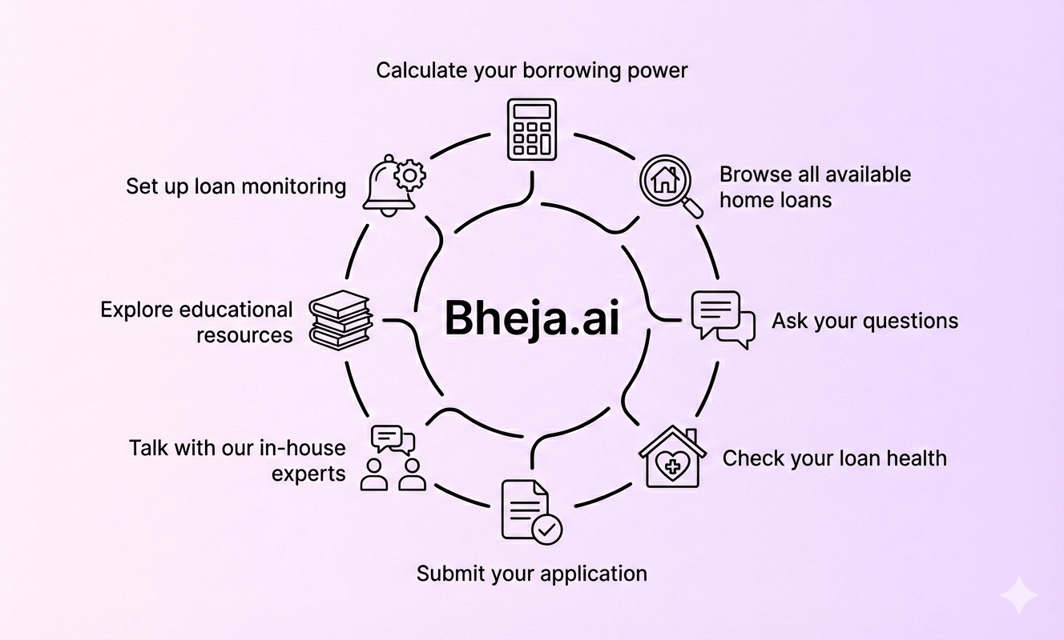

- Navigate home loans with AI-driven insights from Bheja.ai. Compare over 100 brands, receive proactive alerts, and make better financial choices easily.

Overview of Visa 189/190 Process

The Visa 189 and Visa 190 are skilled migration options for individuals who wish to settle in Australia. These visas allow skilled workers to permanently reside and work in Australia. It’s vital to understand the criteria for eligibility, as it will determine your options as a prospective homeowner.

Eligibility Criteria for Visa 189/190

To be eligible for these visas, applicants must meet specific criteria:

- Skills Assessment: Applicants need a positive skills assessment from a relevant authority.

- Points Test: A minimum score on the points test is required. Points can be earned through age, education, work experience, and English proficiency.

- Occupation List: Applicants must have an occupation listed on the relevant skilled occupations list.

- Health and Character Requirements: Health checks and police clearances are mandatory.

Understanding these criteria is crucial because they will influence your ability to secure a home loan once the visa is approved.

Implications for Homeownership

Receiving either visa means that you can stay and work in Australia indefinitely. This provides a stable environment to consider purchasing a home. However, you’ll need to navigate the home loan landscape geared towards visa holders.

Home Loan Options for Visa Holders

As a skilled visa holder, several home loan options are available to you. Understanding these options can save you time and money.

Key Lenders Catering to Skilled Migrants

Certain lenders have dedicated programs for skilled migrants. Here are a few notable options:

- Commonwealth Bank of Australia: Offers competitive rates and flexible terms specifically for visa holders.

- ANZ: Provides tailored solutions for international visa holders, including lower deposit requirements.

- Westpac: Specializes in helping skilled migrants, often considering foreign income as part of the assessment.

Types of Home Loans Available

There are various home loan types generally available:

- Fixed-Rate Loans: Interest rates are fixed for a certain period; good for budgeting.

