Navigating the path to home ownership while on a Visa 482 (TSS) can be challenging, but it’s very much achievable. If you're in Australia on this type of visa, understanding your home loan options is essential. This guide will help you explore the various home loan possibilities available to you and provide clear steps to make the process easier.

Key Takeaways

- Visa 482 (TSS) holders can absolutely secure home loans in Australia, easing the path to home ownership.

- It's essential to have all your documents ready, like proof of income and employment contracts. This makes the approval process smoother.

- Good credit history really counts; it can help you secure better interest rates and terms for your loan.

- There are two main types of home loans available: fixed and variable rates, each catering to different financial needs.

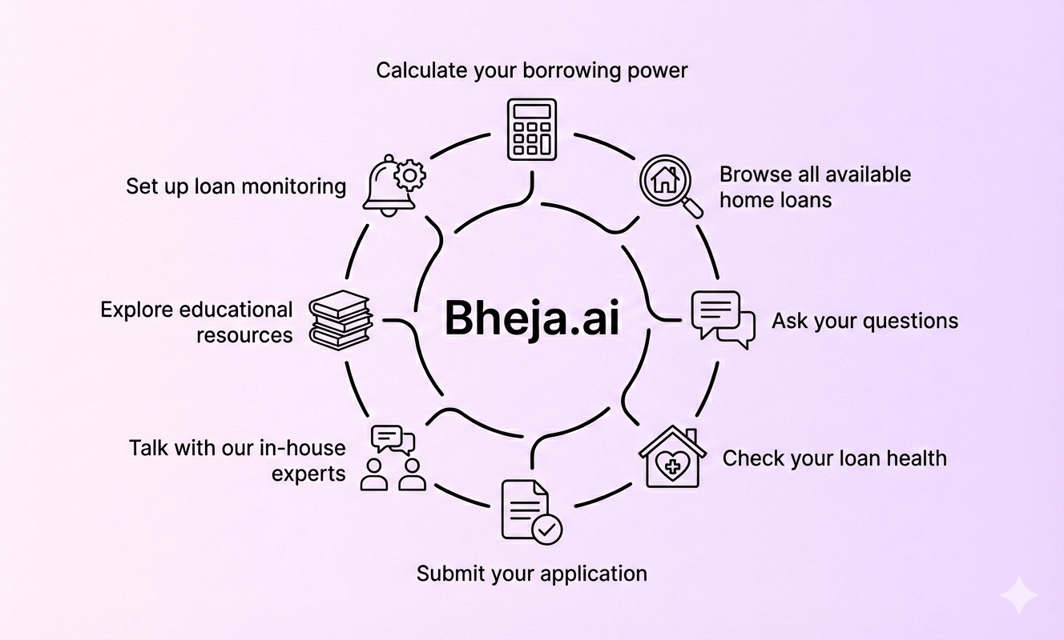

- Navigate home loans with AI-driven insights from Bheja.ai. Compare over 100 brands, get proactive alerts, and make smarter financial choices easily.

Home Loans for Visa 482 (TSS)

Understanding the Visa 482 (TSS)

The Visa 482, also known as the Temporary Skill Shortage (TSS) visa, allows Australian employers to sponsor foreign workers for skilled positions. This visa is crucial for both employers seeking to fill skill gaps and for individuals looking to live and work in Australia. To qualify for this visa, applicants typically need to meet certain requirements regarding work experience and qualifications.

Eligibility for Home Loans

Obtaining a home loan while on a Visa 482 can be challenging, but it is certainly possible. Here’s what lenders generally look for:

- Employment Status: You should be employed in a skilled occupation. Lenders prefer that your job is relevant to your qualifications and visa.

- Income Verification: Proof of stable income is a must. Lenders will typically request payslips, tax returns, and bank statements.

- Duration of Your Visa: Lenders tend to favor applicants whose visas are valid for at least the duration of the home loan, usually around 3 to 5 years.

Major Home Loan Types for Visa Holders

When applying for a home loan, you will encounter different types of loans. Each has its benefits and considerations.

Fixed-Rate Home Loans

Fixed-rate home loans have an interest rate that remains the same for a set period, usually between 1 to 5 years. This provides certainty in budgeting and protects you from interest rate rises during that period.

Variable-Rate Home Loans

Variable-rate loans have an interest rate that can fluctuate over time. While you might benefit from falling rates, your payments can increase if rates rise.

Getting Pre-Approval for a Home Loan

Pre-approval is a smart step before house hunting. It gives you an idea of how much you can borrow and strengthens your position when making an offer. Here are the steps to get pre-approval:

- Gather Documents:

- Recent payslips

- Tax returns for the last two years

- Bank statements, usually for three months

- Identification documents (passport, visa)

- Check Your Credit History: A good credit score is vital. You can obtain a free credit report from several reliable sources online.

- Apply for Pre-Approval: Choose a lender and submit your application with the required documents.

- Wait for Approval: The lender will assess your application and may ask for additional information.

Importance of Good Credit History

A good credit history can significantly enhance your chances of securing a favorable home loan. Lenders typically evaluate:

- Timely Payments: Always pay your bills on time.

- Debt-to-Income Ratio: Maintain a comfortable balance between your income and existing debts.

- Credit Utilisation: Avoid maxing out credit cards.

Lenders That Offer Home Loans for Visa 482 Holders

Not all lenders offer home loans for Visa 482 holders. However, some lenders have specific programs that cater to visa holders. Here’s a brief overview:

- Commonwealth Bank: Offers a range of products but requires a minimum one-year visa validity.

- Westpac: Allows applications from temporary visa holders, pending assessment of your situation.

- ANZ: Known to offer loans to visa holders with certain conditions.

Each lender has unique requirements and lending criteria, which can vary substantially, so it is advisable to compare their offerings carefully.

Trusted Resources for Further Information

For detailed insights into the Visa 482 process and home loans in Australia, you can explore the following resources:

- Australian Government's Department of Home Affairs: Offers comprehensive information about visas.

- Australian Taxation Office (ATO): Provides details on tax obligations and financial responsibilities in Australia.

Final Thoughts

Navigating the Australian home loan landscape can seem daunting, especially for Visa 482 holders. However, understanding the eligibility criteria, types of loans available, the pre-approval process, and which lenders are open to your application can make the journey smoother. By leveraging available resources and maintaining a good credit standing, you’ll be well on your way to securing a home loan in Australia.

Conclusion

Navigating home loans on a Visa 482 can seem tough, but you now know the ins and outs. Remember the importance of having a good credit history, understanding your income options, and knowing the specific lenders that cater to your needs.

With Bheja AI, you can explore your options easily. Get AI-driven insights, compare over 100 brands, and receive proactive alerts. It's time to make smarter financial choices without the stress. Start your journey today!

Frequently Asked Questions (FAQs)

Yes, Visa 482 holders can definitely get home loans in Australia. Many lenders offer flexible options for temporary visa holders and it is crucial to show your employment status and income to get approved.