Navigating the world of home loans can be tricky, especially if you're on a partner visa like the 820 or 801. Understanding what lenders look for and knowing your options is key to finding the right loan for you. This guide will walk you through the essential steps to secure a home loan that meets your needs.

Key Takeaways

- Visa 820 or 801 holders can definitely apply for home loans in Australia.

- You’ll need important documents like proof of identity, income, and bank statements to apply.

- Your relationship status can help or affect your loan approval. Partner’s financial info matters.

- It is important to shop around for lenders who understand unique cases of Visa holders.

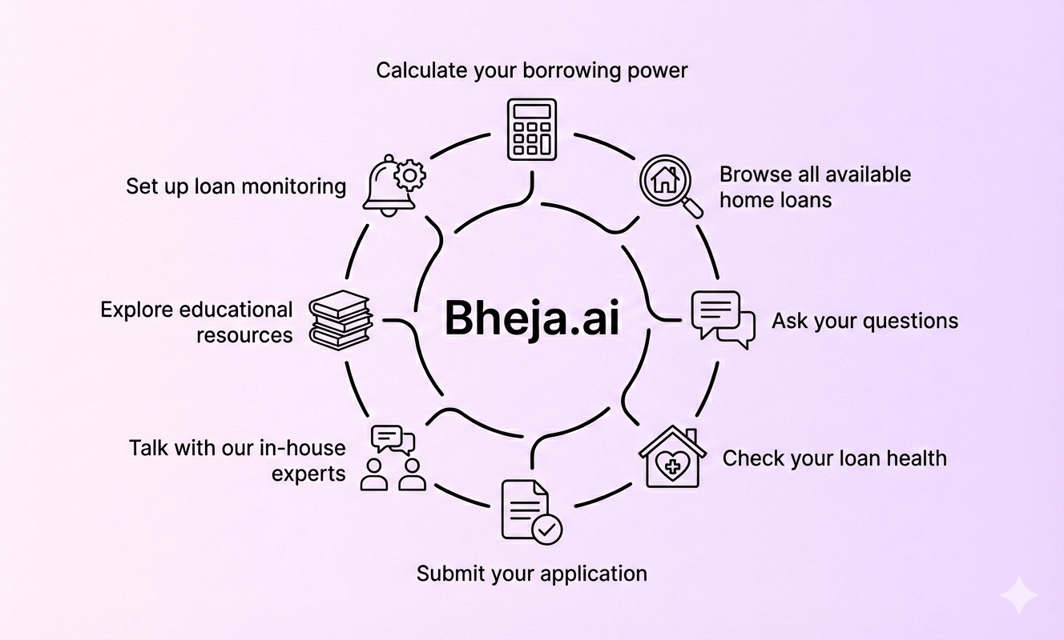

- Navigate home loans with AI-driven insights from Bheja.ai. Compare 100+ brands, get proactive alerts and make smarter financial choices with ease!

Understanding Home Loans for Visa 820/801 Holders

Navigating home loans can be a bit tricky, especially for holders of the visa 820/801 (Partner). Understanding what lenders look for can help make this process smoother. Here are some main points to consider:

Eligibility Assessment for Home Loans

When lenders assess eligibility, they typically evaluate a few key factors:

- Income Verification: Lenders need to see proof of stable income. This might include pay slips, bank statements, and employment letters. The more consistent your income, the better your chances.

- Credit History: A good credit history is essential. Lenders will look at your previous borrowing behavior, including any defaults or late payments. If you have limited credit history, lenders might ask for additional reassurance.

- Deposit Requirement: A substantial deposit can improve your chances of approval. Generally, aiming for a deposit of at least 20% can make lenders more comfortable with your application. If you have a smaller deposit, you might have to pay Lenders Mortgage Insurance (LMI).

Types of Home Loans Suitable for Visa Holders

There are several types of home loans to consider, each with its pros and cons:

Quick Tip: It's smart to use tools like :

Bheja AI home loans comparison tool to find the best deals tailored to your situation!

A summary of various home loan types | Bheja AI to learn about differnt types of loans

The Complete Guide to Comparing Home Loans in Australia: A Step-by-Step Approach to understand in-out of the process.

Key Documentation Needed

Applying for a home loan comes with its required paperwork. Here’s a list of documentation you may need:

- Proof of Income: This includes recent pay slips, tax returns, and bank statements.

- Identification: You’ll need to verify your identity, usually with a passport or driver’s license.

- Relationship Documentation: Since you hold a Partner visa, you may need to provide evidence of your relationship with your partner, like joint bank statements or shared bills.

- Residency Evidence: Provide proof of your current status in Australia, such as a visa grant notice.

Seeking Professional Advice

Navigating the mortgage landscape can be complex, especially when dealing with visa specifics. Consulting a mortgage broker familiar with visa holders can be helpful. They can guide you through the application process and help you find lenders willing to work with people in your situation.

Helpful Resources

To gain more insight and clarity, consider exploring these resources:

- Australian Government’s Immigration website: This site provides valuable information about various visas and regulatory details.

- Australian Securities and Investments Commission: A great resource for understanding financial regulations and consumer rights.

- The Mortgage & Finance Association of Australia (MFAA): This site can help you find qualified mortgage brokers and provide resources related to home loans.

Tips for Improving Your Chances

To boost your chances of securing a home loan, consider these tips:

- Build Your Credit Score: Before applying, work on enhancing your credit score by paying off existing debts and making payments on time.

- Save for a Larger Deposit: The more you can put down initially, the less you need to borrow, making you a more appealing candidate.

- Limit New Credit Applications: Avoid applying for new credit cards or loans before applying for your home loan, as it may negatively impact your credit score.

Always use Bheja AI to compare over 100 lenders, enabling you to make informed choices effortlessly.

Conclusion

Acquiring a home loan as a visa holder involves some careful planning and understanding. From assessing your eligibility to gathering the necessary documents, every step counts. Whether you decide on a fixed-rate, variable-rate, or split loan, make sure you weigh your options carefully. And remember, professional guidance can be invaluable in navigating this process efficiently.

In summary, navigating home loans for Visa 820 or 801 holders can be confusing. It's crucial to know about eligibility, required documents, and lender options. Remember, your relationship status matters, and often, lenders will consider your partner's financial standing too.

For a smooth journey, consider using Bheja AI to compare 100+ brands and get helpful alerts. With our AI-driven insights, making smart financial choices is easier than ever. Start today and take the first step towards your dream home!

Frequently Asked Questions (FAQs)

Yes! Visa 820 and 801 holders can apply for home loans in Australia. Many lenders recognise these visa types and consider them when evaluating applications.