- Variable-Rate Loans: Interest rates can fluctuate; may be beneficial if rates fall.

- Interest-Only Loans: Borrowers only pay interest for a set period, reducing upfront costs.

Exploring these options through tools like Bheja AI will allow you to compare rates and features effectively.

Application Process for Home Loans

Securing a home loan as a visa holder involves several steps. Below is a guide on what to prepare for the application process.

Required Documents

You’ll need to gather specific documents before applying for a home loan:

- Proof of Identity: Passport, driver’s license, etc.

- Visa Documentation: Copies of your Visa 189 or 190.

- Income Evidence: Pay slips, employment letters, tax returns.

- Credit History: Statements showing any existing debts or loans.

What to Expect During Approval

The approval process includes:

- Application Submission: Complete your application with all necessary documentation.

- Credit Assessment: The lender will assess your creditworthiness.

- Property Valuation: A valuation of the property will be conducted by the lender.

- Conditional Approval: You may receive conditional approval based on documents submitted.

- Final Approval: Upon meeting all conditions, you receive final approval, and the loan is processed.

It’s essential to consult with financial experts during this process to ensure you are making informed decisions. Also, being clear about the Loan-to-Value Ratio (LVR) can help you understand the financial commitment involved better. For further reading on LVR, check this resource: Loan-to-Value Ratio (LVR): Why It Matters for Home Loans in Australia.

Common Challenges and Questions

As a visa holder, securing a home loan can come with unique challenges. Being proactive can mitigate these issues.

Potential Challenges

- Limited Credit History: Many visa holders may not have an established credit history in Australia, which can affect loan approval.

- Income Verification: If your income includes foreign sources, lenders may require additional verification.

- Higher Deposit Requirements: Some lenders may require a larger deposit from visa holders due to perceived risks.

Frequently Asked Questions

- Can I use foreign income for my mortgage application? Yes, many lenders accept foreign income but require thorough documentation.

- What if my visa status changes? Ensure you discuss your circumstances with your lender, as changes may influence your loan.

- Are there assistance programs for first-time home buyers? Yes, various state governments and financial institutions offer programs to assist first-time buyers. Research local prospects.

Understanding the local property market is crucial for your decision-making process. Look for resources that explain market trends in your desired location.

Effective Budget Management for Homeowners

Once you secure a home loan, managing your budget effectively is essential to maintain smooth financial health.

Budgeting Tips

- Track All Expenses: Know where your money is going each month.

- Split Fixed and Variable Costs: This helps in identifying areas where you can save.

- Plan for Contingencies: Always set aside funds for unexpected expenses like repairs.

- Use Budgeting Tools: Utilise applications or templates that help you keep track and plan.

Helpful Tools and Templates

You can find several budgeting templates online. Some suggestions include:

- Excel Budget Spreadsheets: Great for customising your budget.

- Mobile Budgeting Apps: Apps like Pocketbook or You Need A Budget (YNAB) can help keep you on track.

By following these budgeting tips and utilising available resources, you can make informed financial decisions throughout your home ownership journey.

For more details on comparing home loans and making informed decisions, visit this comprehensive guide: The Complete Guide to Comparing Home Loans in Australia: A Step-by-Step Approach.

In this financial landscape, being informed and utilising tools effectively is key to navigating the home loan process as a Visa 189/190 holder.

Conclusion

In summary, navigating home loans as a Visa 189 or 190 holder can be tricky but not impossible. It's important to understand your eligibility, required documents, and loan features. Remember, knowing how to approach lenders can make a significant difference.

With the guidance of AI, Bheja AI offers insights to simplify your home loan journey. Compare over 100 brands, get alerts, and enjoy smarter decisions in your financial path. Take that next step today!

Frequently Asked Questions (FAQs)

Visa 189 and 190 holders can access various home loans in Australia. These include fixed-rate loans, variable-rate loans, and interest-only loans. Some lenders even offer special packages for skilled migrants, which might include lower deposit requirements or more flexible terms.