Navigating home loans can be tricky, especially for graduates on a 485 visa in Australia. The good news is there are options available to help you secure your first home. This guide will walk you through the eligibility criteria, types of loans to consider, and tips for making your application stand out. Let's get started!

Key Takeaways

- There are home loan options for Visa 485 holders in Australia, allowing access to various types of loans.

- Lenders look for proof of steady income and employment when approving loans for temporary residents.

- Explore both fixed-rate and variable loans to understand which best fits your financial situation.

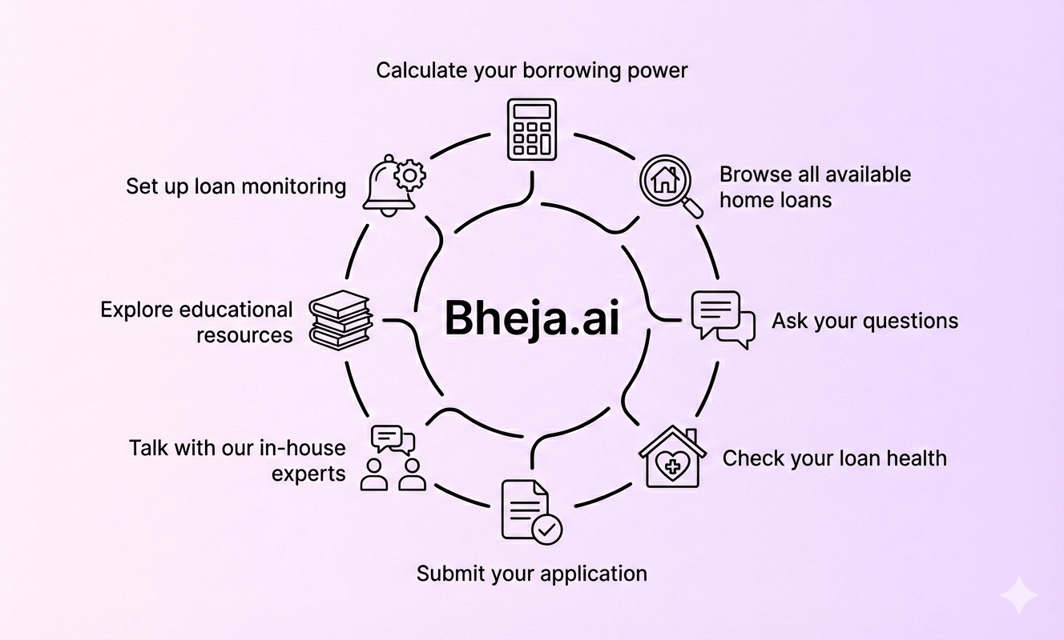

- Navigating home loans is easier with AI-driven insights from Bheja.ai. Compare 100+ brands, receive proactive alerts, and make smarter choices without hassle.

- Always check for local grants and incentives available for first-time buyers to get extra help with your purchase.

Eligibility Criteria for Home Loans for Visa 485 Holders

Understanding Visa 485

The Subclass 485 visa, commonly known as the Temporary Graduate Visa, allows international students who have recently graduated from an Australian educational institution to live, study, and work in Australia. This visa is popular among graduates looking to establish their careers and settle down, which can also lead to home ownership.

Income Stability

When applying for a home loan, lenders pay close attention to your income stability. They want to ensure that you have a reliable income source. Important factors include:

- Duration of employment: A full-time job or a stable part-time position can enhance your application.

- Type of employment: Permanent positions often carry more weight compared to casual work.

- Income level: Lenders need to see that your income is capable of supporting loan repayments.

Employment Status

Your employment status significantly influences the loan approval process. Consider these aspects:

- Job title and sector: Lenders might be more favourable towards professions in high-demand industries.

- Duration in the current role: Longer tenure can boost your credibility.

- Skills assessment: Having your skills assessed by a relevant authority may enhance your chances.

Types of Home Loans Available

Explore various home loan options available to visa 485 holders. Check out our detailed guides.

- A summary of various home loan types | Bheja AI

- The Complete Guide to Comparing Home Loans in Australia: A Step-by-Step Approach

Tips for Approval

A successful application requires preparation. Here are some practical steps:

- Seek Pre-Approval: This gives you a better idea of your budget and strengthens your offer when searching for a home.

- Maintain a Good Credit Score: Regularly check your credit report, pay bills on time, and minimize debt.

- Gather Documentation: Collect payslips, tax returns, and proof of identification to streamline the application process.

Grants and Incentives for New Migrants

First Home Buyer Grants

As a visa 485 holder, you may be eligible for various grants that could significantly reduce your financial burden. These include:

- First Home Owner Grant: This is a one-off government payment to assist you in purchasing your first home in Australia.

- First Home Loan Deposit Scheme: Allows eligible first home buyers to purchase a home with a deposit as low as 5%, with the government guaranteeing the remaining amount.

- State-Specific Grants: Each state has its own incentives, so it’s useful to look into what is available in your area.

Final Thoughts

Navigating the home loan process as a temporary graduate can seem complex, but with an understanding of your eligibility, the types of loans available, and guidance from professionals, you can make informed decisions. Resources like Bheja AI are designed to help you compare your options and find the best fit for your situation.

In summary, navigating home loans on a 485 visa can be tricky but not impossible. Understanding eligibility, loan types, and application tips is crucial. Remember, different lenders offer various options and some might be more flexible than others. So, don’t hesitate to explore your choices. With AI-driven insights from Bheja AI, you can easily compare over 100 brands, get proactive alerts, and make smarter financial choices. Start your journey towards homeownership today!

Frequently Asked Questions (FAQs)

The Visa 485, also known as the Temporary Graduate visa, allows international students who have recently graduated from an Australian institution to live, study and work in Australia. In terms of home loan eligibility, lenders will look at your income, job stability, and credit history. It’s essential to provide proof of steady income and employment to improve your chances.