Navigating the journey of buying a home can feel overwhelming, especially for holders of Visa 491 in Australia. This special visa opens doors to regional living, but knowing how to secure a home loan can be tricky. In this article, we’ll break down the process step by step, making it easier for you to achieve your dream of homeownership in a welcoming community.

Key Takeaways

- Understanding Visa 491 is key for buyers in regional Australia

- You can apply for home loans with a Visa 491, just ensure steady income and good credit

- Collect necessary documents like proof of income and personal identification to smooth the application process

- Explore loan options from lenders who are open to working with temporary visa holders

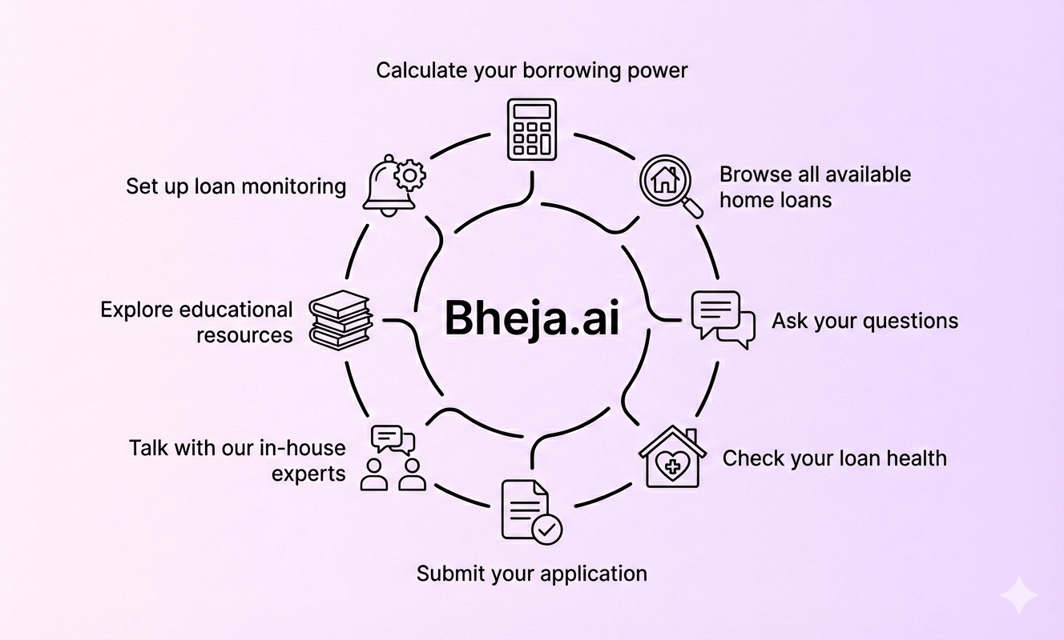

- Navigate home loans effortlessly with AI-driven insights from Bheja.ai: compare 100+ brands, get proactive alerts, and make smarter financial decisions without stress

Overview of Visa 491 and Its Significance for Regional Settlement in Australia

Visa 491, also known as the Skilled Work Regional (Provisional) visa, is designed for skilled workers who wish to live and work in regional areas of Australia. This visa plays a crucial role in addressing labor shortages in these regions and encourages migrants to settle outside major metropolitan areas.

Eligibility Requirements

To qualify for visa 491, applicants must:

- Be under 45 years of age.

- Have a nominated occupation on the relevant skilled occupation list.

- Hold a valid skills assessment for their occupation.

- Obtain a nomination from an Australian state or territory, or an invitation from the Australian government.

Benefits of Visa 491

Visa 491 provides various advantages. Holders can:

The ability to settle in regional areas not only fosters community development but also opens doors for home ownership, particularly through specialized home loan options.

Home Loan Process for Visa Holders

Navigating the home loan process as a visa 491 holder includes several steps.

Necessary Documentation

Gathering the right documents is essential. Commonly required documentation includes:

- Proof of identification (passport, visa).

- Employment verification (pay slips, employment letters).

- Evidence of income (bank statements, tax returns).

- A credit report (self-obtained or from the lender).

Lender Requirements

Different lenders may have varied requirements, but general expectations often include:

What Makes a Good Application

To improve the chances of a successful home loan application:

- Ensure all documentation is accurate and up-to-date.

- Provide a solid history of savings to show financial discipline.

- Consider using a financial adviser or mortgage broker familiar with visa categories.

Tips on Finding Suitable Lenders

Finding a lender that understands the nuances of visa 491 can be daunting but is crucial. Here are some strategies to consider:

Utilise Local Resources

- Australian Banking Association: This organisation provides resources that can guide potential borrowers in understanding their options.

- Migrant Resource Centres: These centers often have connections with lenders willing to assist visa holders.

Research and Compare

Use platforms like Bheja AI to navigate home loans. Their AI-driven insights help you compare various lenders and products, ensuring you make informed decisions.

Seek Recommendations

Networking within community groups or online forums can yield rich insights. Other visa 491 holders may share their experiences with lenders that provide favourable terms.

Government Assistance Programs for Visa 491 Holders

As a visa 491 holder, accessing government support can significantly ease the path to home ownership.

Grants Available

Check for specific grants designed for regional buyers, such as:

- First Home Owner Grant: Offers financial assistance to first-time buyers to help with the costs of purchasing or building a home.

- First Home Loan Deposit Scheme: This allows eligible buyers to purchase a home with a deposit as low as 5%, supporting those who might struggle to save a larger amount.

Regional Home Buyer Schemes

The Australian government occasionally runs specific initiatives aimed at promoting home ownership in regional areas. Stay updated on current programs or incentives offered by:

- The Department of Home Affairs

- State and territory government websites

Common Pitfalls to Avoid

When applying for a home loan, certain missteps can lead to frustration and delays.

Neglecting to Check Credit Score

Frequently review your credit history and rectifying any inaccuracies before applying.

Overlooking Loan Comparisons

Failing to compare multiple lenders may result in missing better interest rates or favourable terms. Utilise tools like Bheja AI to easily explore your options.

Misunderstanding Visa Conditions

Some lenders might misunderstand the specifics of the visa 491. Ensure that you provide clear information regarding your visa status and seek lenders familiar with this visa type.

Expert Advice

Connecting with professionals in the financial industry can provide tailored advice.

- Contact local financial advisers who specialise in helping visa holders.

- Stay informed through resources like Seniors Rights, which can aid in understanding your rights as a borrower.

Incorporating these strategies can significantly enhance your home-buying journey as a visa 491 holder, increasing the likelihood of securing a loan and finding your dream home in regional Australia.

Conclusion

In summary, navigating the home loan process with a Visa 491 doesn’t have to be hard. Understanding your eligibility, knowing the required documents, and finding the right lender are key steps. Remember, government support can also help you along the way.

With Bheja AI, you can easily navigate home loans. Compare over 100 brands, get proactive alerts, and make smarter financial decisions effortlessly. Take charge of your journey to homeownership today!

Frequently Asked Questions (FAQs)

A Visa 491 is a skilled work regional visa in Australia. It allows skilled workers to live and work in regional areas. This visa impacts home loans, as lenders consider the visa type when assessing eligibility. Some lenders might have stricter criteria, while others may be more flexible.